Insider Buying: Florian Brand Acquires 40,000 Shares of ATAI Life Sciences NV

On September 13, 2023, Florian Brand, See Remarks at ATAI Life Sciences NV (NASDAQ:ATAI), made a significant purchase of 40,000 shares of the company's stock. This move is noteworthy and deserves a closer look.

Who is Florian Brand?

Florian Brand is a key figure at ATAI Life Sciences NV, serving in the role of See Remarks. His insider status provides him with a unique perspective on the company's operations, financial health, and future prospects. His recent purchase of ATAI shares is a strong vote of confidence in the company's direction and potential.

About ATAI Life Sciences NV

ATAI Life Sciences NV is a biotechnology company that is at the forefront of innovation in the field of mental health treatment. The company is pioneering the development of novel therapeutics that leverage psychedelic compounds, digital therapeutics, and other approaches to address significant unmet medical needs. ATAI's mission is to transform the treatment of mental health disorders and help patients reclaim their lives.

Insider Buying Analysis

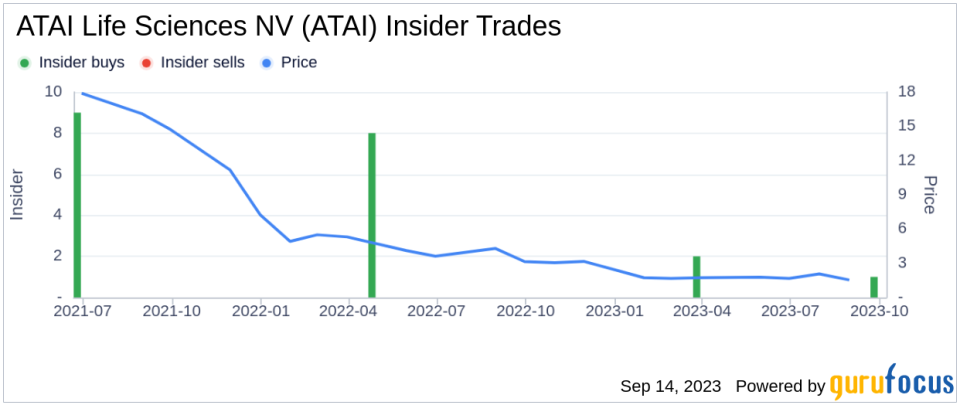

Over the past year, Florian Brand has purchased a total of 110,000 shares of ATAI Life Sciences NV, and has not sold any shares. This trend of consistent buying indicates a strong belief in the company's potential.

The insider transaction history for ATAI Life Sciences NV shows a total of 3 insider buys over the past year, with no insider sells recorded over the same timeframe. This trend of insider buying is generally seen as a positive sign, as it often indicates that those with the most intimate knowledge of the company believe its stock is undervalued or that it is poised for growth.

Stock Price and Valuation

On the day of the insider's recent buy, shares of ATAI Life Sciences NV were trading at $1.45 each. This gives the company a market cap of $240.715 million. While not in the billion-dollar range, this valuation is substantial and suggests that the market sees potential in ATAI's innovative approach to mental health treatment.

Conclusion

The recent purchase of 40,000 shares by Florian Brand, coupled with the overall trend of insider buying at ATAI Life Sciences NV, suggests a positive outlook for the company. Investors may want to keep a close eye on this stock, as the insider's actions could be indicative of a strong belief in the company's future growth potential.

This article first appeared on GuruFocus.