Insider Sell Alert: CEO Thomas Leonard Divests 42,558 Shares of Agiliti Inc (AGTI)

Agiliti Inc (NYSE:AGTI), a company specializing in healthcare equipment management and services, has recently witnessed a significant insider sell by its Chief Executive Officer, Thomas Leonard. On November 16, 2023, the insider executed a sale of 42,558 shares of the company's stock. This transaction has caught the attention of investors and market analysts, as insider activity, particularly by high-ranking executives, can provide valuable insights into a company's financial health and future prospects.

Who is Thomas Leonard of Agiliti Inc?

Thomas Leonard is the Chief Executive Officer of Agiliti Inc, a role he has held with distinction. His leadership has been instrumental in steering the company through the dynamic healthcare industry landscape. Leonard's tenure at Agiliti Inc has been marked by strategic initiatives aimed at enhancing the company's service offerings and expanding its market reach. His insider transactions are closely monitored as they may reflect his confidence in the company's current strategy and future performance.

Agiliti Inc's Business Description

Agiliti Inc is a leading provider in the healthcare equipment management sector. The company offers a comprehensive suite of services that includes the rental, sales, and servicing of medical equipment to healthcare facilities across the United States. Agiliti Inc's business model is designed to help healthcare providers optimize their operations by managing costs, increasing efficiency, and ensuring the availability of high-quality medical equipment. This approach not only benefits healthcare providers but also aims to improve patient care outcomes.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

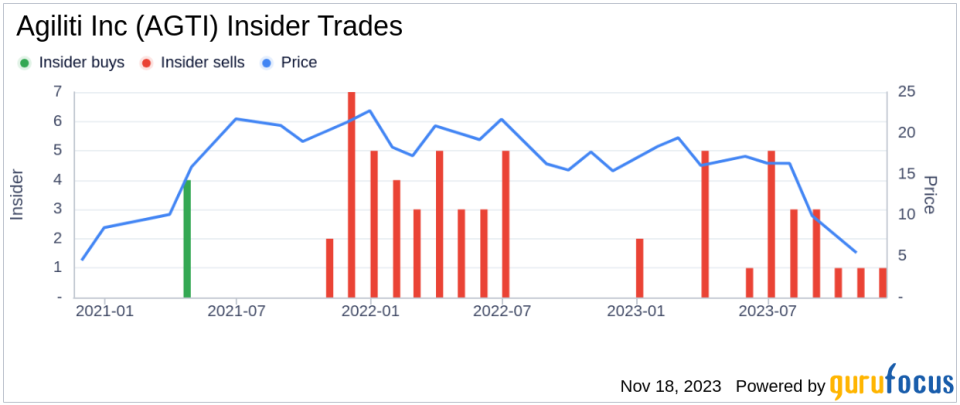

Insider transactions, such as the recent sale by Thomas Leonard, can serve as a barometer for a company's internal perspective on its stock's valuation and future direction. Over the past year, Leonard has sold a total of 255,848 shares and has not made any purchases. This pattern of behavior could suggest that the insider believes the stock may be fully valued or that there may be better investment opportunities elsewhere.

It is important to consider the context of these sales. If the insider is diversifying their portfolio or financing personal expenditures, the sales may not necessarily indicate a lack of confidence in the company. However, consistent selling over time could be a signal for investors to reevaluate their position in the stock.

The insider transaction history for Agiliti Inc shows a lack of insider purchases over the past year, with 22 insider sells recorded during the same timeframe. This trend could be interpreted as a bearish signal, potentially indicating that insiders are taking profits or have concerns about the company's valuation or growth prospects.

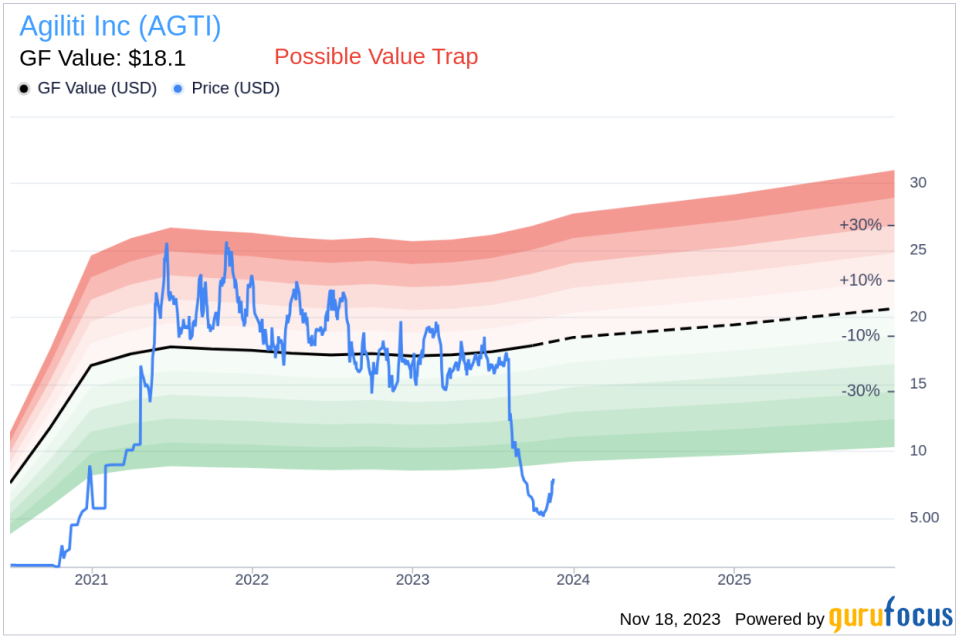

On the day of the insider's recent sale, shares of Agiliti Inc were trading at $7.4, giving the company a market cap of $1.073 billion. This valuation is particularly interesting when juxtaposed with the company's GF Value.

With a price of $7.4 and a GuruFocus Value of $18.10, Agiliti Inc has a price-to-GF-Value ratio of 0.41. This indicates that the stock is considered a Possible Value Trap, and investors should think twice based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. When the price-to-GF-Value ratio is below 1, it suggests that the stock may be undervalued; however, when it is significantly below 1, as in the case of Agiliti Inc, it raises concerns about a potential value trap.

Investors should be cautious and conduct thorough due diligence to understand why the stock is trading at such a significant discount to its GF Value. Factors such as market sentiment, industry challenges, or company-specific issues could be at play.

The insider trend image above provides a visual representation of the selling pattern by insiders at Agiliti Inc. The absence of insider buying coupled with consistent selling could be a red flag for potential investors.

The GF Value image further illustrates the discrepancy between the current stock price and the estimated intrinsic value. This gap may either represent an opportunity for investors to buy a potentially undervalued stock or serve as a warning to avoid a value trap.

Conclusion

Thomas Leonard's recent insider sell of 42,558 shares of Agiliti Inc is a significant event that warrants investor attention. While insider selling alone should not be the sole factor in making investment decisions, it is an important piece of the puzzle. The lack of insider buying at Agiliti Inc, combined with the stock's low price-to-GF-Value ratio, suggests that investors should approach the stock with caution and conduct additional research to understand the underlying reasons for the stock's valuation.

As always, investors are encouraged to look at the broader picture, including company fundamentals, industry trends, and macroeconomic factors, before making investment decisions. Insider transactions are just one of many tools that can help investors gauge the potential risks and rewards associated with a particular stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.