Insider Sell Alert: BridgeBio Pharma Inc's Brian Stephenson Unloads 22,685 Shares

In a notable insider transaction, Brian Stephenson, the Secretary, Treasurer & CFO of BridgeBio Pharma Inc (NASDAQ:BBIO), sold 22,685 shares of the company on November 17, 2023. This move has caught the attention of investors and market analysts, as insider selling patterns can provide valuable insights into a company's financial health and future prospects.

Who is Brian Stephenson of BridgeBio Pharma Inc?

Brian Stephenson plays a pivotal role at BridgeBio Pharma Inc, holding the positions of Secretary, Treasurer, and Chief Financial Officer. His responsibilities include overseeing the financial operations, managing corporate finances, and ensuring regulatory compliance. Stephenson's actions, particularly in terms of stock transactions, are closely monitored by investors as they may reflect his confidence in the company's financial stability and growth potential.

BridgeBio Pharma Inc's Business Description

BridgeBio Pharma Inc is a biopharmaceutical company focused on discovering, developing, and delivering breakthrough medicines for genetic diseases. The company has a diverse portfolio of drugs targeting various illnesses, with an emphasis on providing solutions for patients with unmet medical needs. BridgeBio leverages cutting-edge science and a robust R&D pipeline to create transformative medications that can significantly improve the lives of individuals affected by genetic disorders.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

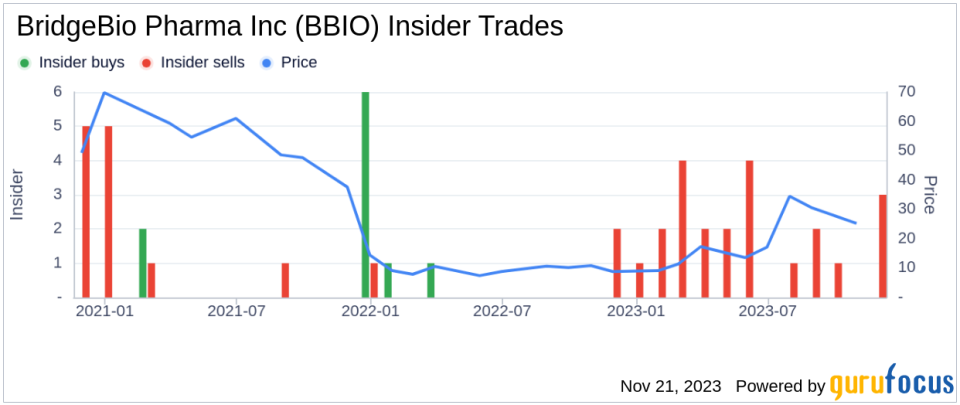

The recent sale by the insider, Brian Stephenson, is part of a larger pattern observed over the past year. Stephenson has sold a total of 392,710 shares and has not made any purchases. This one-sided transaction history could signal a lack of buying interest from insiders, which might be interpreted as a cautious stance towards the company's valuation or future prospects.

The absence of insider buys over the past year, coupled with 22 insider sells, suggests that insiders may perceive the stock as fully valued or are taking profits off the table. This trend can impact investor sentiment and potentially influence the stock price, as insider selling is often viewed as a bearish signal.

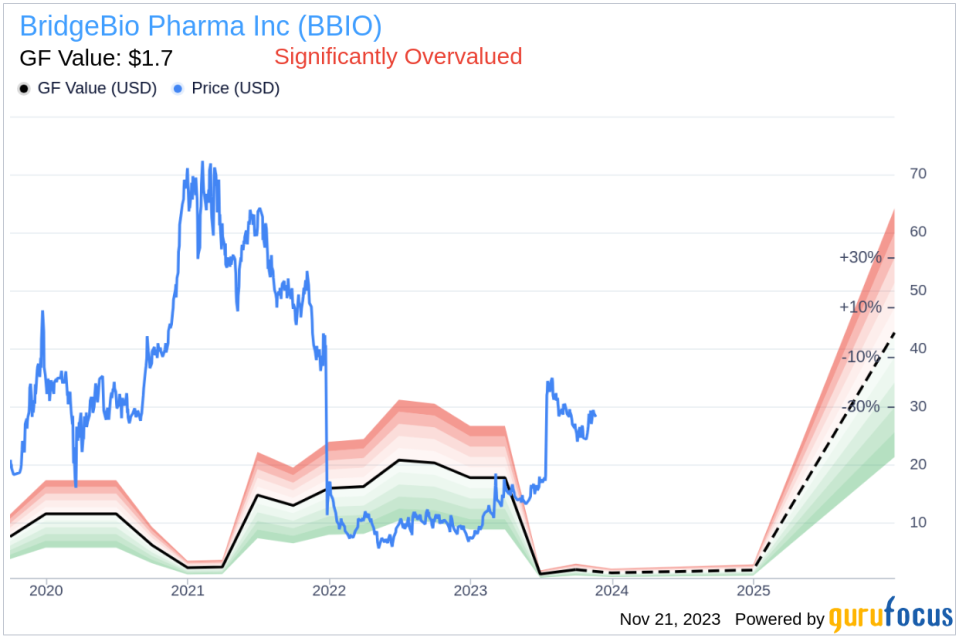

On the day of Stephenson's recent sale, BridgeBio Pharma Inc's shares were trading at $29.1, giving the company a market cap of $4.925 billion. This valuation places the stock in the significantly overvalued category according to the GuruFocus Value (GF Value) of $1.70, with a price-to-GF-Value ratio of 17.12.

The GF Value is a proprietary metric that considers historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business estimates. The significant discrepancy between the current stock price and the GF Value suggests that the market may be pricing in optimistic future growth or that the stock is experiencing a speculative run-up.

The insider trend image above illustrates the recent selling activity, which could be a point of concern for potential investors. It is important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or liquidity needs. However, the absence of insider buying does not provide a counterbalance to this selling pressure.

The GF Value image further emphasizes the disparity between the stock's current market price and its estimated intrinsic value. While the market seems to be assigning a premium to BridgeBio Pharma Inc's shares, investors should be cautious and consider whether the premium is justified by the company's growth prospects and financial performance.

Conclusion

Brian Stephenson's recent sale of 22,685 shares of BridgeBio Pharma Inc is a significant event that warrants attention from the investment community. While insider selling does not always indicate a problem within a company, the pattern of sales without corresponding buys from insiders at BridgeBio Pharma Inc could suggest a cautious or bearish outlook from those with intimate knowledge of the company.

Investors should weigh the insider selling trend against the company's valuation, as indicated by the GF Value, and consider the broader context of the biopharmaceutical industry and BridgeBio Pharma Inc's position within it. As always, a well-rounded investment decision should be based on a comprehensive analysis of the company's financials, growth potential, competitive landscape, and market conditions.

It is also advisable for investors to monitor any further insider transactions and company announcements that could provide additional clues about the future direction of BridgeBio Pharma Inc's stock price. Keeping an eye on the insider trends and valuation metrics can help investors make more informed decisions in their investment journey.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.