Insider Sell Alert: CEO Sumedh Thakar Sells Shares of Qualys Inc

In the realm of cybersecurity, Qualys Inc (NASDAQ:QLYS) stands out as a prominent player, offering cloud-based security and compliance solutions. The company's suite of tools enables organizations to identify security risks to their IT infrastructures, help protect their IT systems and applications from cyber attacks, and achieve compliance with internal policies and external regulations.At the helm of Qualys Inc is Sumedh Thakar, the CEO and President, who has been a part of the company's journey for several years. Thakar's expertise in the cybersecurity field has been instrumental in steering Qualys towards innovation and market leadership. His tenure has seen the company grow and adapt to the ever-evolving landscape of cyber threats.However, a recent transaction by the insider has caught the attention of investors and market analysts. On November 14, 2023, Sumedh Thakar sold 5,004 shares of Qualys Inc, a move that prompts a closer examination of insider activity and its potential implications for the stock's performance.

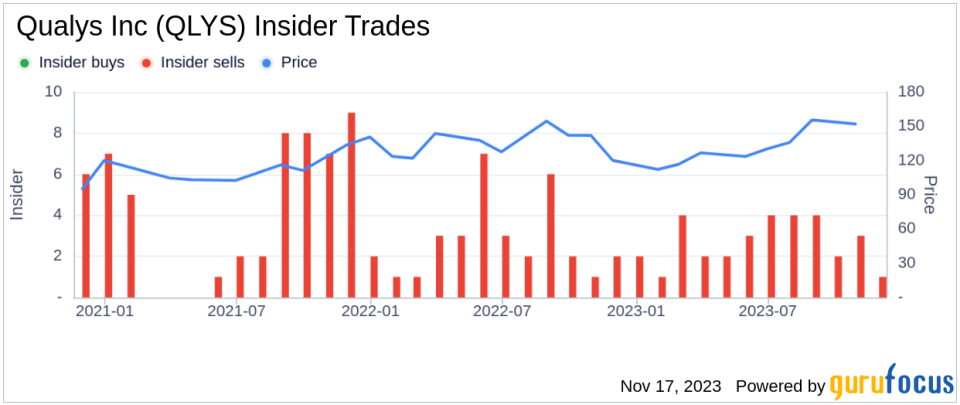

The insider's transaction history over the past year reveals a pattern of selling, with Thakar having sold a total of 113,678 shares and not having purchased any. This one-sided activity raises questions about the insider's confidence in the company's short-term growth prospects.When looking at the broader insider trends for Qualys Inc, we observe that there have been no insider buys over the past year, contrasted with 32 insider sells. This trend could suggest that those with intimate knowledge of the company may perceive the stock's current valuation as ripe for realizing gains, or it could be part of planned selling programs often used by executives to avoid concerns about insider trading.Shares of Qualys Inc were trading at $175.1 on the day of Thakar's recent sell, giving the company a market cap of $6.435 billion. The price-earnings ratio stands at 47.28, which is above the industry median of 26.59, indicating that the stock is trading at a premium compared to its peers. However, it is worth noting that this ratio is lower than the company's historical median, suggesting some level of normalization in valuation.

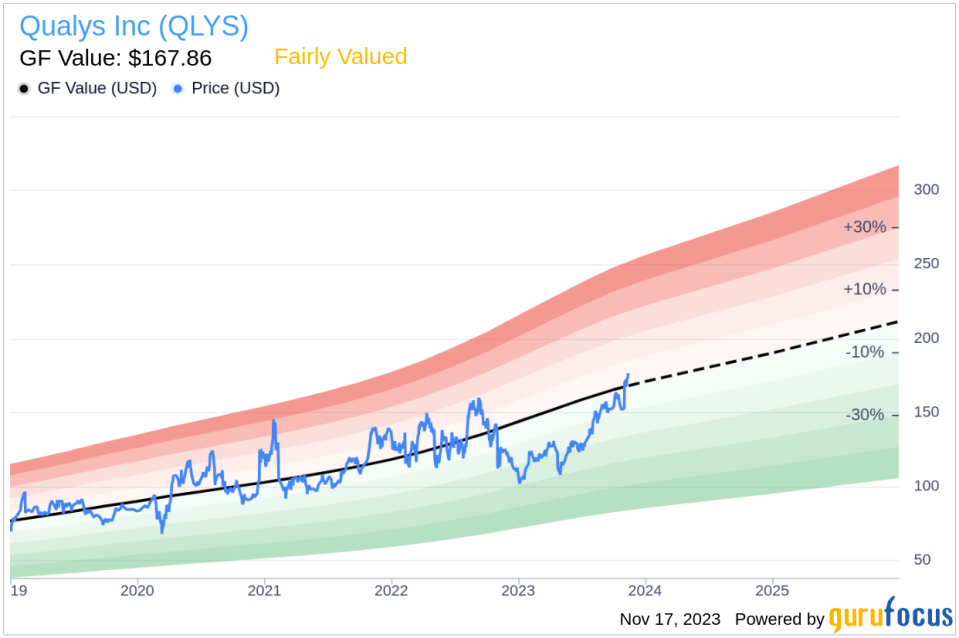

The stock's price-to-GF-Value ratio is 1.04, with a GF Value of $167.86, indicating that Qualys Inc is Fairly Valued based on GuruFocus's intrinsic value estimate. The GF Value is a proprietary metric that considers historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.The relationship between insider selling and stock price can be complex. While extensive insider selling can sometimes precede a downturn in the stock's price, it is not always a reliable indicator of future performance. Executives may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations.In the case of Qualys Inc, the consistent insider selling, particularly by the CEO, could be interpreted in multiple ways. Investors might view it as a signal to exercise caution, especially if they believe insiders are best positioned to assess the company's future. On the other hand, the fact that the stock is deemed Fairly Valued suggests that the market has already priced in the available information, including insider transactions.As with any investment decision, it is crucial for investors to consider a multitude of factors, including the company's fundamentals, industry trends, and broader market conditions, rather than relying solely on insider trading patterns. Qualys Inc's position in the cybersecurity industry, its financial health, and its growth prospects should all be part of a comprehensive analysis before making any investment decisions.In conclusion, while the insider selling by CEO Sumedh Thakar is noteworthy, it should be one of many elements in an investor's due diligence process. The cybersecurity sector remains dynamic and growth-oriented, and Qualys Inc's role within this space should be evaluated in the context of its competitive advantages, innovation capabilities, and the increasing global emphasis on digital security.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.