Insider Sell Alert: CEO Karim Temsamani Unloads Shares of Cardlytics Inc

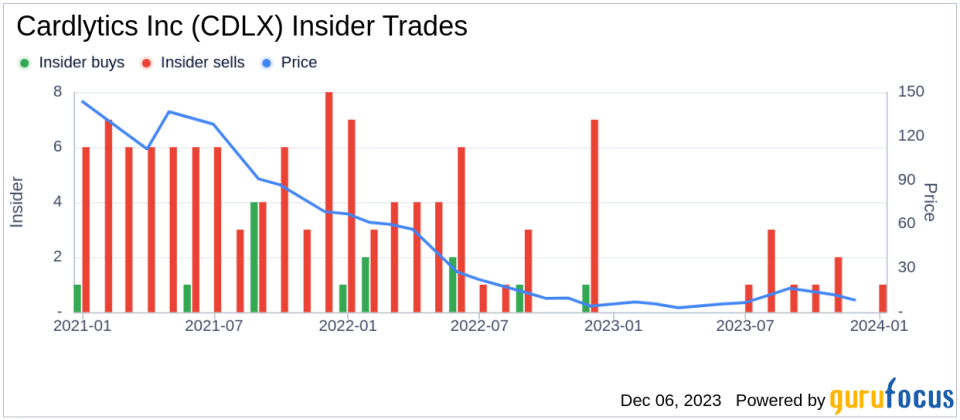

In a notable insider transaction, CEO Karim Temsamani has parted with a substantial number of shares in Cardlytics Inc (NASDAQ:CDLX). On December 5, 2023, the insider executed a sale of 40,413 shares of the company, a move that has caught the attention of investors and market analysts alike.Karim Temsamani is a key figure at Cardlytics Inc, holding the position of Chief Executive Officer. His role at the company gives him a deep understanding of the business's operations, strategy, and potential, making his trading activities particularly noteworthy for stakeholders and potential investors.Cardlytics Inc operates in the financial technology sector, providing a platform that leverages purchase intelligence to deliver relevant rewards, thereby helping financial institutions deepen their customer relationships and drive meaningful revenue. The company's proprietary technology enables marketers to reach consumers through their trusted and frequently used banking channels, with a focus on driving measurable sales and building loyalty.The insider's recent transaction follows a pattern observed over the past year, where Karim Temsamani has sold a total of 261,536 shares and has not made any purchases. This trend raises questions about the insider's confidence in the company's future prospects and whether this selling pattern is indicative of a broader sentiment among company insiders.

The insider transaction history for Cardlytics Inc shows a lack of insider buying over the past year, with zero insider buys recorded. On the other hand, there have been nine insider sells during the same period. This trend could suggest that insiders, including the CEO, may believe that the stock is fully valued or potentially overvalued at current levels, or they may have personal financial planning reasons for selling their shares.On the valuation front, Cardlytics Inc's shares were trading at $8.21 on the day of the insider's recent sale, giving the company a market cap of $320.708 million. When compared to the GuruFocus Value (GF Value) of $31.69, the stock's price-to-GF-Value ratio stands at 0.26, indicating that the stock could be a Possible Value Trap and warrants caution before investing.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business performance estimates provided by Morningstar analysts. The current price-to-GF-Value ratio suggests that while the stock appears undervalued, investors should think twice, as it may not necessarily represent a buying opportunity.The relationship between insider trading activity and stock price is complex. While insider selling can sometimes be a red flag, it is important to consider the context of the transactions. Insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations.However, when a CEO like Karim Temsamani sells a significant portion of their holdings, it can lead to investor speculation about the company's health and future performance. Given the lack of insider buying and the current price-to-GF-Value ratio, potential investors in Cardlytics Inc should conduct thorough due diligence and consider the broader market conditions before making any investment decisions.In conclusion, the recent insider sell by CEO Karim Temsamani is a development that warrants attention. While it may not necessarily signal a lack of confidence in Cardlytics Inc's future, it underscores the importance of a cautious approach to investing in the company's stock. Investors should keep an eye on further insider transactions and company performance indicators to better understand the potential risks and rewards associated with Cardlytics Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.