Insider Sell Alert: Candace Formacek Sells 3,767 Shares of Universal Corp (UVV)

In the realm of stock market movements, insider trading activity is often a significant indicator that investors and analysts closely monitor. Recently, Candace Formacek, Vice President & Treasurer of Universal Corp (NYSE:UVV), executed a notable transaction by selling 3,767 shares of the company's stock. This event occurred on November 22, 2023, and has sparked interest in the implications of such a sell-off by a key insider.

Who is Candace Formacek of Universal Corp?

Candace Formacek holds a pivotal role at Universal Corp as the Vice President & Treasurer. With a deep understanding of the company's financial strategies and liquidity management, Formacek's actions within the market carry weight and are often scrutinized for underlying sentiments about the company's financial health and future prospects. Her recent decision to sell shares has put her in the spotlight, as market participants attempt to decipher the rationale behind her move.

Universal Corp's Business Description

Universal Corp, with its ticker symbol UVV, is a global business conglomerate that primarily operates in the tobacco industry. The company is known for its expertise in sourcing, processing, and supplying tobacco and plant-based ingredients across the world. With a rich history dating back to 1918, Universal Corp has established itself as a key player in the tobacco sector, providing services that range from financing to shipping and processing. The company's commitment to sustainability and its global footprint make it a significant entity in the agricultural products space.

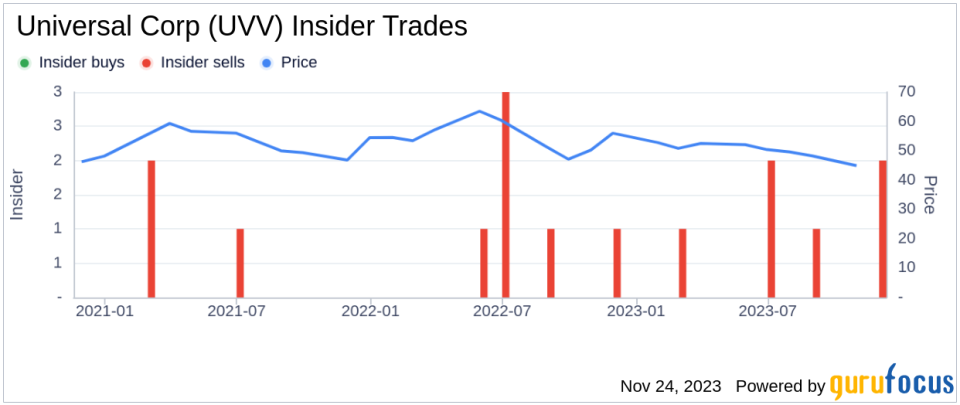

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading patterns, particularly those involving sales, can provide valuable insights into a company's internal perspective. Over the past year, Candace Formacek has sold a total of 3,767 shares and has not made any purchases. This one-sided activity raises questions about the insider's confidence in the company's future performance. When insiders sell shares, it can sometimes indicate their belief that the stock may be fully valued or that they foresee potential headwinds for the company.

However, it's important to consider that insiders might sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investment portfolio. Therefore, while insider sales can be a red flag, they should not be the sole factor in making investment decisions.

Looking at the broader picture, there have been 0 insider buys and 7 insider sells over the past year at Universal Corp. This trend suggests a general inclination towards selling among insiders, which could be interpreted as a cautious stance on the company's valuation or future growth prospects.

On the day of Formacek's recent sale, Universal Corp's shares were trading at $54.94, giving the company a market cap of $1.35 billion. This price point is particularly interesting when considering the company's valuation metrics.

The price-earnings ratio of 11.36 is lower than both the industry median of 12.35 and Universal Corp's historical median, suggesting that the stock might be undervalued based on earnings. This could mean that the insider believes the market has not fully recognized the company's earnings potential, or it could be a signal of undetected issues that might affect future earnings.

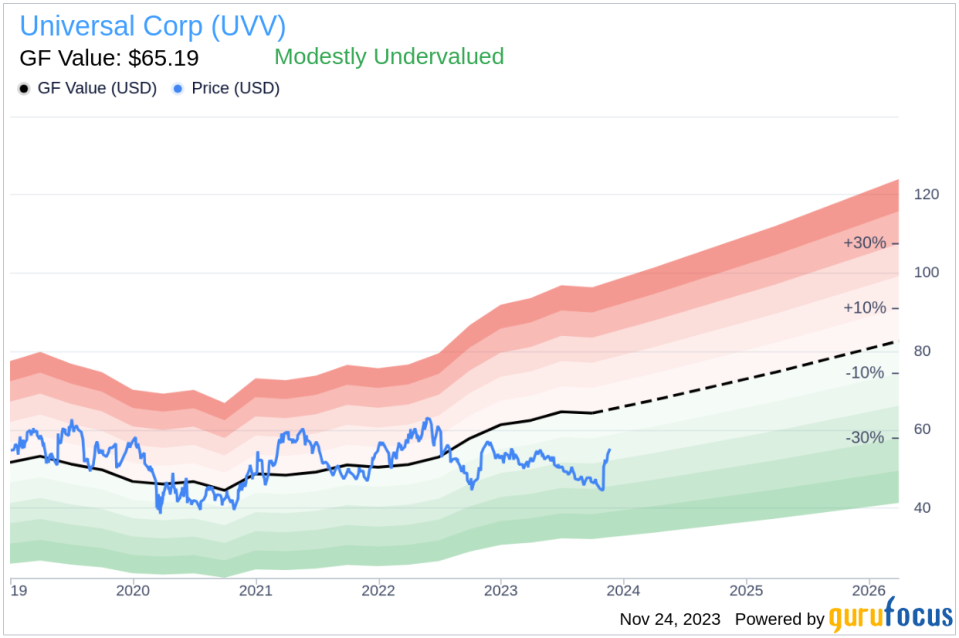

Moreover, with a price-to-GF-Value ratio of 0.84, Universal Corp is considered modestly undervalued according to the GF Value, which is an intrinsic value estimate developed by GuruFocus. This valuation suggests that the stock might be a good buy for value investors, as it trades below what is considered its fair market value.

The GF Value is determined by historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation provides a multi-faceted view of the stock's intrinsic value.

The insider trend image above illustrates the recent selling pattern, which could be a signal for investors to delve deeper into the company's financials and potential market challenges.

The GF Value image provides a visual representation of the stock's current undervaluation, which might be an attractive entry point for investors who believe in the company's fundamentals and long-term growth trajectory.

Conclusion

While the insider sell-off by Candace Formacek at Universal Corp may raise some eyebrows, it is essential to consider the broader context of the company's valuation and market position. The stock's current undervaluation according to the GF Value and its lower-than-average price-earnings ratio could indicate a potential opportunity for investors. However, the insider selling trend warrants a cautious approach, prompting further research and analysis to understand the underlying reasons for these transactions. As always, investors should consider a multitude of factors, including insider trading patterns, when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.