Insider Sell Alert: CEO Yancey Spruill Offloads Shares of DigitalOcean Holdings Inc

In a significant move within the tech industry, Yancey Spruill, the CEO of DigitalOcean Holdings Inc (NYSE:DOCN), has sold a substantial number of shares in the company. On November 22, 2023, the insider executed a sale of 911,289 shares, a transaction that has caught the attention of investors and market analysts alike.

Who is Yancey Spruill?

Yancey Spruill is an influential figure in the tech sector, serving as the Chief Executive Officer of DigitalOcean Holdings Inc. With a background that combines technology and finance, Spruill has been instrumental in steering DigitalOcean through the competitive landscape of cloud infrastructure providers. His leadership has been pivotal in the company's growth and strategic initiatives, making his trading activities particularly noteworthy for stakeholders and potential investors.

About DigitalOcean Holdings Inc

DigitalOcean Holdings Inc is a cloud infrastructure provider that caters primarily to developers, startups, and small to medium-sized businesses. The company simplifies cloud computing by offering an easy-to-use platform and cost-effective solutions that enable businesses to deploy, manage, and scale applications. DigitalOcean's emphasis on simplicity and customer support has made it a popular choice among developers and has contributed to its steady growth in the competitive cloud services market.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider trading activities, such as those of Yancey Spruill, can provide valuable insights into a company's health and future prospects. Over the past year, Spruill has sold a total of 1,658,033 shares and has not made any purchases. This pattern of selling could signal various things, including personal financial management or a belief that the stock may be currently overvalued.

It's important to consider these transactions in the context of overall insider trends. DigitalOcean Holdings Inc has seen 1 insider buy and 23 insider sells over the past year. This trend suggests that insiders may have concerns about the company's current valuation or future growth prospects.

On the day of the insider's recent sale, shares of DigitalOcean Holdings Inc were trading at $28.7, giving the company a market cap of $2.484 billion. This valuation is a critical factor to consider when analyzing insider trading patterns.

Insider Trend Image Analysis

The insider trend image provides a visual representation of the buying and selling activities of insiders over time. A predominance of selling, as seen in the case of DigitalOcean Holdings Inc, could be interpreted as a lack of confidence by insiders in the stock's future appreciation. However, it's also essential to consider the broader market conditions and individual circumstances of each insider when evaluating these trends.

Valuation and GF Value Analysis

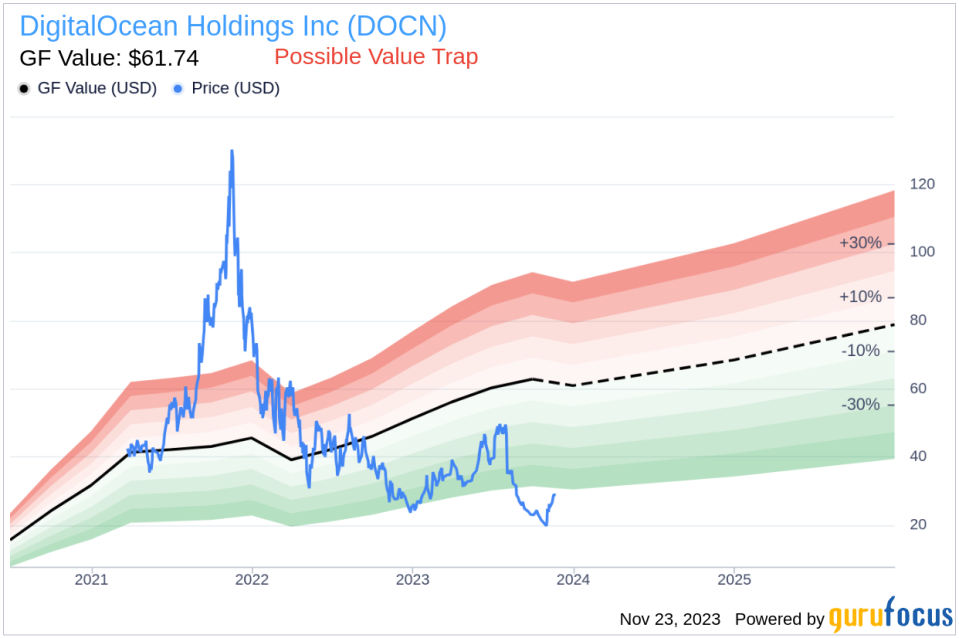

With a trading price of $28.7 and a GuruFocus Value (GF Value) of $61.74, DigitalOcean Holdings Inc has a price-to-GF-Value ratio of 0.46. This ratio indicates that the stock is currently considered a Possible Value Trap, and investors should think twice before making an investment decision based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

GF Value Image Analysis

The GF Value image illustrates the disparity between the current trading price and the estimated intrinsic value. A price-to-GF-Value ratio below 1 suggests that the stock may be undervalued, assuming the intrinsic value estimate is accurate. However, given the label of Possible Value Trap, investors should exercise caution and conduct further analysis to understand why the stock is trading at such a discount to its GF Value.

Conclusion

The recent insider sell by CEO Yancey Spruill of DigitalOcean Holdings Inc represents a significant transaction that warrants attention from the investment community. While insider selling can have various motivations, the consistent pattern of sells over buys among insiders could be a red flag. Coupled with the stock's current price-to-GF-Value ratio, it suggests that investors should thoroughly investigate the company's fundamentals and market position before making any investment decisions. As always, insider trading is just one piece of the puzzle, and a holistic approach to investment analysis is recommended.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.