Insider Sell Alert: CEO Doug Black Sells 8,000 Shares of SiteOne Landscape Supply Inc (SITE)

In a notable insider transaction, CEO Doug Black of SiteOne Landscape Supply Inc (NYSE:SITE) sold 8,000 shares of the company's stock on November 15, 2023. This move has caught the attention of investors and market analysts, as insider sales can provide valuable insights into a company's internal perspective.

Who is Doug Black?

Doug Black is the Chief Executive Officer of SiteOne Landscape Supply Inc, a leading national wholesale distributor of landscape supplies in the United States. Under Black's leadership, SiteOne has experienced significant growth, expanding its reach and services within the landscaping industry. His tenure has been marked by strategic acquisitions and a focus on customer service, which has helped solidify the company's position in the market.

About SiteOne Landscape Supply Inc

SiteOne Landscape Supply Inc is a prominent player in the landscape supply industry, providing a broad selection of products, including irrigation supplies, fertilizers, hardscapes, nursery goods, landscape lighting, and many other landscape accessories. The company caters to a diverse customer base, ranging from independent landscape contractors to large-scale commercial entities. SiteOne's business model is built on a strong network of local branches, ensuring timely delivery and personalized service.

Analysis of Insider Buy/Sell and Stock Price Relationship

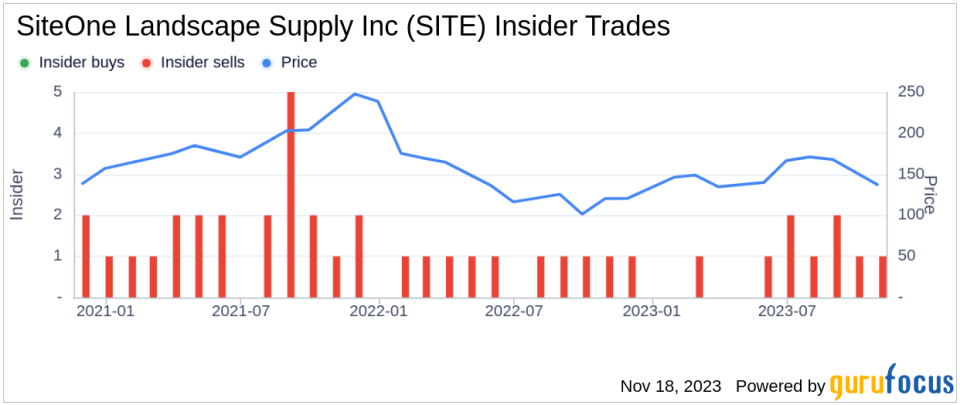

Insider transactions, particularly those involving high-ranking executives like CEOs, can be a strong indicator of a company's financial health and future prospects. In the case of SiteOne Landscape Supply Inc, the insider transaction history over the past year shows a pattern of more insider selling than buying. Specifically, Doug Black has sold a total of 55,960 shares and has not made any purchases. This could signal that insiders might believe the stock is fully valued or potentially overvalued at current prices.

However, it's important to consider the context of these sales. Executives may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations. Therefore, while insider sales can be a red flag, they should not be the sole factor in an investment decision.

When analyzing the relationship between insider selling and stock price, it's crucial to look at the broader market trends and the company's financial performance. SiteOne Landscape Supply Inc's stock was trading at $140.27 on the day of Doug Black's recent sale, with a market cap of $6.246 billion. This price point is significant as it reflects investor sentiment and market valuation of the company.

The price-earnings ratio of 36.05 is higher than the industry median of 12.17, suggesting that the stock may be trading at a premium compared to its peers. However, it is lower than the company's historical median price-earnings ratio, indicating that the stock may be more reasonably priced relative to its own trading history.

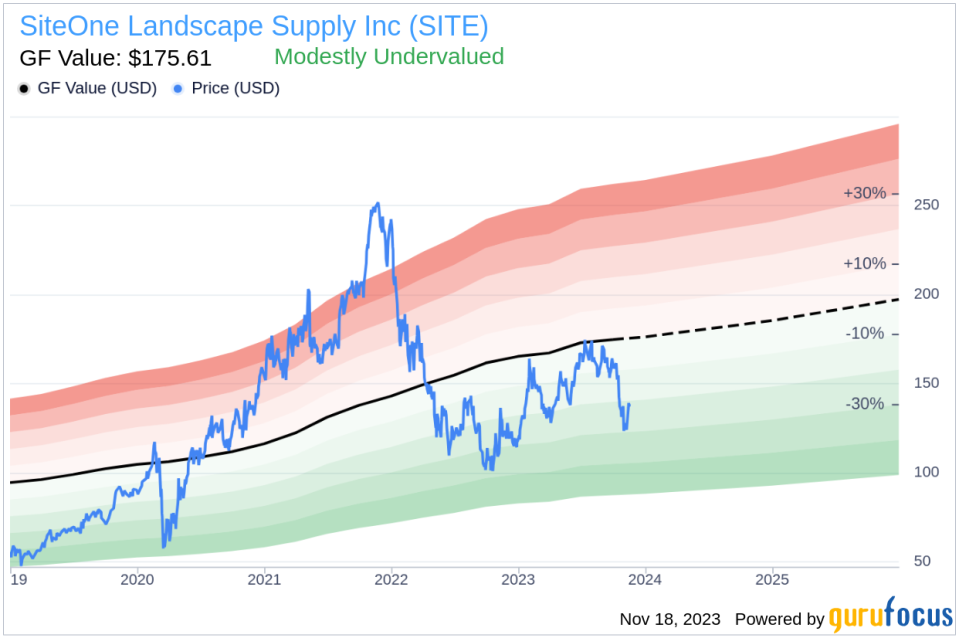

Considering the price-to-GF-Value ratio of 0.8, SiteOne Landscape Supply Inc appears to be modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation suggests that despite insider sales, the stock may still hold potential for investors looking for undervalued opportunities.

The insider trend image above provides a visual representation of the insider selling pattern over the past year. With no insider buys and ten insider sells, the trend indicates a one-sided flow of insider transactions.

The GF Value image further supports the notion that SiteOne Landscape Supply Inc's stock might be undervalued. The current stock price is below the estimated intrinsic value, suggesting that the stock could be a good buy for value investors.

Conclusion

While the insider selling by CEO Doug Black may raise questions, it is essential to consider the broader context of the company's valuation and market performance. SiteOne Landscape Supply Inc's modest undervaluation according to the GF Value, combined with its strong market position and growth prospects, could make it an attractive investment despite the recent insider sales. Investors should conduct their due diligence, considering both insider activity and fundamental analysis, before making any investment decisions.

As always, insider transactions are just one piece of the puzzle when evaluating a stock. They should be weighed alongside other critical financial metrics and market analyses to build a comprehensive investment thesis.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.