Insider Sell Alert: CEO Sujal Shah Divests 64,863 Shares of CymaBay Therapeutics Inc

In a notable insider transaction, CEO Sujal Shah of CymaBay Therapeutics Inc (NASDAQ:CBAY) sold 64,863 shares of the company on November 13, 2023. This move has caught the attention of investors and analysts, as insider sales can provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Sujal Shah of CymaBay Therapeutics Inc?

Sujal Shah has been an integral part of CymaBay Therapeutics Inc, serving as the CEO and a key decision-maker within the company. His tenure has seen him at the helm of various strategic initiatives and his insider perspective on the company's operations and future prospects is invaluable. Shah's actions in the stock market, particularly his recent sale, are closely monitored for indications of his belief in the company's future performance.

About CymaBay Therapeutics Inc

CymaBay Therapeutics Inc is a clinical-stage biopharmaceutical company focused on developing and providing innovative therapies aimed at improving the lives of patients with liver and other chronic diseases. Their pipeline includes a range of drug candidates that are in various stages of clinical trials, targeting markets with significant unmet medical needs. The company's commitment to research and development in the field of liver disease has positioned it as a potential leader in this therapeutic area.

Analysis of Insider Buy/Sell and Relationship with Stock Price

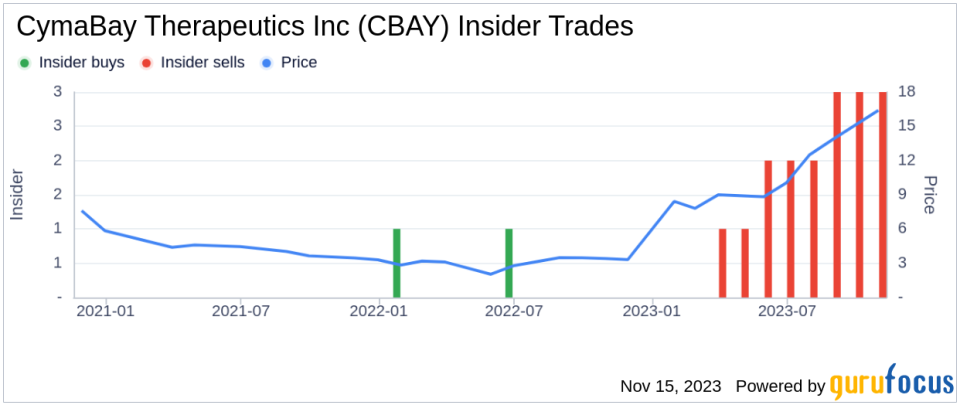

The recent sale by CEO Sujal Shah of 64,863 shares is part of a larger pattern observed over the past year. According to the data, Shah has sold a total of 129,724 shares and has not made any purchases. This one-sided transaction history could be interpreted in several ways. On one hand, it might suggest that the insider is taking profits or diversifying their investment portfolio. On the other hand, it could also be seen as a lack of confidence in the company's short-term growth potential.The absence of insider buys over the past year, coupled with 18 insider sells, may raise questions among investors. Insider selling can sometimes lead to negative market sentiment, as it may imply that those with the most intimate knowledge of the company foresee a less than bullish future.However, it is essential to consider the context of these transactions. Insider sales can be motivated by various personal financial needs or portfolio strategies that do not necessarily reflect a negative outlook on the company's future. Moreover, insiders might sell shares for reasons that have little to do with their expectations for the company, such as exercising stock options or other compensation-related activities.

The insider trend image above provides a visual representation of the buying and selling activities of insiders over a specified period. This trend can be a useful tool for investors when analyzed alongside other fundamental and technical indicators.

Valuation and Market Reaction

On the day of the insider's recent sale, shares of CymaBay Therapeutics Inc were trading at $15.89, valuing the company at a market cap of $2.043 billion. The stock price and market cap are critical factors to consider when evaluating the significance of an insider's trading activities. A high market cap often indicates a more stable company, which might suggest that insider sales are less indicative of concerns about the company's future and more related to personal financial management.In conclusion, while the insider sales by CEO Sujal Shah of CymaBay Therapeutics Inc may raise some eyebrows, it is crucial for investors to look at the broader picture, including the company's performance, market conditions, and other insider activities, before drawing any conclusions. As always, insider transactions are just one piece of the puzzle when it comes to making informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.