Insider Buying: Executive Chairman and CEO David Maura Acquires 40,000 Shares of Spectrum ...

Insider buying is often regarded as a bullish signal by market analysts, as it suggests that insiders are confident about the future prospects of their company. A significant insider purchase can indicate a strong belief in the company's value or the anticipation of positive developments. In a notable move within the consumer goods sector, David Maura, the Executive Chairman and CEO of Spectrum Brands Holdings Inc (NYSE:SPB), has recently increased his stake in the company by purchasing 40,000 shares.

Who is David Maura?

David Maura is the Executive Chairman and CEO of Spectrum Brands Holdings Inc, a diversified global consumer products company. Maura has been with the company for several years and has played a pivotal role in its strategic initiatives and growth. His recent purchase of shares is a testament to his commitment to the company and his belief in its potential for future growth.

Spectrum Brands Holdings Inc's Business Description

Spectrum Brands Holdings Inc is a leading supplier of consumer products globally, with a portfolio that includes well-known brands across various categories such as hardware, home improvement, pet supplies, personal care, and home appliances. The company aims to deliver innovative products with superior quality and value to consumers, leveraging its strong market presence and distribution network.

Description of Insider Buy/Sell

An insider buy occurs when an officer, director, or any person with access to key company information purchases shares of the company's stock. Conversely, an insider sell is when such individuals sell their shares. These transactions are closely monitored by investors and regulatory bodies, as they can provide insights into insider perspectives on the company's financial health and future prospects.

According to the data provided, David Maura has been actively increasing his holdings in Spectrum Brands Holdings Inc. Over the past year, the insider has purchased a total of 65,000 shares and has not sold any shares. This pattern of insider buying, without any corresponding sells, can be interpreted as a strong vote of confidence in the company's direction and management.

Insider Trends

The insider transaction history for Spectrum Brands Holdings Inc shows a clear trend of insider confidence. With 5 insider buys and no insider sells over the past year, the data suggests that those with the most intimate knowledge of the company's workings are optimistic about its future.

Valuation

On the date of the insider's recent purchase, shares of Spectrum Brands Holdings Inc were trading at $66.72, giving the company a market cap of $2.396 billion. This valuation is particularly interesting when considering the company's price-earnings ratio and its comparison to industry standards.

The price-earnings ratio of 1.52 is significantly lower than the industry median of 19.14 and also lower than the company's historical median price-earnings ratio. This discrepancy suggests that the stock may be undervalued relative to its peers and its own trading history, potentially offering an attractive entry point for investors.

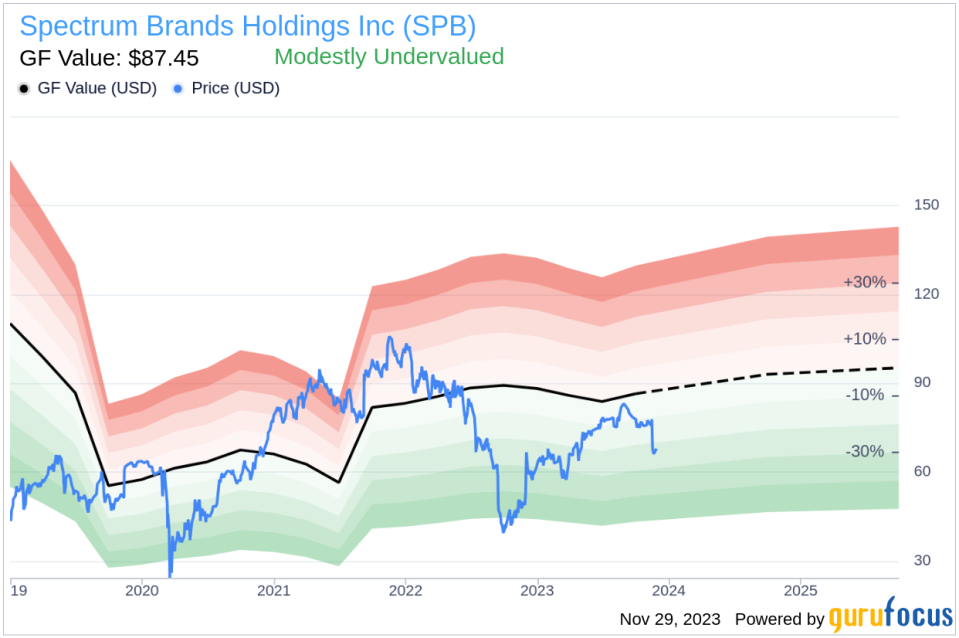

Further reinforcing this perspective is the price-to-GF-Value ratio. With a stock price of $66.72 and a GuruFocus Value of $87.45, Spectrum Brands Holdings Inc has a price-to-GF-Value ratio of 0.76, indicating that the stock is Modestly Undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated considering historical trading multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future business performance estimates from analysts. The current GF Value suggests that Spectrum Brands Holdings Inc's stock is trading below its intrinsic value, which may have been a factor in the insider's decision to increase their stake.

Conclusion

The recent insider buying activity by David Maura, coupled with the company's favorable valuation metrics, paints an intriguing picture for Spectrum Brands Holdings Inc. The insider's substantial purchase aligns with the broader trend of insider confidence and the company's undervalued status according to the price-to-GF-Value ratio. Investors may find these signals compelling when considering the potential for Spectrum Brands Holdings Inc as an investment opportunity.

As always, while insider buying can be a positive indicator, it is essential for investors to conduct their own due diligence, considering the full spectrum of financial and market data before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.