Insider Buying: Director Weston Hicks Acquires Shares of White Mountains Insurance Group Ltd

Insider buying is often regarded as a strong signal about the prospects of a company. When insiders purchase shares, they demonstrate confidence in the company's future performance. Recently, Weston Hicks, a director at White Mountains Insurance Group Ltd (NYSE:WTM), made a notable insider buy that has caught the attention of investors.

Who is Weston Hicks of White Mountains Insurance Group Ltd?

Weston Hicks is a seasoned executive with extensive experience in the insurance industry. As a director of White Mountains Insurance Group Ltd, Hicks has an in-depth understanding of the company's operations, challenges, and opportunities. His insights into the company are invaluable, and his investment decisions are closely watched by market participants for indications of the company's health and potential.

White Mountains Insurance Group Ltd's Business Description

White Mountains Insurance Group Ltd is a diversified insurance and financial services organization. The company's primary business operations include property and casualty insurance and reinsurance, as well as other insurance-related enterprises. White Mountains Insurance Group Ltd is known for its disciplined underwriting approach, strong balance sheet, and strategic investments in the insurance sector. The company's subsidiaries provide a range of insurance products and services to clients worldwide.

Description of Insider Buy/Sell

Insider transactions are the buying and selling of a company's stock by its executives, directors, or other insiders. These transactions are closely monitored as they can provide insights into an insider's view of the company's future. An insider buy, such as the one made by Weston Hicks, suggests that the insider believes the stock is undervalued or that there is potential for growth. Conversely, insider sells may indicate that insiders believe the stock is fully valued or that they are diversifying their investments.

Weston Hickss Recent Insider Buying Activity

On November 17, 2023, Weston Hicks purchased 1,000 shares of White Mountains Insurance Group Ltd at a price of $1,480.56 per share. This transaction increased his total holdings in the company, reflecting a positive sentiment towards the stock's future. Over the past year, Hicks has purchased a total of 2,000 shares and has not sold any shares, reinforcing the notion that he remains bullish on the company's prospects.

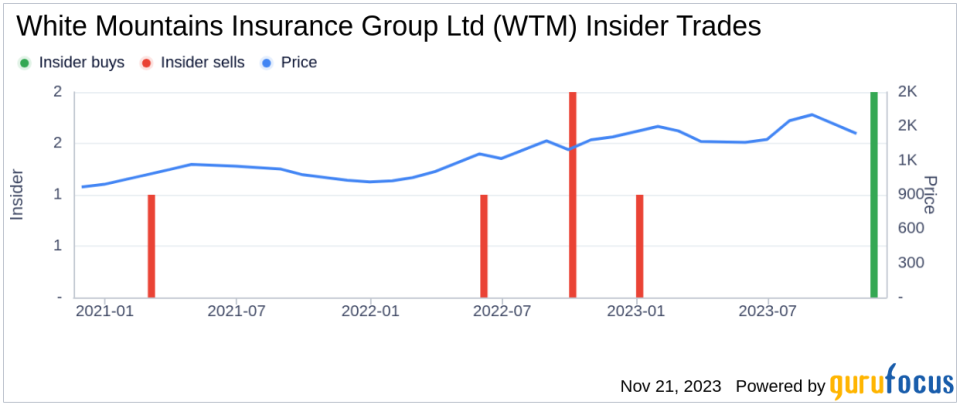

Insider Trends at White Mountains Insurance Group Ltd

The insider transaction history for White Mountains Insurance Group Ltd shows a pattern of more insider buying than selling over the past year. There have been 2 insider buys and only 1 insider sell during this period. This trend can be interpreted as a positive signal, as more insiders are investing in the company's stock rather than cashing out.

Valuation and Market Cap of White Mountains Insurance Group Ltd

With the stock trading at $1,480.56 on the day of Hicks's recent purchase, White Mountains Insurance Group Ltd holds a market cap of $3,808.468 billion. The price-earnings ratio stands at 14.53, which is higher than the industry median of 10.74 and also above the company's historical median price-earnings ratio. This could suggest that the stock is trading at a premium compared to its peers and its own historical valuation.

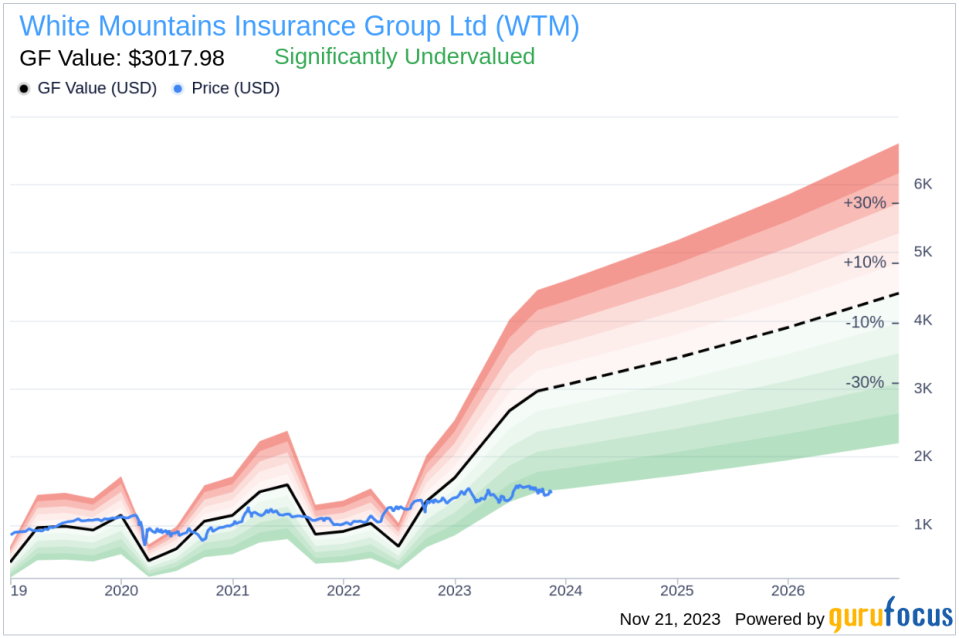

However, the price-to-GF-Value ratio tells a different story. With a price of $1,480.56 and a GuruFocus Value of $3,017.98, the stock has a price-to-GF-Value ratio of 0.49, indicating that it is Significantly Undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. When the stock's price is significantly below the GF Value, it may represent a buying opportunity for investors who believe in the company's fundamentals.

Conclusion

Weston Hicks's recent insider purchase of White Mountains Insurance Group Ltd shares adds to the positive insider buying trend observed over the past year. Despite the stock's higher price-earnings ratio compared to the industry median, the price-to-GF-Value ratio suggests that the stock is undervalued. Investors may consider this insider buying activity, along with the company's valuation metrics, as part of their due diligence when evaluating the potential of White Mountains Insurance Group Ltd as an investment.

As always, it is important for investors to conduct their own research and consider multiple factors before making investment decisions. Insider buying is just one piece of the puzzle, and it should be weighed alongside other financial analyses and market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.