Insider Buying: Sealed Air Corp CEO Doheny Edward L II Acquires 10,000 Shares

On September 8, 2023, Doheny Edward L II, President and CEO of Sealed Air Corp (NYSE:SEE), purchased 10,000 shares of the company, signaling a strong vote of confidence in the firm's prospects. This article will delve into the details of this insider buying activity and its potential implications for investors.

Who is Doheny Edward L II?

Doheny Edward L II is the President and CEO of Sealed Air Corp, a leading global provider of packaging solutions for various industries. With a wealth of experience in the industry, Doheny has been instrumental in driving the company's growth and innovation strategies. His recent purchase of Sealed Air Corp shares underscores his belief in the company's future success.

About Sealed Air Corp

Sealed Air Corp is a renowned name in the packaging industry, offering innovative and sustainable solutions to businesses across the globe. The company's products and services cater to a wide range of sectors, including food, healthcare, and e-commerce, among others. With a market cap of $4.88 billion, Sealed Air Corp is a significant player in the packaging industry.

Insider Buying Analysis

Over the past year, the insider has purchased a total of 10,000 shares and sold none. This trend is mirrored in the broader insider transaction history of Sealed Air Corp, which shows a total of four insider buys and zero sells over the same period.

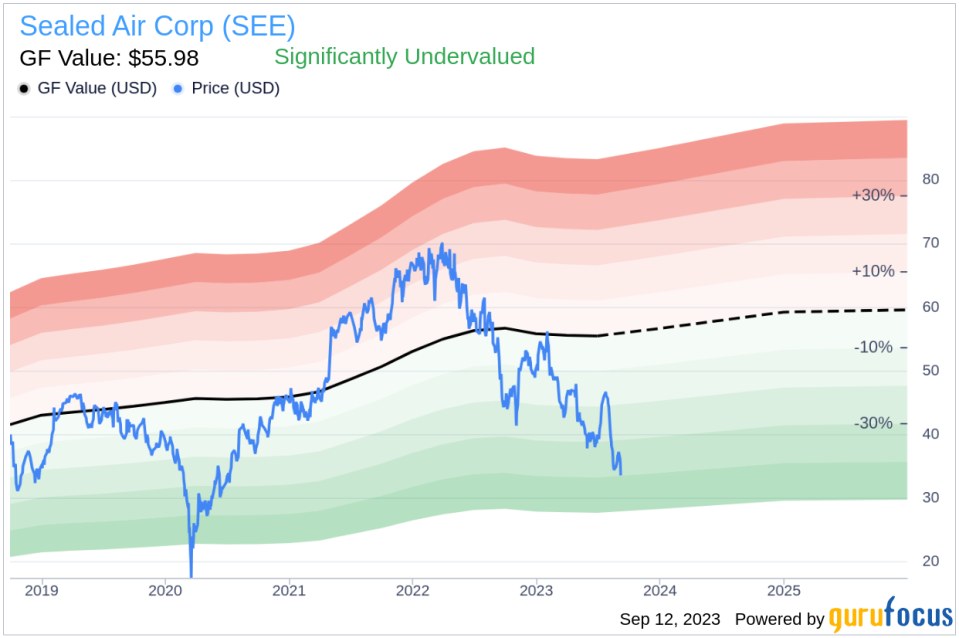

The correlation between insider buying and stock price is often seen as a positive signal by investors. The insider's recent purchase came when the stock was trading at $33.85, which is significantly lower than the GuruFocus Value of $55.98. This suggests that the stock is undervalued, potentially offering a lucrative investment opportunity.

Valuation

Sealed Air Corp's price-earnings ratio stands at 12.57, lower than both the industry median of 15.64 and the company's historical median. This, coupled with a price-to-GF-Value ratio of 0.6, indicates that the stock is significantly undervalued.

The GF Value is a proprietary valuation model developed by GuruFocus, taking into account historical multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. Based on this model, Sealed Air Corp's current stock price offers a compelling value proposition.

In conclusion, the insider's recent purchase of Sealed Air Corp shares, coupled with the stock's undervalued status, presents a potentially attractive opportunity for investors. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.