Insider Buying: Director Thomas Monahan Acquires Shares of TransUnion (TRU)

Insider buying and selling activities are closely monitored by investors as they can provide insights into a company's financial health and future prospects. A recent transaction that has caught the attention of the market is the purchase of shares by Director Thomas Monahan of TransUnion (NYSE:TRU). On November 17, 2023, the insider acquired 1,800 shares of the company, indicating a potential confidence in the firm's trajectory.

Who is Thomas Monahan of TransUnion?

Thomas Monahan is a seasoned professional with a significant role at TransUnion. His experience and insights are valuable to the company's strategic direction. As a director, Monahan is involved in overseeing the company's operations and ensuring that it adheres to its mission and goals. His decision to increase his stake in the company is often interpreted as a positive signal by investors.

TransUnion's Business Description

TransUnion is a global leader in credit reporting and information management services. The company provides a wide range of data and analytics solutions that help businesses and consumers make informed decisions. TransUnion's offerings include credit reports, risk scores, analytical services, and fraud detection tools. The company operates in numerous countries and serves various industries, including finance, insurance, healthcare, and retail.

Description of Insider Buy/Sell

Insider buying refers to the purchase of shares of a company by its executives, directors, or other insiders. Such transactions are considered a sign of confidence in the company's future performance. Conversely, insider selling is when these individuals sell their shares, which could indicate potential concerns about the company's prospects. However, insider selling can also occur for personal reasons, such as diversifying assets or liquidity needs, and does not always reflect a negative outlook.

According to the data provided:

Thomas Monahans trades: Over the past year, Thomas Monahan has purchased 1,800 shares in total and sold 0 shares in total.

Insider Trends

The insider transaction history for TransUnion shows a disparity between insider buys and sells over the past year. There have been 2 insider buys and 17 insider sells during this period. This trend can be interpreted in various ways, but the recent purchase by Monahan may suggest a belief in the company's undervalued status or upcoming positive developments.

Valuation

On the day of the insider's recent buy, shares of TransUnion were trading at $57.46, giving the company a market cap of $11,614.252 billion. This valuation is a critical factor for investors to consider when assessing the company's size and market position.

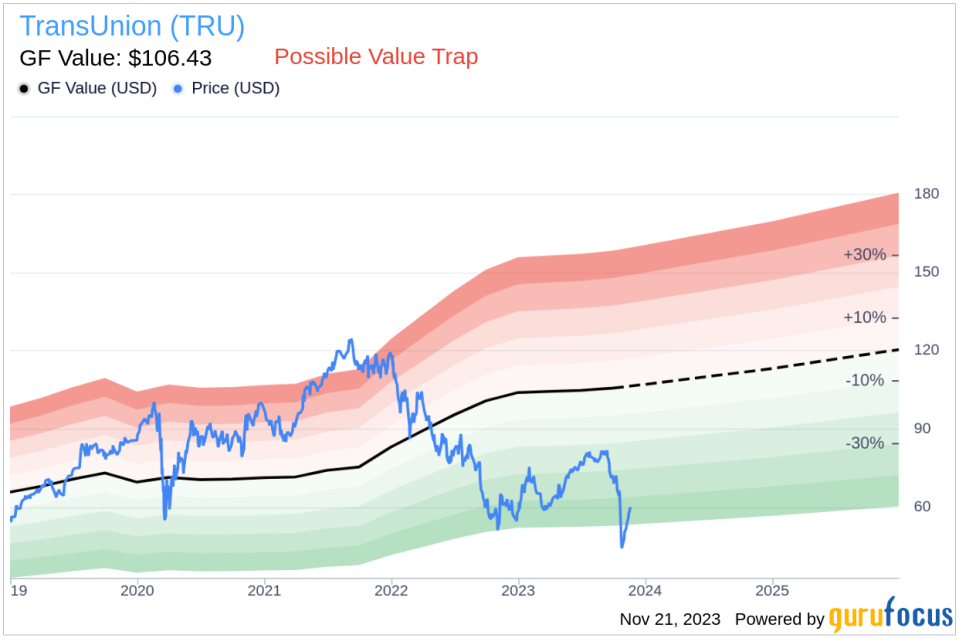

With a price of $57.46 and a GuruFocus Value of $106.43, TransUnion has a price-to-GF-Value ratio of 0.54. This ratio suggests that the stock is a Possible Value Trap, Think Twice, based on its GF Value. The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts.

The historical multiples include price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. The GuruFocus adjustment factor is based on the company's past returns and growth, providing a nuanced view of its valuation. Lastly, the future estimates of business performance from Morningstar analysts offer a forward-looking perspective that can influence the GF Value.

In conclusion, the insider buying activity by Thomas Monahan at TransUnion may signal a potential opportunity for investors. While the price-to-GF-Value ratio indicates that the stock might be undervalued, it is essential to approach with caution, as the designation of a Possible Value Trap suggests that further analysis is warranted. Investors should consider the insider trends, the company's business model, and comprehensive valuation metrics before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.