Insider Sell Alert: CFO Maritza Arizmendi Sells Shares of OFG Bancorp

Maritza Arizmendi, the Chief Financial Officer of OFG Bancorp, has recently sold 6,129 shares of the company on November 20, 2023. This transaction has caught the attention of investors and market analysts, as insider selling can often provide valuable clues about a company's future prospects. In this article, we will delve into the details of this transaction, the background of Maritza Arizmendi, and the business description of OFG Bancorp. Additionally, we will analyze the relationship between insider buy/sell activities and the stock price, incorporating the insider trend and GF Value images to provide a comprehensive overview.

Who is Maritza Arizmendi?

Maritza Arizmendi serves as the Chief Financial Officer of OFG Bancorp, a financial institution with a significant presence in Puerto Rico. Arizmendi has been a key figure in the company's financial management and strategic planning. Her role involves overseeing the financial operations, ensuring regulatory compliance, and contributing to the overall growth and profitability of the company. The insider's decisions to buy or sell shares are closely monitored, as they may reflect their confidence in the company's financial health and future performance.

OFG Bancorp's Business Description

OFG Bancorp is a diversified financial services company operating primarily in Puerto Rico, with additional operations in the U.S. Virgin Islands, the British Virgin Islands, and Florida. The company provides a wide range of banking and financial products and services, including commercial, consumer, and mortgage lending, as well as treasury and investment banking. OFG Bancorp prides itself on its community-focused approach and its commitment to providing innovative financial solutions to its customers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often considered a signal of the management's belief in the company's future. A sale or purchase of stock by an insider can indicate their confidence or concern about the company's prospects. In the case of OFG Bancorp, the recent sale by CFO Maritza Arizmendi of 6,129 shares could be interpreted in various ways. Over the past year, Arizmendi has sold a total of 6,129 shares and has not made any purchases. This one-sided activity might raise questions among investors about the insider's perspective on the stock's valuation or future growth potential.

Looking at the broader insider transaction history for OFG Bancorp, there have been no insider buys and 17 insider sells over the past year. This trend could suggest that insiders, on balance, believe the stock may be fully valued or that they are taking profits after a period of appreciation.

On the valuation front, OFG Bancorp's shares were trading at $33.39 on the day of the insider's recent sale, giving the stock a market cap of $1.565 billion. The price-earnings ratio stands at 8.73, which is slightly higher than the industry median of 8.48 but lower than the company's historical median price-earnings ratio. This suggests that the stock may be reasonably valued in comparison to its peers and its own trading history.

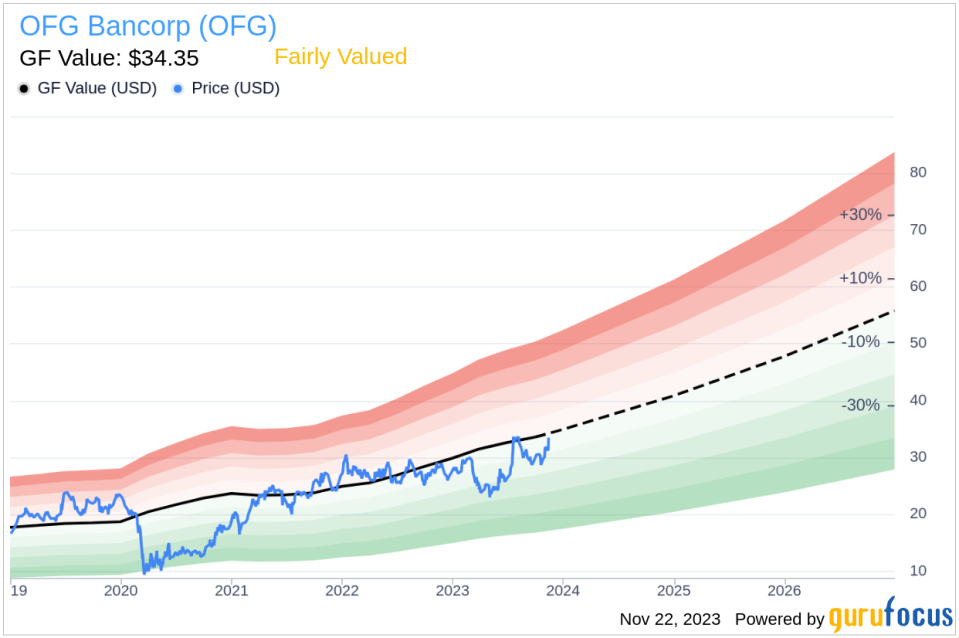

When considering the GF Value, which is an intrinsic value estimate that takes into account historical multiples, a GuruFocus adjustment factor, and future business performance estimates, OFG Bancorp has a price-to-GF-Value ratio of 0.97. This indicates that the stock is Fairly Valued based on its GF Value of $34.35.

The GF Value serves as a benchmark for investors, suggesting that the stock is not significantly overvalued or undervalued at its current price. However, the insider's decision to sell shares could imply that they believe the stock's growth potential is limited or that they see better investment opportunities elsewhere.

Conclusion

The sale of shares by CFO Maritza Arizmendi may prompt investors to consider the implications for OFG Bancorp's stock. While the insider's actions do not necessarily predict the future movement of the stock, they do offer a piece of the puzzle when evaluating the company's valuation and prospects. With the stock being fairly valued according to the GF Value and the insider selling trend, investors should keep a close eye on the company's performance and any further insider transactions that may provide additional insights into the company's direction.

As always, it is important for investors to conduct their own due diligence and consider a variety of factors, including insider transactions, when making investment decisions. The sale by Maritza Arizmendi is just one of many elements to consider in the complex and ever-changing landscape of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.