Insider Sell: Akero Therapeutics Inc CEO Andrew Cheng Sells 25,000 Shares

On October 2, 2023, President and CEO Andrew Cheng of Akero Therapeutics Inc (NASDAQ:AKRO) sold 25,000 shares of the company's stock. This move is part of a larger trend of insider selling at Akero Therapeutics, which we will explore in more detail below.

Who is Andrew Cheng?

Andrew Cheng is the President and CEO of Akero Therapeutics Inc. He has been with the company since its inception and has played a pivotal role in its growth and development. Cheng's leadership has been instrumental in guiding Akero Therapeutics through various stages of drug development and commercialization. His recent sale of 25,000 shares is noteworthy and warrants further analysis.

About Akero Therapeutics Inc

Akero Therapeutics Inc is a clinical-stage biotechnology company focused on the development and commercialization of transformative treatments for patients with serious metabolic diseases. The company's lead product candidate, Efruxifermin, is in clinical development for the treatment of non-alcoholic steatohepatitis (NASH), a severe form of non-alcoholic fatty liver disease.

Insider Sell Analysis

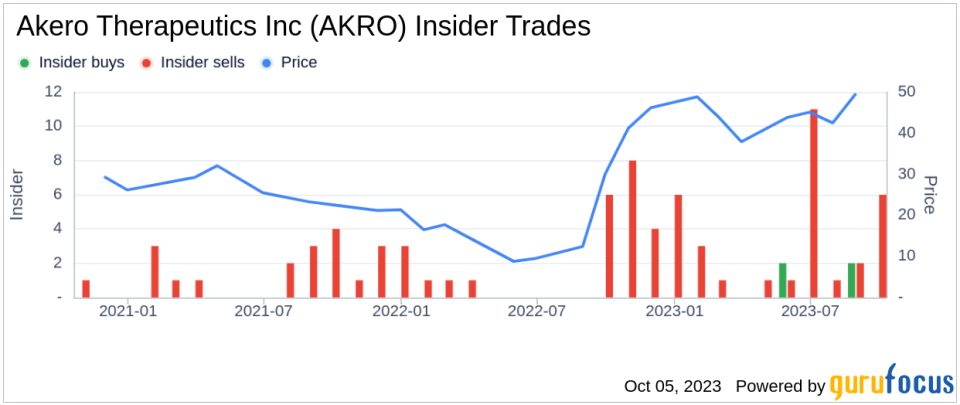

Over the past year, the insider has sold a total of 248,295 shares and purchased 0 shares. This recent sale of 25,000 shares is part of a larger trend of insider selling at Akero Therapeutics. The insider transaction history for Akero Therapeutics shows that there have been 4 insider buys in total over the past year, compared to 45 insider sells over the same timeframe.

The above image shows the trend of insider transactions at Akero Therapeutics. The high number of insider sells compared to buys could be a potential red flag for investors. However, it's important to note that insider selling does not necessarily indicate a lack of confidence in the company. Insiders may sell shares for a variety of reasons, including personal financial planning or diversification.

Stock Price and Valuation

On the day of the insider's recent sale, shares of Akero Therapeutics were trading for $47.91 apiece. This gives the stock a market cap of $2.56 billion. The relationship between insider selling and the stock price is complex. While a high volume of insider selling can sometimes indicate a lack of confidence in the company's future prospects, it can also simply reflect personal financial decisions by the insiders. Therefore, investors should consider the context of the insider transactions along with other factors when making investment decisions.

In conclusion, while the recent insider selling at Akero Therapeutics warrants attention, it should be considered as part of a broader analysis of the company's financial health, business prospects, and market conditions.

This article first appeared on GuruFocus.