Insider Sell Alert: CEO C. Hussey Sells 4,000 Shares of Huron Consulting Group Inc (HURN)

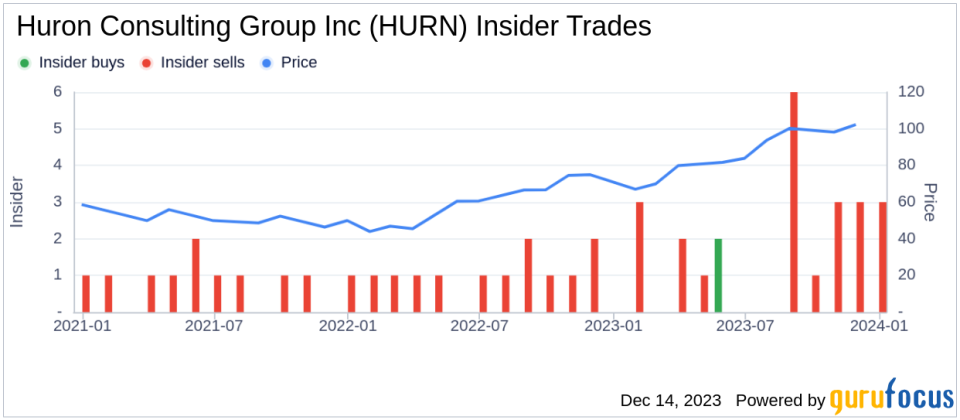

In a recent transaction on December 11, 2023, C. Hussey, the CEO and President of Huron Consulting Group Inc, sold 4,000 shares of the company's stock. This move has caught the attention of investors and market analysts, prompting a closer look at the insider's trading behavior and its potential implications for the stock's future performance.Who is C. Hussey of Huron Consulting Group Inc?C. Hussey is a key executive at Huron Consulting Group Inc, holding the positions of CEO and President. As a leader of the company, Hussey's actions, particularly in the stock market, are closely monitored for insights into the company's health and strategic direction. The insider's trades can offer valuable clues about the executive's confidence in the firm's prospects and financial stability.Huron Consulting Group Inc's Business DescriptionHuron Consulting Group Inc is a global professional services firm that assists clients in the healthcare, education, life sciences, and commercial sectors. The company offers a range of services, including strategy, operations, advisory, technology, and analytics solutions. Huron's expertise lies in helping organizations navigate complex challenges, improve performance, and drive sustainable growth.Analysis of Insider Buy/Sell and the Relationship with the Stock PriceThe insider's recent sale of 4,000 shares is part of a broader pattern observed over the past year. C. Hussey has sold a total of 4,000 shares and purchased 2,000 shares during this period. This activity provides a glimpse into the insider's trading strategy and may signal their perspective on the company's valuation and future outlook.The insider transaction history for Huron Consulting Group Inc shows a trend of more insider sells than buys over the past year, with 22 insider sells and only 2 insider buys. This could indicate that insiders, including C. Hussey, may believe the stock is fully valued or potentially overvalued at current levels, prompting them to lock in profits.On the day of the insider's recent sale, shares of Huron Consulting Group Inc were trading at $104.51, giving the company a market cap of $1.977 billion. The price-earnings ratio stands at 27.05, which is higher than both the industry median of 17.175 and the company's historical median price-earnings ratio. This suggests that the stock may be trading at a premium compared to its peers and its own historical valuation.

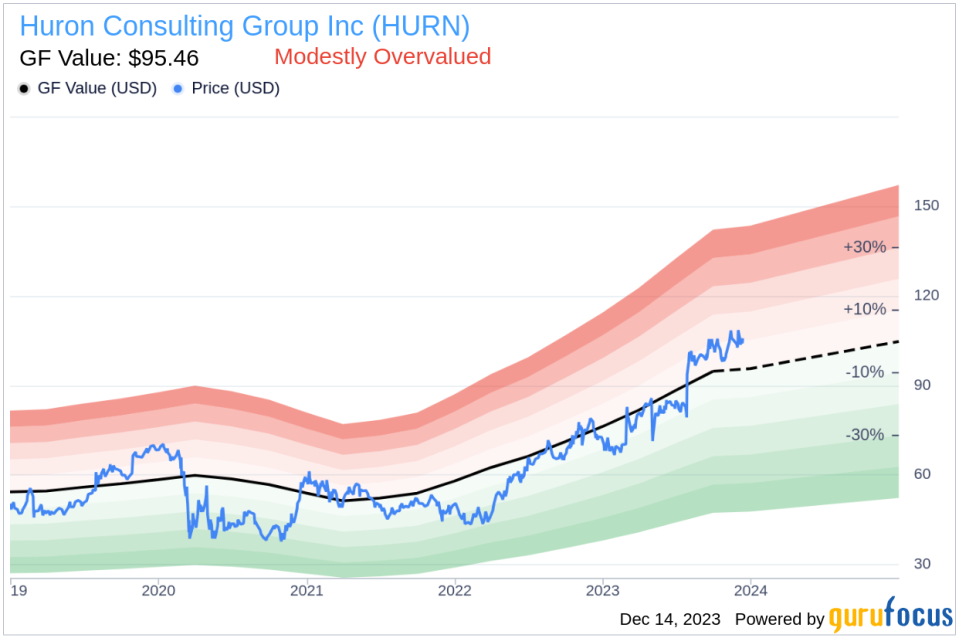

The relationship between insider trading activity and stock price can be complex. While insider sells do not always indicate a lack of confidence in the company, they can sometimes lead to negative market sentiment, especially when they occur in large volumes or are conducted by high-ranking executives like the CEO.Valuation and GF Value AnalysisConsidering the stock's price of $104.51 and the GuruFocus Value (GF Value) of $95.46, Huron Consulting Group Inc has a price-to-GF-Value ratio of 1.09. This indicates that the stock is modestly overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The modest overvaluation of Huron Consulting Group Inc's stock, as suggested by the GF Value, may corroborate the insider's decision to sell shares. If the insider believes that the stock's current market price exceeds its intrinsic value, selling could be a prudent move to capitalize on the higher market valuation.ConclusionThe recent insider sell by CEO C. Hussey of Huron Consulting Group Inc is a transaction that warrants attention from investors and market analysts. While the insider's trading activity alone should not be the sole factor in making investment decisions, it is an important piece of the puzzle when assessing the company's valuation and future prospects.Investors should consider the broader context of the company's performance, industry trends, and market conditions when interpreting insider behavior. As always, a diversified investment approach and thorough due diligence are recommended to mitigate risks and capitalize on potential opportunities in the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.