Insider Sell: Aldo Pagliari Sells 4,842 Shares of Snap-on Inc

On September 12, 2023, Aldo Pagliari, the Sr VP - Finance & CFO of Snap-on Inc (NYSE:SNA), sold 4,842 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

But who is Aldo Pagliari? He is a seasoned financial executive with a long history at Snap-on Inc. As the Sr VP - Finance & CFO, he plays a crucial role in the company's financial strategy and operations. His insider trades, therefore, provide valuable insights into the company's financial health and future prospects.

Snap-on Inc is a leading global innovator, manufacturer, and marketer of tools, equipment, diagnostics, repair information, and systems solutions for professional users performing critical tasks. The company's products and services include hand and power tools, tool storage, diagnostics software, information and management systems, shop equipment, and other solutions for vehicle dealerships and repair centers, as well as for customers in industries, including aviation and aerospace, agriculture, construction, government and military, mining, natural resources, power generation, and technical education.

Over the past year, the insider has sold a total of 24,070 shares and purchased 0 shares. This trend of selling without any insider buys raises questions about the company's current valuation and future prospects.

The insider transaction history for Snap-on Inc shows that there have been 0 insider buys and 24 insider sells over the past year. This trend suggests that insiders may believe the stock is currently overvalued, prompting them to sell their shares.

On the day of the insider's recent sell, shares of Snap-on Inc were trading for $262.13 apiece, giving the stock a market cap of $13.97 billion. The price-earnings ratio is 14.62, which is lower than the industry median of 21.73 and lower than the companys historical median price-earnings ratio. This suggests that the stock may be undervalued compared to its peers and its own historical averages.

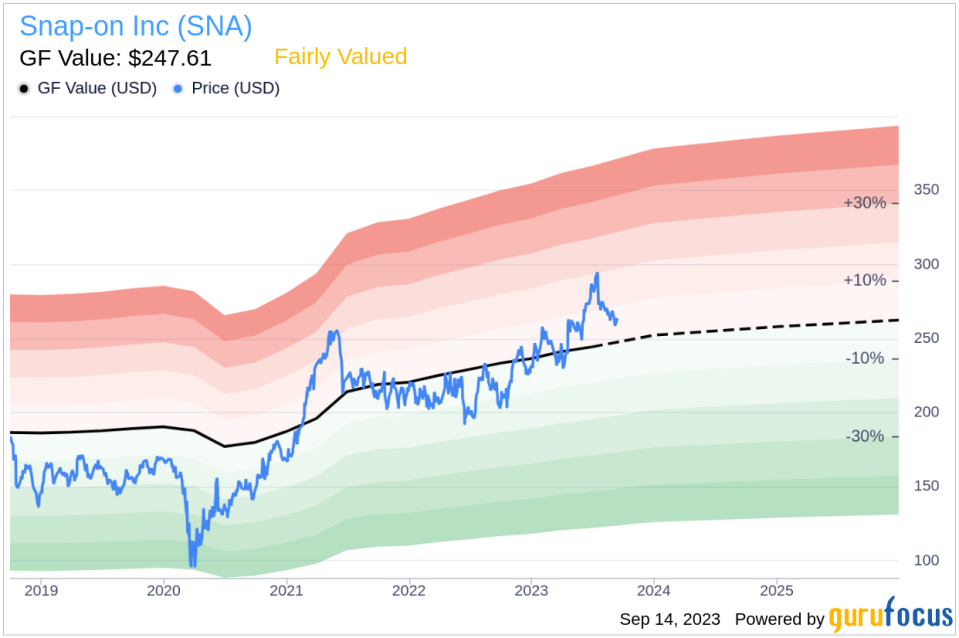

However, with a price of $262.13 and a GuruFocus Value of $247.61, Snap-on Inc has a price-to-GF-Value ratio of 1.06. This means the stock is fairly valued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus that is calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's recent sell and the overall trend of insider sells over the past year may raise some concerns, the stock's current valuation metrics suggest that it is fairly valued. Investors should keep a close eye on future insider transactions and other indicators of the company's financial health and prospects.

This article first appeared on GuruFocus.