Insider Sell Alert: CFO Joo Kim Sells Shares of Qualys Inc (QLYS)

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Joo Kim, the Chief Financial Officer (CFO) of Qualys Inc (NASDAQ:QLYS), made a notable move by selling 1,598 shares of the company on November 28, 2023. This transaction has caught the attention of market watchers and raises questions about the potential implications for Qualys Inc's stock.

Who is Joo Kim of Qualys Inc?

Joo Kim has been serving as the CFO of Qualys Inc, a position that places him in the upper echelons of the company's financial decision-making process. As CFO, Kim is responsible for overseeing the financial strategy, reporting, and operations of Qualys, ensuring that the company maintains its financial health and complies with regulatory requirements. His actions, particularly in terms of buying or selling company stock, are closely monitored for insights into the company's internal financial expectations and outlook.

Qualys Inc's Business Description

Qualys Inc is a pioneer and leading provider of cloud-based security and compliance solutions. The company offers a comprehensive suite of tools that enable organizations to identify security risks to their IT infrastructures, help protect their IT systems and applications from cyber-attacks, and achieve compliance with internal policies and external regulations. Qualys' cloud platform and integrated suite of solutions are designed to provide organizations with a streamlined approach to managing security and compliance.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

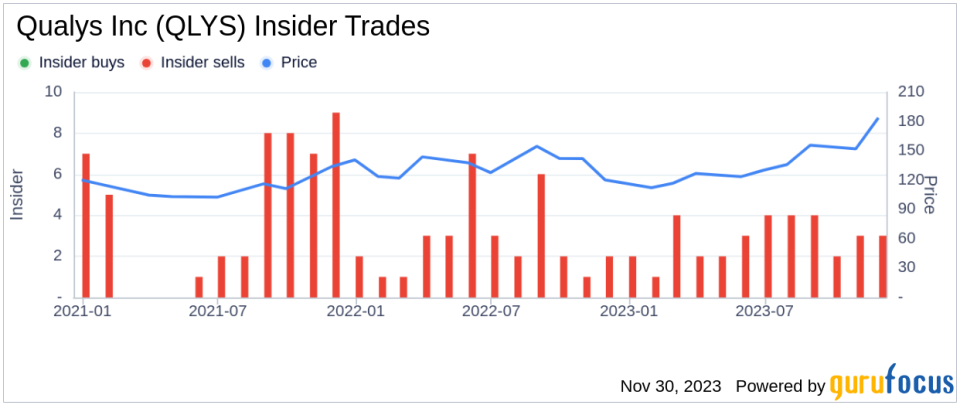

Insider transactions, particularly those involving high-ranking executives like CFOs, can provide valuable clues about a company's financial health and future prospects. Over the past year, Joo Kim has sold a total of 6,598 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as a good opportunity to realize gains or that they may have concerns about the company's future growth potential.

When examining the broader insider transaction history for Qualys Inc, we observe that there have been no insider buys over the past year, while there have been 35 insider sells during the same period. This trend of insider selling could indicate that those with the most intimate knowledge of the company's workings are choosing to cash in on their holdings rather than invest more in the company's stock.

On the day of Joo Kim's recent sale, shares of Qualys Inc were trading at $180.42, giving the company a market cap of $6.759 billion. This valuation places the stock at a price-earnings ratio of 49.66, which is higher than the industry median of 26.48 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to the industry, it is somewhat undervalued compared to its own historical standards.

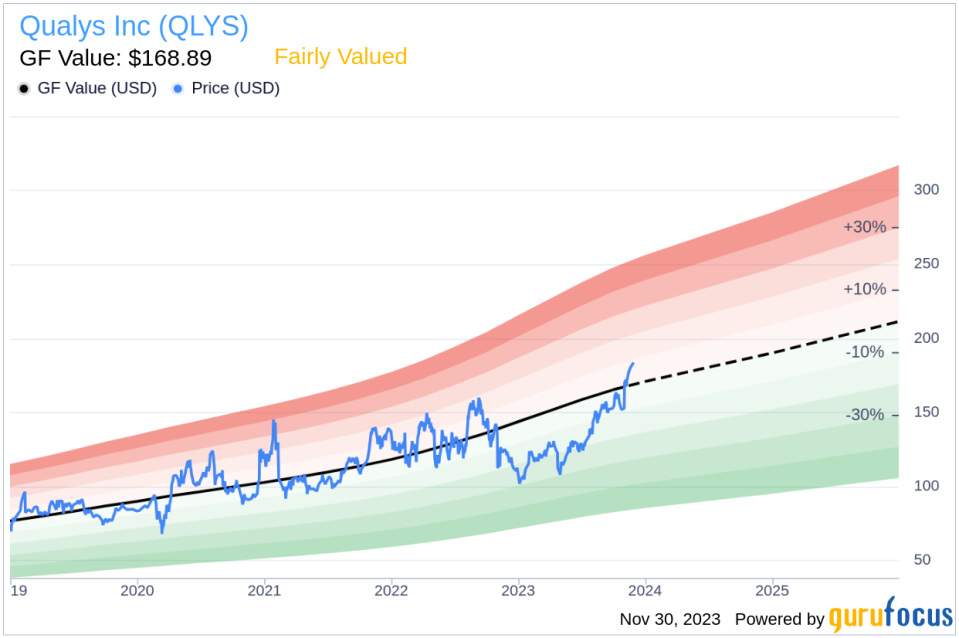

Considering the price-to-GF-Value ratio, which stands at 1.07, Qualys Inc is deemed to be Fairly Valued based on its GF Value of $168.89. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation metric implies that the stock is reasonably priced, neither significantly undervalued nor overvalued.

The insider trend image above provides a visual representation of the selling pattern among Qualys Inc insiders. The consistent selling could be interpreted as a lack of confidence in the stock's ability to provide substantial future returns, or it could simply reflect individual financial planning decisions by the insiders.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value, reinforcing the notion that Qualys Inc is trading at a fair market price.

Conclusion

The recent insider sell by CFO Joo Kim of Qualys Inc is a significant event that warrants attention from investors. While the company's stock is considered fairly valued based on the GF Value, the pattern of insider selling over the past year could be a signal for investors to proceed with caution. It is essential for investors to consider the context of these insider transactions and to analyze them alongside other financial metrics and market trends before making investment decisions.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. Investors should conduct thorough due diligence, considering both the company's financials and the broader market environment, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.