Insider Buying: SVP LOGAN RON M JR Acquires Shares of Kayne Anderson Energy Infrastructure Fund, Inc

In the realm of investment, insider transactions hold a significant place as they can provide insights into a company's internal perspective on its financial health and future prospects. A recent transaction that has caught the attention of the market is the purchase of shares by Senior Vice President LOGAN RON M JR of Kayne Anderson Energy Infrastructure Fund, Inc (NYSE:KYN). On November 28, 2023, the insider acquired a notable 15,354 shares of the company, indicating a potential confidence in the firm's trajectory.

Who is LOGAN RON M JR?

LOGAN RON M JR serves as a Senior Vice President at Kayne Anderson Energy Infrastructure Fund, Inc. His role within the company positions him to have an informed perspective on the fund's operations and investment strategies. Insider transactions by high-ranking executives like LOGAN RON M JR are closely monitored as they may reflect the management's belief in the company's current valuation and future performance.

Kayne Anderson Energy Infrastructure Fund, Inc's Business Description

Kayne Anderson Energy Infrastructure Fund, Inc is a non-diversified, closed-end management investment company. The fund primarily invests in equity securities of companies in the energy industry, which includes midstream energy companies such as pipelines and storage facilities, as well as other businesses that are related to the energy sector. The fund's investment objective is to provide a high level of total return with an emphasis on making cash distributions to its stockholders.

Understanding Insider Buy/Sell

An insider buy occurs when an officer, director, or any person with access to key company information purchases shares of their company's stock. Conversely, an insider sell is when such individuals sell their shares. These transactions are considered material information as they can signal how insiders view the company's current valuation and future prospects. Regulatory bodies require insiders to report these transactions, ensuring transparency in the market.

Insider Transaction History and Trends

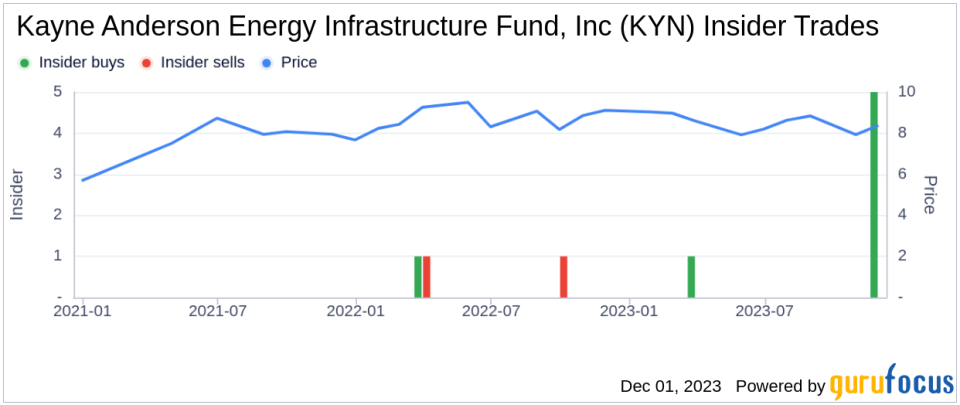

The insider transaction history for Kayne Anderson Energy Infrastructure Fund, Inc reveals a pattern of insider confidence. Over the past year, there have been seven insider buys and notably, zero insider sells. This trend suggests that insiders are generally optimistic about the fund's future and are willing to invest their personal capital into the company's shares.

The recent purchase by LOGAN RON M JR is part of this broader trend of insider buying. With 15,354 shares acquired over the past year and no shares sold, the insider's actions may be interpreted as a positive signal regarding the company's valuation and outlook.

Valuation and Market Cap

On the day of the insider's recent acquisition, shares of Kayne Anderson Energy Infrastructure Fund, Inc were trading at $10.03 each. This pricing gives the stock a market capitalization of approximately $1.449 billion. Market capitalization is a critical metric as it represents the total market value of a company's outstanding shares and is used to determine a company's size.

Objective Analysis Based on Data

When analyzing insider transactions, it is essential to consider the context of the broader market and the specific industry in which the company operates. The energy infrastructure sector has been subject to various market forces, including fluctuating commodity prices, regulatory changes, and shifts in consumer demand. Despite these challenges, the consistent insider buying at Kayne Anderson Energy Infrastructure Fund, Inc may suggest that the insiders believe the company is well-positioned to navigate the industry's complexities.

Furthermore, the lack of insider selling over the past year could indicate that insiders do not believe the stock is overvalued or that they expect future growth. This absence of selling is particularly noteworthy as it diverges from the behavior often seen in other companies, where insiders might sell shares to realize gains or diversify their investments.

The insider's recent purchase also aligns with the fund's investment strategy, which focuses on energy infrastructure companies that may offer attractive distribution yields. The fund's emphasis on cash distributions could be appealing to insiders who are looking for income-generating investments, especially in a market environment where interest rates and bond yields are relatively low.

It is also worth noting that the insider's purchase was made at a price point that is reflective of the current market valuation. The stock's price on the day of the transaction suggests that the insider believes the shares are fairly valued or undervalued, providing a potential opportunity for capital appreciation in addition to the income from distributions.

In conclusion, the insider buying activity at Kayne Anderson Energy Infrastructure Fund, Inc, particularly the recent purchase by Senior Vice President LOGAN RON M JR, provides an optimistic outlook for the company. While insider transactions should not be the sole factor in making investment decisions, they can offer valuable insights into the perspectives of those with intimate knowledge of the company. As always, investors should conduct their due diligence and consider a multitude of factors when evaluating investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.