Insider Buying: QCR Holdings Inc CEO Larry Helling Acquires 1,000 Shares

Larry Helling, CEO of QCR Holdings Inc (NASDAQ:QCRH), has recently purchased 1,000 shares of the company's stock, according to a filing with the Securities and Exchange Commission. The transaction took place on September 8, 2023.

Larry Helling has been with QCR Holdings Inc for several years, serving in various leadership roles before becoming CEO. His deep understanding of the company's operations and strategic direction makes his stock purchases particularly noteworthy for investors.

QCR Holdings Inc is a multi-bank holding company. The company serves the Quad Cities, Cedar Rapids, Waterloo/Cedar Falls, Des Moines/Ankeny, and Springfield communities through its wholly owned subsidiary banks. The banks provide full-service commercial and consumer banking and trust and asset management services.

Over the past year, Larry Helling has purchased a total of 7,000 shares and has not sold any shares. This recent purchase of 1,000 shares further strengthens his position in the company.

The insider transaction history for QCR Holdings Inc shows a total of 25 insider buys over the past year, compared to just 2 insider sells. This suggests a positive sentiment among the company's insiders.

On the day of the insider's recent buy, shares of QCR Holdings Inc were trading at $50 each, giving the company a market cap of $845.304 million. The price-earnings ratio is 7.43, lower than both the industry median of 8.22 and the companys historical median price-earnings ratio. This suggests that the stock may be undervalued.

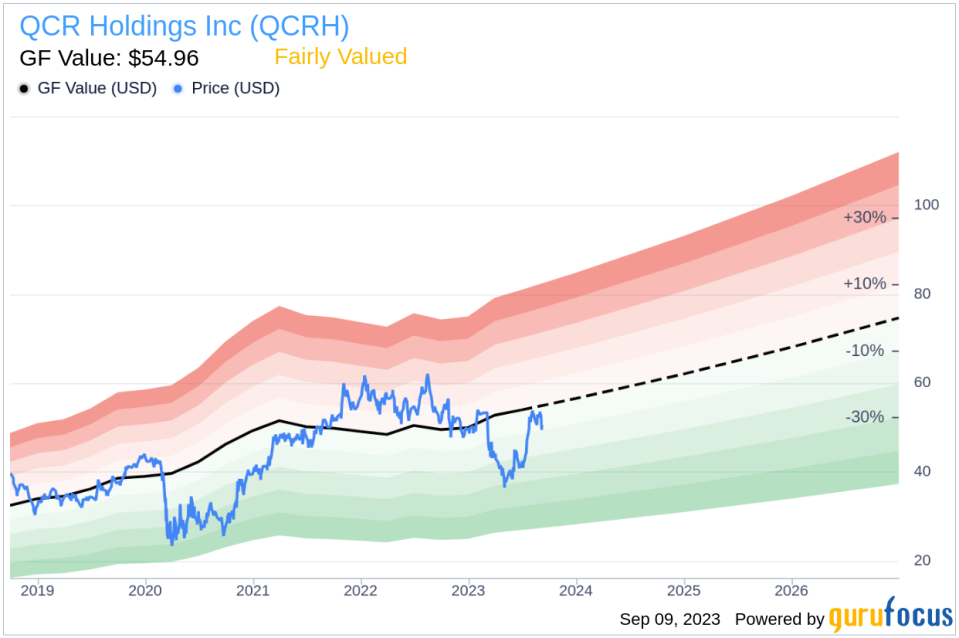

The GuruFocus Value for QCR Holdings Inc is $54.96, resulting in a price-to-GF-Value ratio of 0.91. This indicates that the stock is fairly valued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's recent purchase, along with the positive insider buying trend and the stock's fair valuation, suggest that QCR Holdings Inc may be a solid investment opportunity. However, as always, potential investors should conduct their own due diligence before making investment decisions.

This article first appeared on GuruFocus.