Insider Sell Alert: CEO Martijn Hagman Offloads Shares of PVH Corp

In a notable insider transaction, Martijn Hagman, the CEO of TH Global and PVH Europe, has sold a significant number of shares in PVH Corp (NYSE:PVH). On December 14, 2023, the insider executed a sale of 20,756 shares of the company, a move that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the background of Martijn Hagman, and an analysis of insider trading patterns in relation to PVH Corp's stock price.

Who is Martijn Hagman?

Martijn Hagman has been a prominent figure in the fashion industry, particularly known for his leadership roles within PVH Corp. As the CEO of TH Global and PVH Europe, Hagman oversees the operations of some of the most recognized brands in the apparel sector. His strategic vision and management have been instrumental in steering the company through the dynamic landscape of global fashion and retail.

PVH Corp's Business Description

PVH Corp is a global apparel company that boasts a portfolio of iconic brands such as Tommy Hilfiger, Calvin Klein, and Van Heusen. With a presence in over 40 countries, PVH Corp has established itself as a leader in designing and marketing a wide range of products, including sportswear, jeanswear, underwear, and footwear. The company's commitment to quality, innovation, and sustainability has solidified its position in the competitive fashion industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

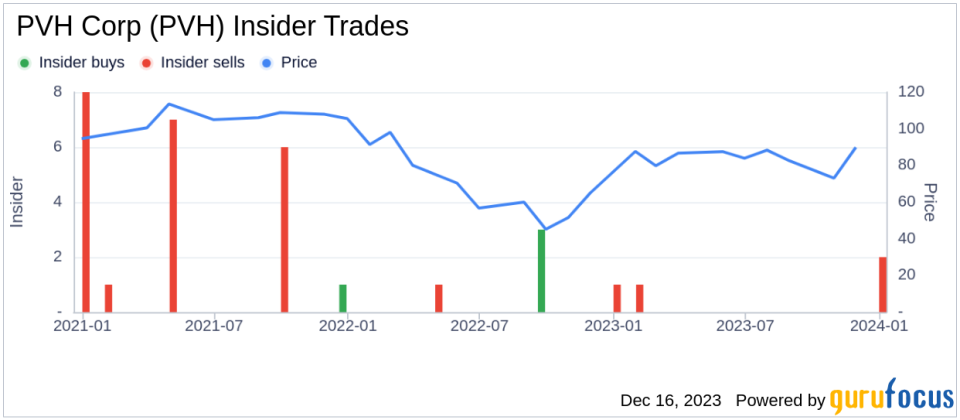

Insider trading activities, particularly those of high-ranking executives, can provide valuable insights into a company's health and future prospects. In the case of PVH Corp, the insider transaction history shows a lack of insider purchases over the past year, with four insider sells recorded during the same period. This could signal a cautious or bearish sentiment among those with intimate knowledge of the company's operations and potential.

On the day of the insider's recent sale, shares of PVH Corp were trading at $115.26, giving the company a market cap of $7.067 billion. This valuation places the stock at a price-earnings ratio of 13.97, which is lower than both the industry median of 19.09 and the company's historical median price-earnings ratio. Such a lower price-earnings ratio may suggest that the stock is undervalued compared to its peers, or it could reflect market skepticism about the company's growth prospects.

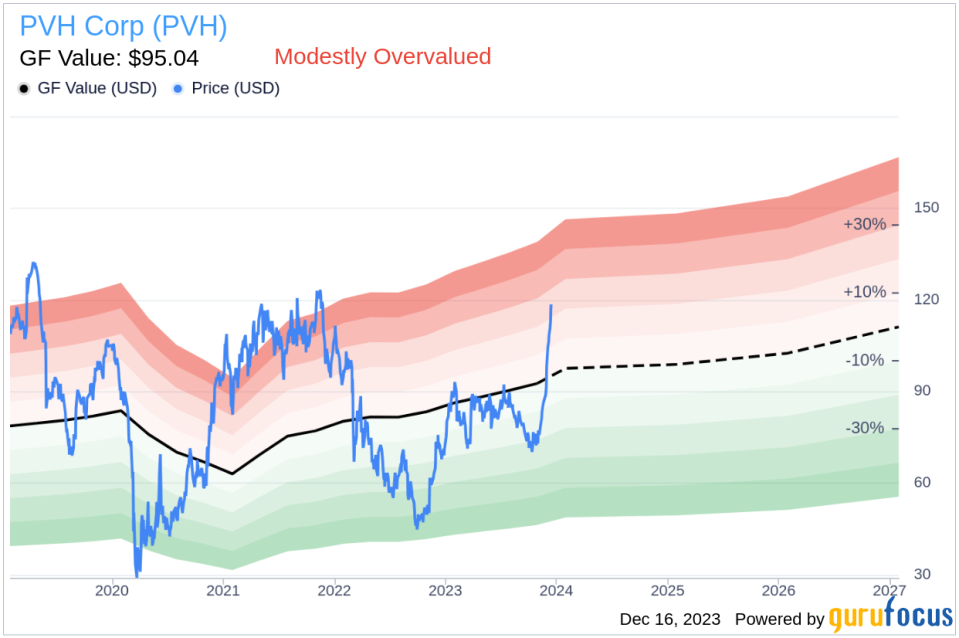

When considering the price-to-GF-Value ratio, PVH Corp appears to be modestly overvalued with a ratio of 1.21, based on a trading price of $115.26 and a GuruFocus Value of $95.04. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above illustrates the recent selling pattern, which could be interpreted as a lack of confidence in the stock's near-term appreciation potential. However, it is also important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investment portfolio.

The GF Value image provides a visual representation of the stock's valuation in relation to its intrinsic value. The current modest overvaluation suggests that investors may want to exercise caution, as the stock price may have limited upside potential based on the GF Value estimate.

Conclusion

The recent insider sell by CEO Martijn Hagman is a significant event that warrants attention from PVH Corp shareholders and potential investors. While the lower price-earnings ratio could indicate an undervalued stock, the modest overvaluation based on the GF Value suggests that the current stock price may already reflect much of the company's intrinsic value. As always, insider trading is just one piece of the puzzle, and investors should consider a comprehensive analysis of the company's financials, market position, and growth prospects before making investment decisions.

It is also crucial to monitor further insider transactions and broader market trends that could impact the stock's performance. With a clear understanding of the factors at play, investors can make informed decisions aligned with their investment strategy and risk tolerance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.