Insider Sell Alert: CEO Thomas Crockett Offloads Shares of KalVista Pharmaceuticals Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Thomas Crockett, the CEO of KalVista Pharmaceuticals Inc (NASDAQ:KALV), made a notable move by selling 14,807 shares of the company on November 20, 2023. This transaction has caught the attention of market watchers and raises questions about the potential implications for the stock's future.

Who is Thomas Crockett?

Thomas Crockett is a key figure at KalVista Pharmaceuticals Inc, serving as the company's Chief Executive Officer. His role puts him at the helm of the company's strategic direction and operational execution. With a deep understanding of the pharmaceutical industry and the company's business, Crockett's actions, particularly in the stock market, are closely monitored for insights into the company's health and prospects.

KalVista Pharmaceuticals Inc: A Business Overview

KalVista Pharmaceuticals Inc is a pharmaceutical company focused on the discovery, development, and commercialization of small molecule protease inhibitors. The company's primary therapeutic area is hereditary angioedema (HAE), a rare and potentially life-threatening condition characterized by recurrent episodes of severe swelling. KalVista's portfolio includes both oral and injectable drug candidates that are designed to provide relief for patients suffering from HAE and other related conditions.

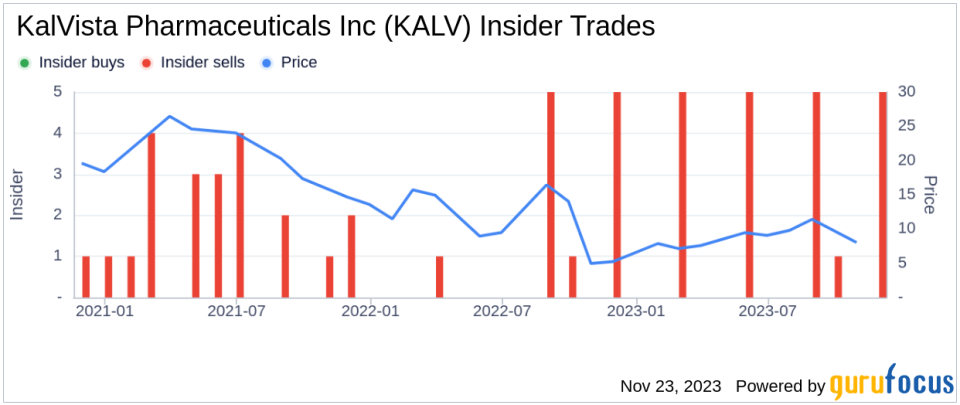

Analysis of Insider Buy/Sell and Stock Price Relationship

The insider transaction history for KalVista Pharmaceuticals Inc reveals a pattern that is worth analyzing. Over the past year, Thomas Crockett has sold a total of 42,010 shares and has not made any purchases. This one-sided activity could be interpreted in several ways. On one hand, it might suggest that the insider sees limited growth potential or perceives the stock to be overvalued. On the other hand, these sales could be part of a pre-determined trading plan or for personal financial management reasons that are not directly related to the company's performance.

When examining the relationship between insider selling and stock price, it's important to consider the context of each transaction. The timing of Crockett's recent sale coincides with a stock price of $8.23 per share, giving KalVista Pharmaceuticals Inc a market cap of $260.778 million. This price point is significantly higher than the GuruFocus Value (GF Value) of $2.72, indicating that the stock is currently Significantly Overvalued based on its GF Value.The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With a price-to-GF-Value ratio of 3.03, investors might view the CEO's decision to sell as a confirmation that the stock's current valuation is stretched.

Insider Trends and Market Sentiment

The broader insider trends at KalVista Pharmaceuticals Inc show a lack of insider buying over the past year, with 21 insider sells recorded during the same period. This trend could be indicative of a general consensus among insiders that the stock's upside potential is limited at current valuation levels. However, it's also important to note that insider selling does not always correlate with negative performance or outlook for the stock. Insiders might sell shares for a variety of reasons unrelated to their view of the company's future, such as diversifying their investments, tax planning, or personal liquidity needs.

Valuation and Market Cap Considerations

With a market cap of $260.778 million and a trading price significantly above the GF Value, KalVista Pharmaceuticals Inc presents an interesting case for investors. The company's focus on developing treatments for HAE positions it in a niche market with high unmet medical needs, which could offer long-term growth opportunities. However, the current valuation suggests that much of this potential may already be priced into the stock.Investors should weigh the insider selling activity, particularly that of CEO Thomas Crockett, against the backdrop of the company's fundamentals and growth prospects. While insider transactions can provide valuable clues, they are just one piece of the puzzle in the broader investment decision-making process.In conclusion, Thomas Crockett's recent sale of 14,807 shares of KalVista Pharmaceuticals Inc is a development that warrants attention. As investors digest this information, they should consider the insider trends, the company's valuation, and the stock's price relative to its GF Value to make informed investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.