Insider Buying: Douglas Jones Acquires 10,000 Shares of Neogen Corp

On October 25, 2023, Douglas Jones, the Chief Operating Officer (COO) of Neogen Corp (NASDAQ:NEOG), purchased 10,000 shares of the company. This move is significant as insider buying often indicates a strong belief in the company's future prospects.

Neogen Corporation, founded in 1982 and headquartered in Lansing, Michigan, is an international food safety company that provides test kits and relevant products to detect dangerous substances in food. The company's products are dehydrated culture media, and diagnostic test kits to detect foodborne bacteria, natural toxins, food allergens, drug residues, plant diseases, and sanitation concerns.

Insider buying refers to when a company's executives, directors, or employees purchase the company's stock. This is often seen as a positive sign as these individuals have the most intimate knowledge of the company's workings and future prospects. Conversely, insider selling refers to these individuals selling their shares, which could be seen as a lack of confidence in the company's future performance.

Over the past year, Douglas Jones has purchased a total of 12,500 shares and has not sold any shares. This recent purchase of 10,000 shares is a significant addition to his holdings.

The insider transaction history for Neogen Corp shows a balanced trend with 4 insider buys and 4 insider sells over the past year. The insider's recent purchase could be a positive sign for the company's future performance.

On the day of the insider's recent buy, shares of Neogen Corp were trading for $15.17 apiece, giving the stock a market cap of $3.361 billion.

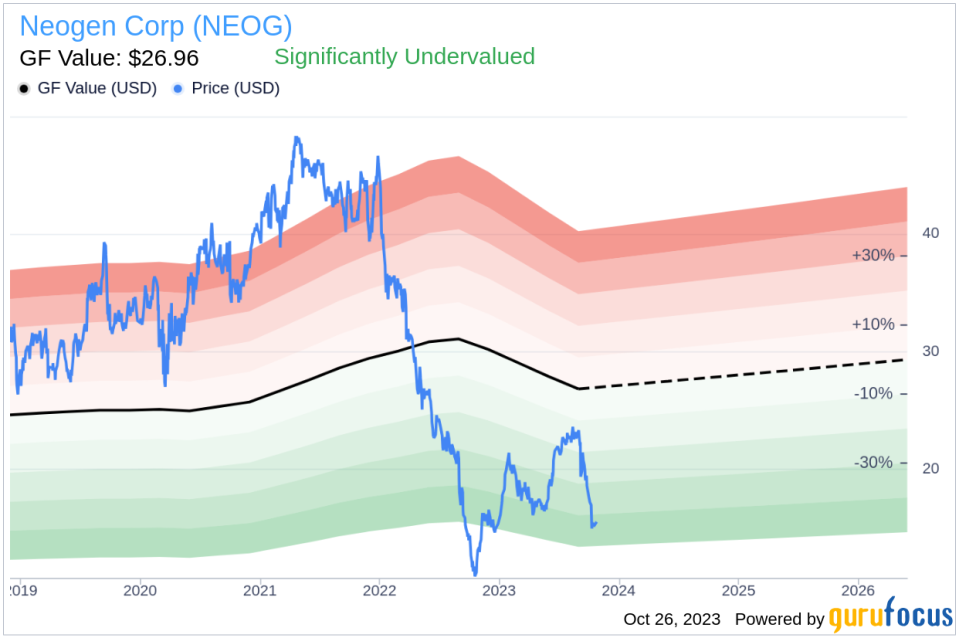

With a price of $15.17 and a GuruFocus Value of $26.96, Neogen Corp has a price-to-GF-Value ratio of 0.56. This indicates that the stock is significantly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's recent purchase, coupled with the stock's undervalued status, could indicate a promising future for Neogen Corp. However, as always, potential investors should conduct their own thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.