Insider Sell Alert: CFO Lester Wong Sells 55,000 Shares of Kulicke & Soffa Industries Inc (KLIC)

In a notable insider transaction, Lester Wong, the Chief Financial Officer of Kulicke & Soffa Industries Inc (NASDAQ:KLIC), sold 55,000 shares of the company on December 14, 2023. This sale is part of a series of transactions over the past year, where the insider has sold a total of 95,000 shares and made no purchases. Such insider activity often garners the attention of investors seeking to understand the implications behind these moves.

Who is Lester Wong?

Lester Wong serves as the Chief Financial Officer of Kulicke & Soffa Industries Inc, a key executive position that involves overseeing the company's financial operations, including financial planning, risk management, record-keeping, and financial reporting. Wong's actions, particularly in buying or selling company stock, are closely monitored as they may provide insights into the insider's perspective on the company's financial health and future prospects.

About Kulicke & Soffa Industries Inc

Kulicke & Soffa Industries Inc is a global leader in the design and manufacture of semiconductor, LED, and electronic assembly equipment. The company's products are used in a wide range of industries, including consumer electronics, automotive, and telecommunications. With a focus on innovation and technology, Kulicke & Soffa provides advanced packaging solutions that meet the complex demands of modern electronics manufacturing.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable clues about a company's future. Over the past year, Kulicke & Soffa Industries Inc has seen 0 insider buys and 10 insider sells. This trend may suggest that insiders, including Lester Wong, perceive the company's stock to be fully valued or potentially overvalued, prompting them to lock in profits.

On the day of the insider's recent sale, shares of Kulicke & Soffa Industries Inc were trading at $55.51, giving the company a market cap of $3.108 billion. The price-earnings ratio of 55.35 is higher than both the industry median of 26.47 and the company's historical median, indicating that the stock may be trading at a premium compared to its peers and its own historical valuation.

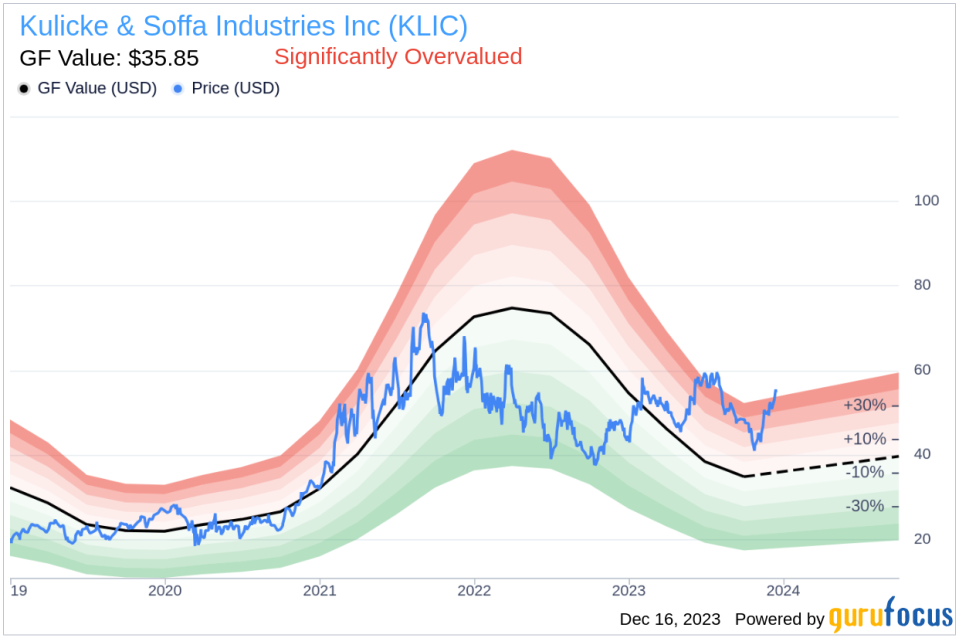

Moreover, with a price-to-GF-Value ratio of 1.55, Kulicke & Soffa Industries Inc is considered Significantly Overvalued based on its GF Value. The GF Value, an intrinsic value estimate, suggests that the stock's current price exceeds its estimated fair value of $35.85 by a considerable margin.

The GF Value is determined by historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates from analysts. The disparity between the current price and the GF Value may have influenced the insider's decision to sell shares.

The insider trend image above illustrates the recent pattern of insider transactions, with a clear prevalence of selling over buying. This could be interpreted as a lack of confidence among insiders in the stock's ability to provide substantial returns in the near future.

The GF Value image provides a visual representation of the stock's valuation compared to its intrinsic value. The current price level, significantly above the GF Value line, reinforces the notion that the stock may be overvalued, which could be a contributing factor to the insider's decision to sell.

Conclusion

The recent insider sell by CFO Lester Wong is a significant event that investors should consider in the context of Kulicke & Soffa Industries Inc's overall financial picture. While insider selling does not always indicate a problem with the company, the combination of a high price-earnings ratio, a significant gap between the stock price and its GF Value, and a trend of insider selling over the past year could suggest that the stock may not offer the best value at its current price. Investors should conduct their own due diligence and consider the implications of insider transactions as part of a broader investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.