Insider Sell: AAR Corp Chairman, President & CEO Holmes John McClain III Sells 12,363 Shares

On October 4, 2023, Holmes John McClain III, the Chairman, President & CEO of AAR Corp (NYSE:AIR), sold 12,363 shares of the company. This move is part of a series of transactions made by the insider over the past year, during which he sold a total of 332,923 shares and made no purchases.

Holmes John McClain III has been with AAR Corp for several years, leading the company through various market conditions. AAR Corp is a global aftermarket solutions company with operations in over 100 countries. The company provides various services to aviation and government & defense markets including parts supply; OEM solutions; integrated solutions; maintenance, repair, overhaul; and engineering.

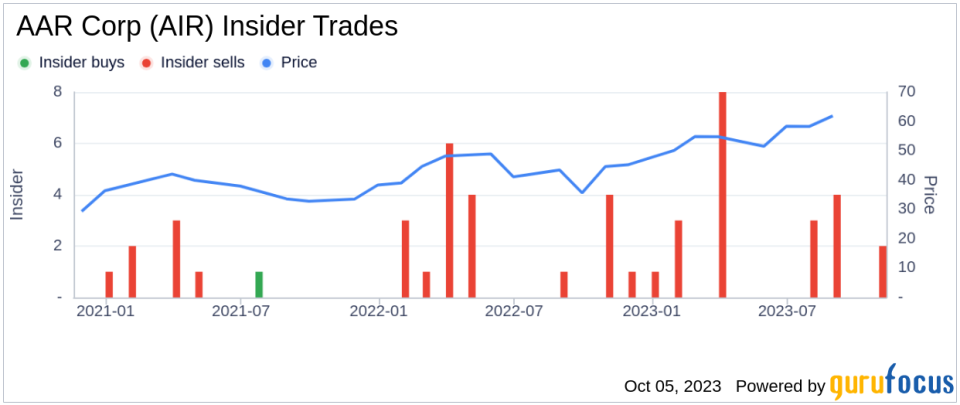

The insider's recent sell has raised questions among investors about the company's current valuation and future prospects. To understand the implications of this sell, it's important to analyze the insider buy/sell trends and their relationship with the stock price.

The insider transaction history for AAR Corp shows a clear trend of more sells than buys over the past year. There have been 26 insider sells and no insider buys. This could indicate that insiders believe the stock is currently overvalued, prompting them to sell their shares.

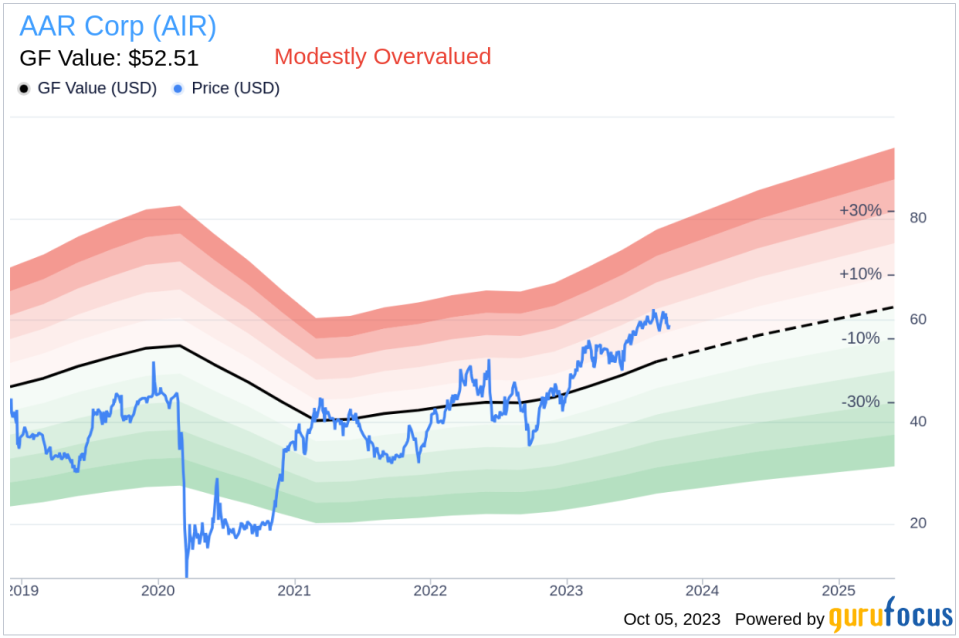

On the day of the insider's recent sell, AAR Corp shares were trading at $59.04, giving the company a market cap of $2.089 billion. The price-earnings ratio was 31.15, lower than the industry median of 33.59 but higher than the companys historical median price-earnings ratio.

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, AAR Corp is modestly overvalued. The stock's price-to-GF-Value ratio is 1.12, with a GF Value of $52.51 and a current price of $59.04.

In conclusion, the insider's recent sell, along with the overall insider sell trend, could be a signal to investors that the stock might be overvalued. However, investors should also consider other factors such as the company's financial health, market conditions, and future growth prospects before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.