Insider Sell: Accel Entertainment Inc CEO and President Andrew Rubenstein Sells 20,000 Shares

On October 2, 2023, Andrew Rubenstein, CEO, President, and 10% Owner of Accel Entertainment Inc (NYSE:ACEL), sold 20,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 242,952 shares and purchased none.

Accel Entertainment Inc is a leading gaming-as-a-service provider, operating over 12,000 gaming devices across more than 1,800 locations in the United States. The company offers a range of entertainment and gaming solutions for businesses, including slot machines, redemption devices, and digital jukeboxes.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. To understand the implications of this move, it's essential to examine the relationship between insider trading and stock price.

The insider transaction history for Accel Entertainment Inc shows a clear trend: over the past year, there have been 28 insider sells and no insider buys. This could indicate that insiders believe the company's stock is overvalued, or it could simply reflect personal financial decisions by the insiders.

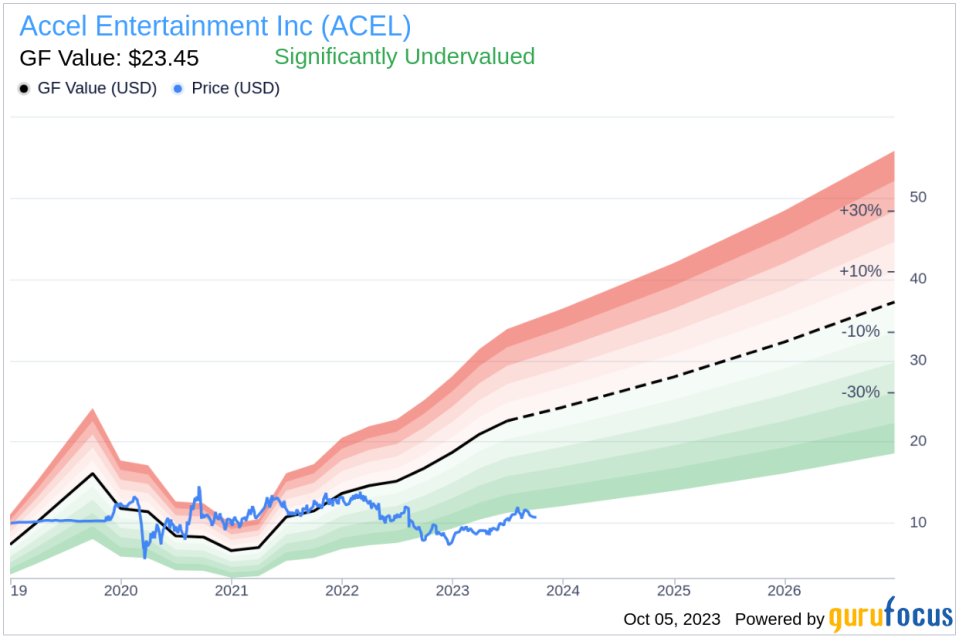

On the day of the insider's recent sell, shares of Accel Entertainment Inc were trading at $10.75, giving the company a market cap of $920.37 million. This is significantly lower than the company's GF Value of $23.45, suggesting that the stock is significantly undervalued.

The GF Value is an intrinsic value estimate developed by GuruFocus, based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. With a price-to-GF-Value ratio of 0.46, Accel Entertainment Inc's stock appears to be a bargain.

However, the insider's recent sell-off could suggest that they believe the company's stock is overvalued, despite its low price-to-GF-Value ratio. This could indicate that the company's future business performance may not meet analysts' expectations, or it could simply reflect the insider's personal financial decisions.

In conclusion, while Accel Entertainment Inc's stock appears to be significantly undervalued based on its GF Value, the insider's recent sell-off raises questions about the company's future prospects. Investors should carefully consider these factors before making investment decisions.

This article first appeared on GuruFocus.