Insider Sell Alert: CFO James Rallo Sells 5,000 Shares of Xometry Inc (XMTR)

In the dynamic world of stock market transactions, insider selling can often provide investors with valuable insights into a company's financial health and future prospects. Recently, James Rallo, the Chief Financial Officer (CFO) of Xometry Inc (NASDAQ:XMTR), sold 5,000 shares of the company on November 30, 2023. This move has caught the attention of market analysts and investors alike, prompting a closer examination of the implications of such insider activity.

Who is James Rallo?

James Rallo serves as the CFO of Xometry Inc, a role that places him at the helm of the company's financial strategies and operations. With a keen understanding of Xometry's financial landscape, Rallo's actions in the stock market are closely monitored for indications of the company's performance and outlook. His recent sale of 5,000 shares is particularly noteworthy, given his position within the company and his access to critical financial information.

Xometry Inc's Business Description

Xometry Inc is a leading technology firm that operates an AI-driven marketplace, which connects buyers with suppliers of manufacturing services. The company leverages proprietary technology to offer a wide range of services, including 3D printing, CNC machining, injection molding, and sheet metal fabrication. Xometry's innovative platform aims to streamline the manufacturing process, making it more efficient and accessible for businesses of all sizes. By providing on-demand manufacturing solutions, Xometry is at the forefront of the industry's digital transformation.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, such as the recent sale by James Rallo, can be a double-edged sword when it comes to interpreting their impact on a company's stock price. On one hand, insiders may sell shares for a variety of reasons unrelated to the company's performance, such as personal financial planning or diversifying their investment portfolio. On the other hand, significant selling by insiders, especially by high-ranking executives like CFOs, can sometimes be perceived as a lack of confidence in the company's future growth potential.

According to the data provided, James Rallo has sold a total of 27,711 shares over the past year without purchasing any shares. This pattern of selling without corresponding buys could suggest that the insider is taking a cautious stance towards the company's valuation or future prospects. However, without additional context, it is difficult to draw definitive conclusions from these actions alone.

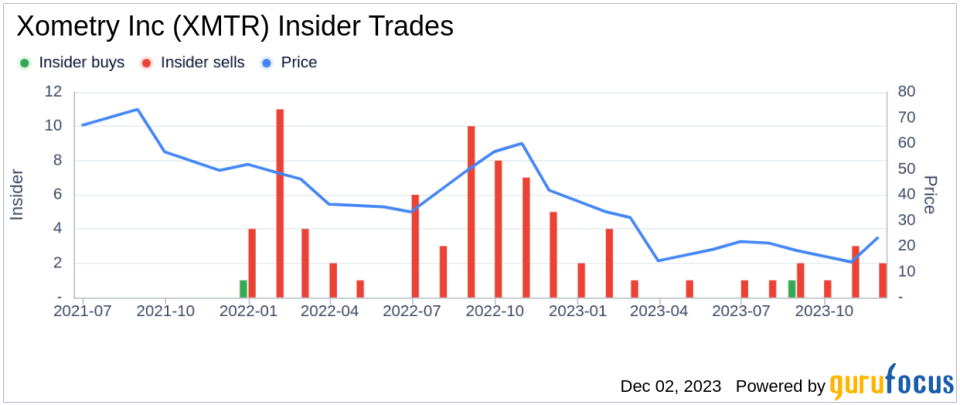

The insider transaction history for Xometry Inc shows a trend of more insider selling than buying over the past year, with 17 insider sells compared to just 1 insider buy. This trend could indicate that insiders, as a group, are choosing to realize gains or redistribute their investment portfolio, rather than increase their stake in the company.

On the day of Rallo's recent sale, shares of Xometry Inc were trading at $23.65, giving the company a market cap of $1.233 billion. The stock price at the time of the transaction is an important factor to consider, as it provides a snapshot of the market's valuation of the company relative to the insider's decision to sell.

It is also crucial to analyze the broader market conditions and company-specific news that may have influenced the stock price at the time of the insider's transaction. Factors such as earnings reports, industry trends, and economic indicators can all play a role in shaping investor sentiment and, consequently, stock prices.

The insider trend image above illustrates the pattern of insider transactions over time. A visual representation of buying and selling activity can help investors discern whether there is a consistent pattern of behavior among insiders, which could signal their collective outlook on the company's future.

Conclusion

James Rallo's recent sale of 5,000 shares of Xometry Inc is a transaction that warrants attention from investors and market analysts. While insider selling can have various motivations, it is essential to consider the broader context, including the company's business model, financial performance, and market conditions. As with any insider activity, investors should use this information as one piece of a larger puzzle when evaluating their investment decisions.

For those interested in following insider transactions as part of their investment strategy, it is advisable to monitor patterns of buying and selling, as well as the timing and size of these transactions. By doing so, investors can gain a more nuanced understanding of insider sentiment and how it may relate to the company's stock price and overall financial health.

As the financial landscape continues to evolve, staying informed about insider activity remains a critical aspect of a comprehensive investment approach. James Rallo's recent sale is a reminder of the importance of keeping a close eye on the actions of those who are most intimately acquainted with a company's inner workings.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.