Insider Sell: Accolade Inc President Robert Cavanaugh Sells 215 Shares

On September 12, 2023, Robert Cavanaugh, President of Accolade Inc (NASDAQ:ACCD), sold 215 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 8,713 shares over the past year and made no purchases.

Robert Cavanaugh is a key figure at Accolade Inc, a company that provides personalized, technology-enabled solutions that help people better understand, navigate, and utilize the healthcare system and their workplace benefits. The company's customers are primarily employers who provide their employees with access to Accolade's personalized health and benefits solutions. Accolade's solutions incorporate a blend of compassionate human touch with an advanced technology platform to influence healthcare outcomes and costs.

The insider's recent sell-off is part of a broader trend within Accolade Inc. Over the past year, there have been 86 insider sells and no insider buys. This trend is illustrated in the following image:

The relationship between insider trading and stock price is complex. Generally, insider selling can be seen as a bearish signal, suggesting that those with the most information about the company believe its stock may underperform. However, insiders may sell shares for many reasons, and it does not necessarily indicate a lack of confidence in the company.

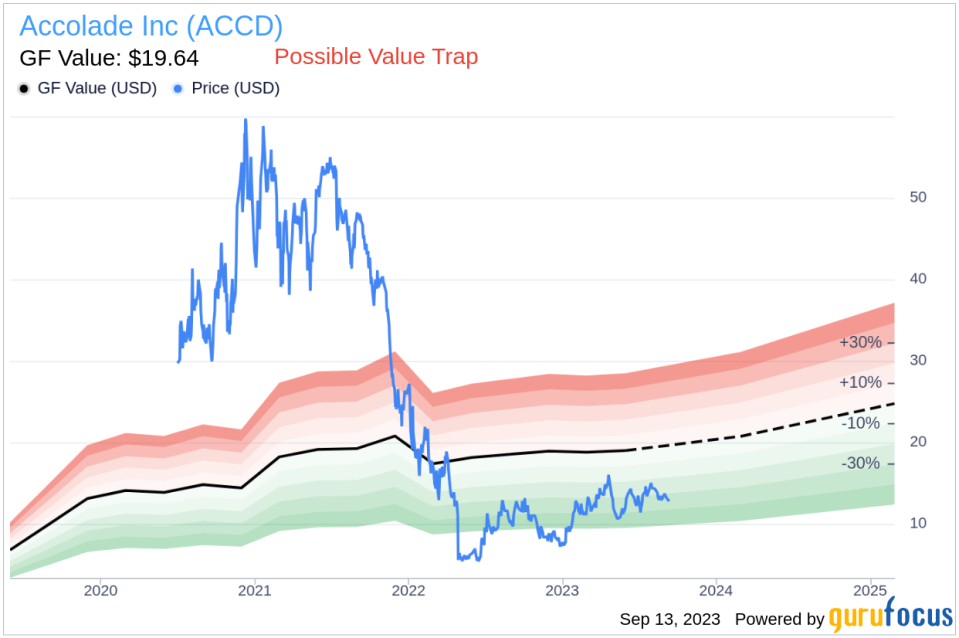

On the day of the insider's recent sell, shares of Accolade Inc were trading at $13.23, giving the company a market cap of $956.733 million. This is significantly below the company's GuruFocus Value of $19.64, as shown in the following image:

The price-to-GF-Value ratio of 0.67 suggests that Accolade Inc may be a possible value trap. Investors should think twice before buying shares. The GF Value is an intrinsic value estimate developed by GuruFocus, based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

In conclusion, the insider's recent sell-off, combined with the company's valuation and the broader trend of insider selling at Accolade Inc, suggests that investors should approach this stock with caution. As always, it's important to conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.