Insider Buying: President James Baker Acquires 37,547 Shares of Kayne Anderson Energy ...

In a notable insider transaction, President James Baker has increased his stake in Kayne Anderson Energy Infrastructure Fund, Inc (NYSE:KYN) by purchasing 37,547 shares. This transaction, dated 2023-11-28, is a sign of confidence from an insider who is privy to the company's operations and potential.

Who is James Baker of Kayne Anderson Energy Infrastructure Fund, Inc?

James Baker serves as the President of Kayne Anderson Energy Infrastructure Fund, Inc, a position that gives him a unique perspective on the company's performance and prospects. His role involves overseeing the strategic direction of the company and ensuring that it meets its financial and operational goals. With a deep understanding of the energy infrastructure sector, Baker's investment decisions are closely watched by investors seeking insights into the company's future.

Kayne Anderson Energy Infrastructure Fund, Inc's Business Description

Kayne Anderson Energy Infrastructure Fund, Inc is an investment company that primarily focuses on the energy sector, including midstream energy companies and other businesses that are poised to benefit from the robust infrastructure demand. The fund seeks to provide a high level of total return with an emphasis on making cash distributions to its stockholders. It invests in a diversified portfolio of energy infrastructure companies, such as pipeline and power companies, which are essential for the transportation and storage of energy resources.

Description of Insider Buy/Sell

Insider buying and selling refer to the transactions made by company insiders such as executives, directors, and major shareholders in the company's own stock. Insider buying can be seen as a positive signal, as insiders might buy shares because they believe the stock is undervalued or that there are positive developments that will drive the stock's price up in the future. Conversely, insider selling might raise red flags, although it can also occur for innocuous reasons, such as diversifying assets or liquidity needs. Tracking these transactions provides investors with insights into the perspectives of those with the most intimate knowledge of the company.

Insider Trends

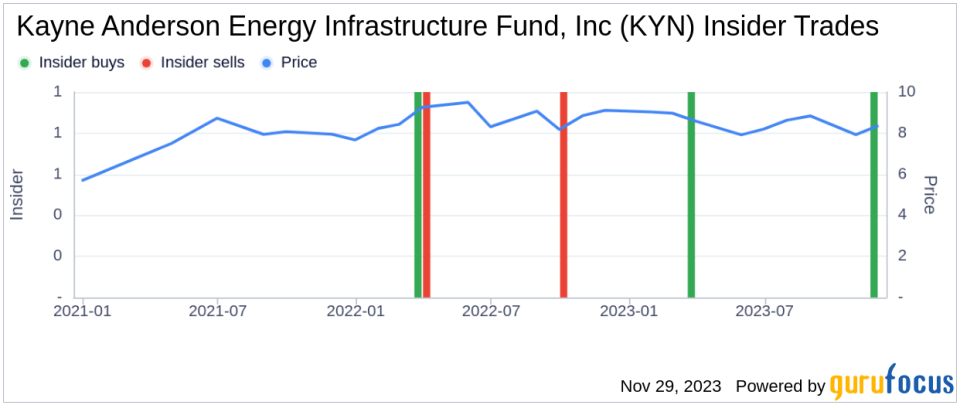

The insider transaction history for Kayne Anderson Energy Infrastructure Fund, Inc shows a pattern of insider confidence. Over the past year, there have been 2 insider buys and notably, no insider sells. This could suggest that the insiders see the stock as undervalued or expect positive developments within the company.

The recent purchase by President James Baker is part of a broader trend of insider acquisitions. Over the past year, the insider has purchased a total of 47,547 shares, demonstrating a consistent interest in increasing his ownership stake in the company.

Valuation

On the day of the insider's recent buy, shares of Kayne Anderson Energy Infrastructure Fund, Inc were trading at $10.03 each. This pricing gives the company a market capitalization of $1.416 billion. The market cap, along with the insider buying trend, can offer insights into how the market is valuing the company and the insider's assessment of the stock's fair value.

In conclusion, the recent insider buying activity by President James Baker at Kayne Anderson Energy Infrastructure Fund, Inc signals a vote of confidence in the company's future prospects. While insider buying alone should not be the sole factor in making an investment decision, it can be a powerful piece of the puzzle when combined with other financial analyses and market research. Investors will be watching closely to see how this insider transaction aligns with the company's performance in the coming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.