Insider Buying: Union Bankshares Inc President & CEO David Silverman Acquires 500 Shares

On September 13, 2023, David Silverman, President & CEO of Union Bankshares Inc (NASDAQ:UNB), purchased 500 shares of the company, signaling a strong vote of confidence in the firm's prospects. This article will delve into the details of this insider buying activity and its potential implications for investors.

About David Silverman and Union Bankshares Inc

David Silverman is the President and CEO of Union Bankshares Inc, a position he has held since 2018. With over 20 years of experience in the banking industry, Silverman has a deep understanding of the financial sector and a proven track record of leadership. His decision to increase his stake in the company is a significant development that investors should take note of.

Union Bankshares Inc is a bank holding company that provides commercial, retail, and municipal banking services through its Union Bank subsidiary. The company operates in Vermont and New Hampshire, offering a wide range of financial products and services, including residential and commercial real estate loans, consumer loans, and commercial business loans.

Analysis of Insider Buying and Stock Price

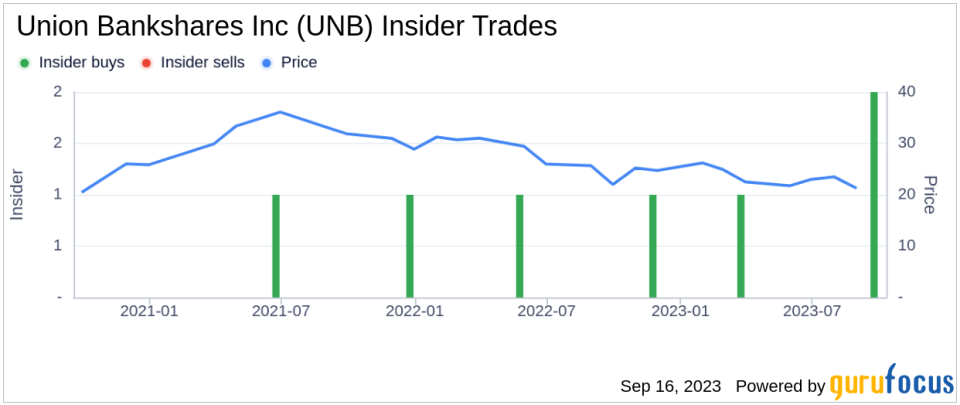

Over the past year, David Silverman has purchased a total of 500 shares and has not sold any shares. This trend is mirrored in the broader insider transaction history for Union Bankshares Inc, which shows a total of 4 insider buys and 0 insider sells over the past year.

The insider's recent acquisition took place when Union Bankshares Inc's shares were trading at $20.11, giving the stock a market cap of $98.705 million. This price represents a price-earnings ratio of 7.66, which is lower than both the industry median of 8.32 and the companys historical median price-earnings ratio. This suggests that the stock may be undervalued, a sentiment echoed by the insider's decision to buy.

GF Value Analysis

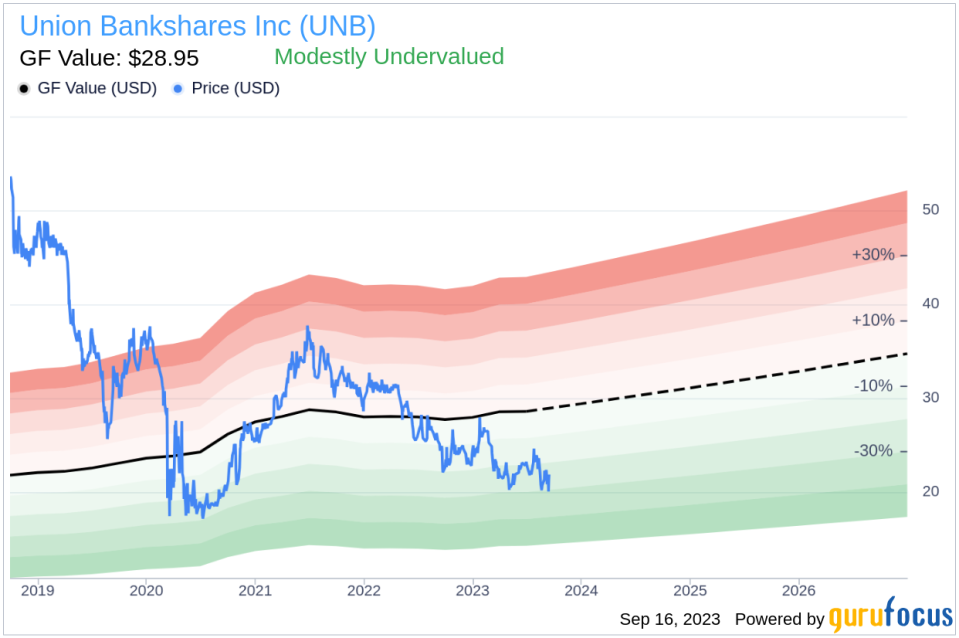

The GuruFocus Value (GF Value) is a proprietary estimate of a stock's intrinsic value, based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. For Union Bankshares Inc, the GF Value is $28.95, significantly higher than the current price of $20.11.

This results in a price-to-GF-Value ratio of 0.69, indicating that the stock is modestly undervalued. This further supports the insider's decision to buy shares, as it suggests that the stock may be trading below its true worth.

In conclusion, the insider's recent purchase of Union Bankshares Inc shares, coupled with the stock's low price-earnings ratio and modest undervaluation according to its GF Value, suggests that the stock could be an attractive investment opportunity. As always, investors should conduct their own research and consider their risk tolerance before making investment decisions.

This article first appeared on GuruFocus.