Insider Buying: Director Tarang Amin Acquires Shares of JM Smucker Co (SJM)

Insider buying can often provide valuable insights into a company's prospects and the confidence that management and board members have in the business. In a recent transaction, Director Tarang Amin of JM Smucker Co (NYSE:SJM) demonstrated such confidence by purchasing 1,000 shares of the company's stock.

Who is Tarang Amin?

Tarang Amin is a notable figure in the consumer goods industry, serving as a director for JM Smucker Co. His experience and leadership have been instrumental in guiding the company through various market conditions. The insider's decision to increase his stake in the company is a move that investors often scrutinize for indications of the company's future performance.

JM Smucker Co's Business Description

JM Smucker Co, known for its iconic jam products, is a leading manufacturer of food and beverage products. The company's portfolio includes a wide range of consumer favorites such as coffee, peanut butter, fruit spreads, pet foods, and snacks. With a focus on quality and innovation, JM Smucker Co has established a strong presence in the food industry, catering to the needs of customers across North America.

Description of Insider Buy/Sell

Insider transactions, including buys and sells, are closely monitored by investors as they can signal the insiders' perspective on the company's valuation and future prospects. An insider buy, such as the one executed by Tarang Amin, may suggest a belief in the company's undervalued stock price or potential for growth. Conversely, insider sells could indicate a variety of reasons, including portfolio diversification or personal financial planning, and do not necessarily reflect a negative outlook on the company.

Insider Trends

The insider transaction history for JM Smucker Co shows a pattern of more insider sells than buys over the past year. With 12 insider sells and only 1 insider buy, investors might look for reasons behind this trend. However, the recent purchase by Tarang Amin could be a sign of changing sentiment or a perceived opportunity at the current valuation.

Valuation and Market Cap

On the day of the insider's recent buy, shares of JM Smucker Co were trading at $125.05, resulting in a market cap of $13.306 billion. This valuation places the company among the sizable players in the consumer goods sector, reflecting its established market position and brand recognition.

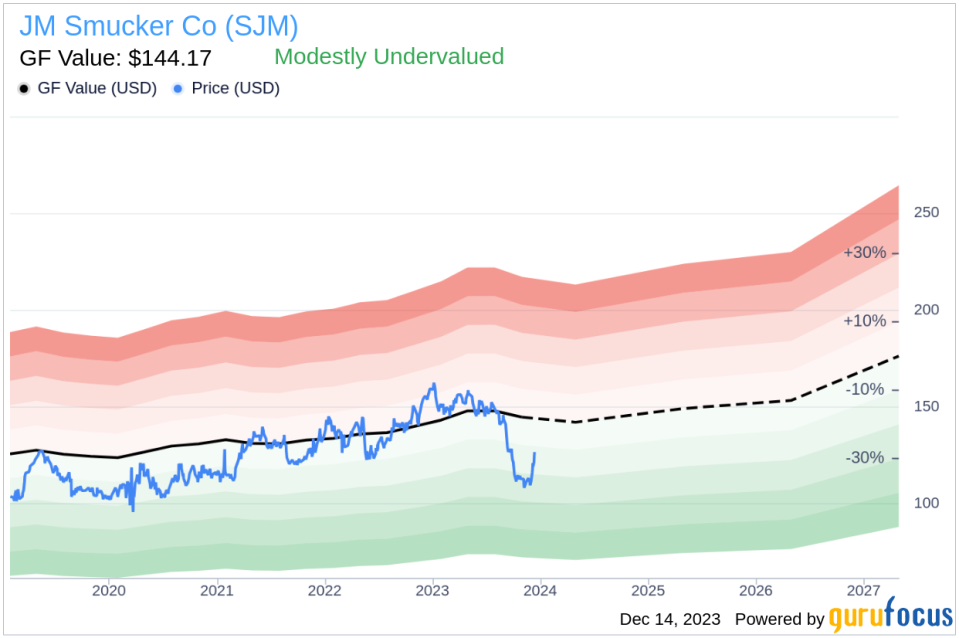

With a price of $125.05 and a GuruFocus Value of $144.17, JM Smucker Co has a price-to-GF-Value ratio of 0.87. This indicates that the stock is modestly undervalued based on its GF Value, suggesting that the insider may have identified an attractive entry point for the investment.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. This comprehensive approach to valuation provides a benchmark for investors to assess whether a stock is trading above or below its intrinsic value.

Objective Analysis Based on Data

When analyzing insider buying activity, it is crucial to consider the context of the transaction. Tarang Amin's purchase of 1,000 shares adds to his existing stake in the company, which could be interpreted as a positive signal regarding the company's future. Over the past year, the insider's trading activity has been more weighted towards buying, with a total of 1,000 shares purchased and only 7 shares sold.

The broader insider trend at JM Smucker Co, however, has been more inclined towards selling, with 12 insider sells over the past year. This divergence between the insider's actions and the overall insider sentiment could be noteworthy. It may indicate that Tarang Amin has a unique perspective or information that gives him a different outlook on the company's potential.

From a valuation standpoint, the modestly undervalued status of JM Smucker Co's stock, as indicated by the price-to-GF-Value ratio, could be a factor in the insider's decision to buy shares. The GF Value suggests that the stock has room to appreciate towards its intrinsic value, which may offer a margin of safety for new investments.

Investors considering following the insider's lead should conduct their due diligence, taking into account the company's financial health, growth prospects, and competitive position in the industry. While insider buying can be a positive sign, it is just one piece of the puzzle when evaluating an investment opportunity.

In conclusion, the recent insider buying activity by Director Tarang Amin at JM Smucker Co may signal a belief in the company's value and prospects. With the stock appearing modestly undervalued according to GuruFocus metrics, investors may find this insider transaction worth considering as part of their investment research.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.