Insider Sell: Akamai Technologies Inc's CTO Robert Blumofe Sells 2,000 Shares

In a recent transaction on November 17, 2023, Robert Blumofe, the Chief Technology Officer of Akamai Technologies Inc (NASDAQ:AKAM), sold 2,000 shares of the company's stock. This move has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its executives.

Who is Robert Blumofe?

Robert Blumofe is a key executive at Akamai Technologies Inc, serving as the Chief Technology Officer. With a background in computer science and extensive experience in the field of technology, Blumofe has been instrumental in shaping Akamai's strategic direction and technological advancements. His role involves overseeing the development and implementation of Akamai's innovative solutions that cater to the ever-evolving digital landscape.

Akamai Technologies Inc's Business Description

Akamai Technologies Inc is a global leader in content delivery network (CDN) services, cybersecurity, and cloud service solutions. The company's advanced web performance, mobile performance, cloud security, and media delivery solutions are designed to help businesses provide secure, high-performing user experiences on any device, anywhere. Akamai's intelligent edge platform surrounds everything, from the enterprise to the cloud, ensuring customers and their businesses can be fast, smart, and secure.

Analysis of Insider Buy/Sell and Relationship with Stock Price

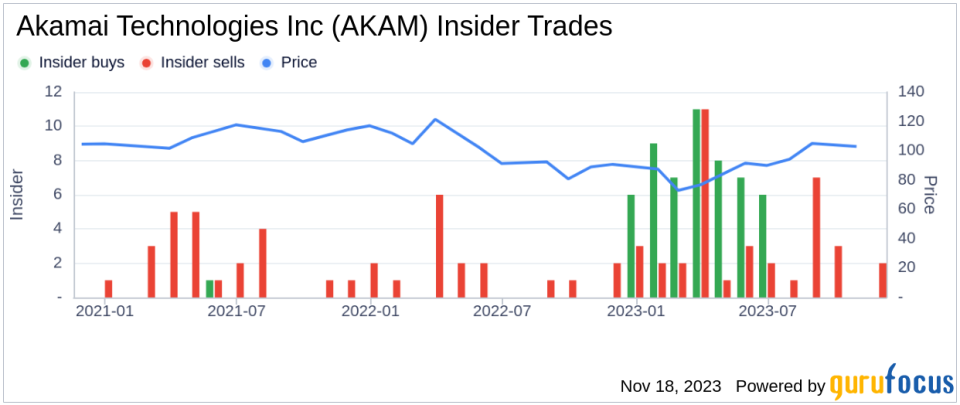

The insider transaction history for Akamai Technologies Inc reveals a pattern of insider activity that can be indicative of the company's internal perspective. Over the past year, there have been 54 insider buys and 39 insider sells. This activity suggests a balanced view among insiders, with a slightly higher inclination towards purchasing shares. However, the recent sale by the insider, Robert Blumofe, who has sold 18,238 shares in total over the past year without any recorded purchases, may signal a shift in sentiment or personal financial planning.

On the day of the insider's recent sale, shares of Akamai Technologies Inc were trading at $111.47, giving the company a market cap of $16.95 billion. The price-earnings ratio stands at 33.85, which is higher than the industry median of 26.59 and also above the company's historical median. This elevated P/E ratio could suggest that the stock is priced on the higher end of its valuation spectrum, potentially influencing the insider's decision to sell.

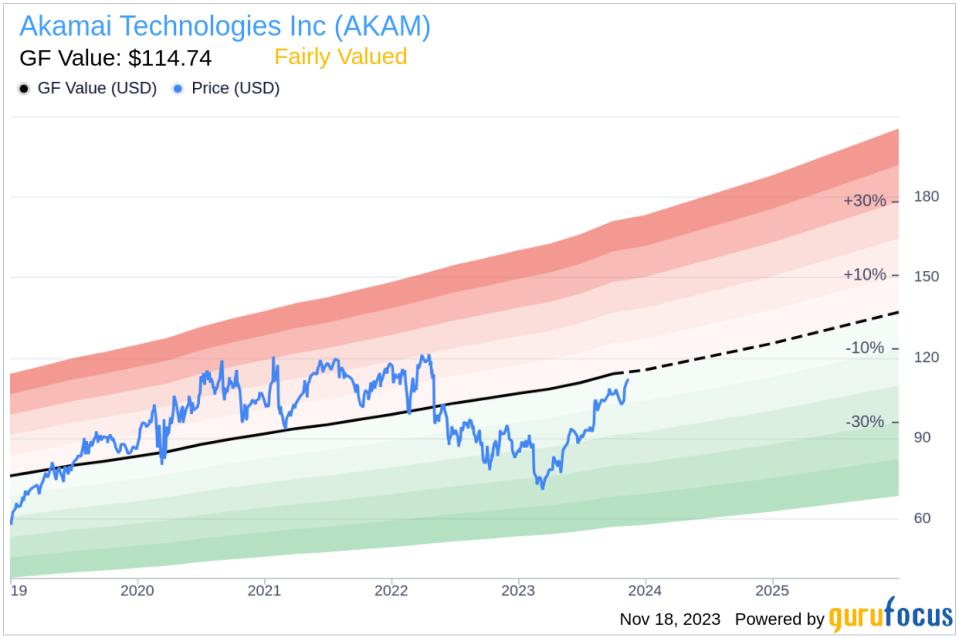

The price-to-GF-Value ratio of 0.97 indicates that Akamai Technologies Inc is fairly valued based on its GF Value of $114.74. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. A ratio close to 1 suggests that the stock is trading at a price that aligns with its estimated true value.

The relationship between insider transactions and stock price can be complex. While insider selling does not always indicate a lack of confidence in the company, it can sometimes precede a downturn in the stock price if it reflects broader concerns about the company's future prospects. Conversely, insider buying can be a bullish signal, suggesting that those with the most knowledge of the company anticipate positive developments.

The insider trend image above provides a visual representation of the buying and selling patterns of Akamai Technologies Inc's insiders. It is important for investors to consider this information in the context of the company's performance, market conditions, and other relevant factors.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. When the stock price is close to or below the GF Value, it may be considered a good investment opportunity, assuming the company's fundamentals remain strong.

Conclusion

In conclusion, the recent insider sale by Robert Blumofe, the CTO of Akamai Technologies Inc, is a transaction that warrants attention. While the company appears to be fairly valued based on the GF Value, the higher price-earnings ratio compared to the industry median may have been a factor in the insider's decision to sell. Investors should monitor insider trends and consider the broader context when evaluating the implications of insider transactions for their investment decisions.

It is also crucial to keep in mind that insider transactions are just one piece of the puzzle when it comes to assessing a stock's potential. A comprehensive analysis should include a review of the company's financial health, growth prospects, competitive position, and market conditions. As always, investors are encouraged to conduct their own due diligence and consult with financial advisors before making investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.