Insider Buying: Director Roland Diggelmann Acquires Shares of Mettler-Toledo International Inc

Mettler-Toledo International Inc (NYSE:MTD), a leading global supplier of precision instruments and services, has recently witnessed insider buying activity that may signal confidence in the company's future prospects. Director Roland Diggelmann has bolstered his stake in the company by purchasing 315 shares on November 13, 2023. This article delves into the details of this transaction and provides an objective analysis based on the available data.

Who is Roland Diggelmann?

Roland Diggelmann is a seasoned executive with extensive experience in the healthcare industry. As a director of Mettler-Toledo International Inc, Diggelmann brings valuable insights and strategic oversight to the company. His background includes leadership roles in various healthcare companies, which equips him with a deep understanding of the operational and financial aspects critical to Mettler-Toledo's success.

Mettler-Toledo International Inc's Business Description

Mettler-Toledo International Inc is a global provider of precision instruments and services for professional use. The company specializes in laboratory instruments, industrial weighing solutions, and process analytics, serving customers in multiple sectors, including pharmaceuticals, chemicals, food and beverage, and academia. Mettler-Toledo's commitment to innovation and quality has positioned it as a leader in its field, offering products that are essential for research, development, quality control, and production processes.

Description of Insider Buy/Sell

Insider buying refers to the purchase of shares in a company by its officers, directors, or other insiders. Such transactions are closely monitored by investors as they can provide insights into the insiders' confidence in the company's future performance. Conversely, insider selling involves these same individuals selling their shares, which can sometimes raise concerns about the company's outlook or valuation. However, insider selling can also occur for personal reasons and does not always indicate a negative perspective on the company's prospects.

Insider Trends

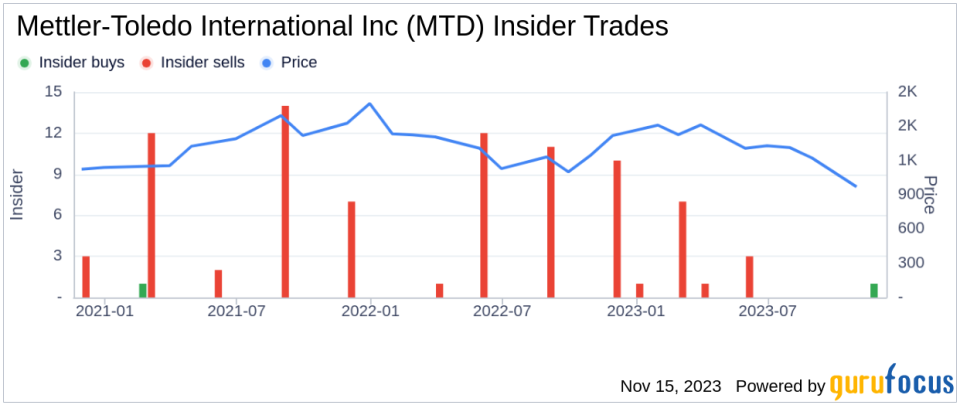

The insider transaction history for Mettler-Toledo International Inc shows a pattern of more insider selling than buying over the past year. There has been only 1 insider buy compared to 14 insider sells during this period. This trend can be interpreted in various ways, but the recent purchase by Director Roland Diggelmann may suggest a positive shift in insider sentiment.

Valuation and Market Cap

On the day of the insider's recent buy, shares of Mettler-Toledo International Inc were trading at $1,026.54, giving the company a market cap of $22.819 billion. This valuation places the company among the larger players in its industry, reflecting its significant market presence and financial stability.

The price-earnings ratio of Mettler-Toledo International Inc stands at 26.83, which is slightly higher than the industry median of 24.63. This indicates that the stock is trading at a premium compared to its peers, possibly due to the company's strong market position and historical performance. However, it is also lower than the company's historical median price-earnings ratio, suggesting that the stock may be more reasonably priced in the context of its own trading history.

With a current price of $1,026.54 and a GuruFocus Value of $1,542.52, Mettler-Toledo International Inc has a price-to-GF-Value ratio of 0.67. This indicates that the stock is significantly undervalued based on its GF Value, which could be a compelling reason for the insider's recent purchase.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated by considering historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. Additionally, a GuruFocus adjustment factor is applied based on the company's past returns and growth, along with future business performance estimates from Morningstar analysts.

Conclusion

The recent insider buying activity by Director Roland Diggelmann at Mettler-Toledo International Inc may be a signal of confidence in the company's future. While the broader insider trend over the past year has shown more selling than buying, Diggelmann's purchase stands out as a potentially bullish indicator. The company's valuation metrics and its significantly undervalued status according to the GF Value further support the notion that the stock may be an attractive investment at current levels. Investors should consider these factors alongside their own research and investment goals when evaluating Mettler-Toledo International Inc as a potential addition to their portfolios.

It is important to note that insider transactions are just one piece of the puzzle when it comes to assessing a company's investment potential. Other factors such as financial performance, industry trends, and macroeconomic conditions should also be taken into account. Nonetheless, insider buying, especially by high-level executives like Roland Diggelmann, can provide valuable insights into the company's internal perspective on its valuation and future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.