Insider Sell Alert: CFO Mark Harris Sells 6,000 Shares of Heidrick & Struggles ...

Mark Harris, the Chief Financial Officer of Heidrick & Struggles International Inc, has recently made a significant stock transaction, selling 6,000 shares of the company on December 12, 2023. This move by a key insider has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Mark Harris?

Mark Harris is the financial steward of Heidrick & Struggles International Inc, a premier provider of executive search, leadership assessment, and development, organization and team effectiveness, and culture shaping services globally. As CFO, Harris is responsible for overseeing the financial operations of the company, ensuring fiscal health, and maintaining investor relations. His actions, particularly in the realm of stock transactions, are closely monitored for insights into the company's financial stability and future prospects.

About Heidrick & Struggles International Inc

Heidrick & Struggles International Inc, traded under the ticker HSII on the NASDAQ, is a global leadership advisory firm, specializing in executive search and consulting. The company operates in the Americas, Europe, the Asia Pacific, and other regions, providing top-tier organizations with services to identify and develop leaders, improve team dynamics, and enhance overall organizational performance. With a deep understanding of leadership trends and a comprehensive approach to human capital, Heidrick & Struggles is a trusted partner for companies seeking transformative growth and competitive advantage.

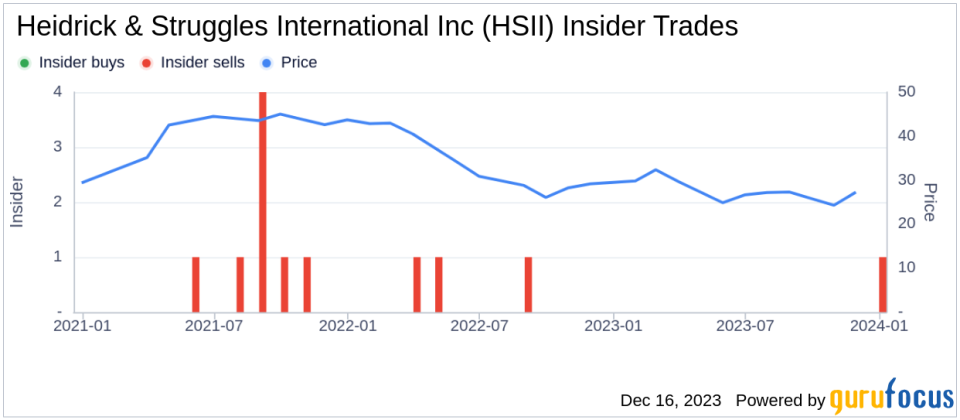

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving buying and selling of shares, can provide valuable insights into the company's internal perspective on its valuation and future performance. Over the past year, Mark Harris has sold a total of 6,000 shares and has not made any purchases. This one-sided activity could suggest that the insider perceives the current stock price as a favorable selling point or may be reallocating personal investment portfolios for reasons not necessarily related to the company's performance.

The absence of insider buys over the past year, coupled with the presence of insider sells, can sometimes raise questions among investors. However, it is essential to consider these transactions within the broader context of the company's stock performance and valuation metrics.

On the day of the insider's recent sell, shares of Heidrick & Struggles International Inc were trading at $28.04, giving the company a market cap of $564.831 million. This valuation places the stock below the industry median price-earnings ratio of 17.175 and the company's historical median, indicating a potentially undervalued situation.

With a price-to-GF-Value ratio of 0.88, based on a GF Value of $31.84, Heidrick & Struggles International Inc appears to be modestly undervalued. The GF Value, an intrinsic value estimate developed by GuruFocus, takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above reflects the recent insider sell activity, which should be weighed against the company's valuation and stock performance. While insider sells can sometimes signal a lack of confidence in the company's future growth, they can also result from personal financial planning or diversification strategies.

The GF Value image provides a visual representation of the stock's current valuation in relation to its intrinsic value. The modest undervaluation of Heidrick & Struggles International Inc suggests that the stock may have room for appreciation, which could be a positive sign for investors considering the stock's potential for growth.

Conclusion

The recent insider sell by CFO Mark Harris of Heidrick & Struggles International Inc is a noteworthy event that warrants attention from investors and market analysts. While the absence of insider buys over the past year may raise some concerns, the company's current valuation and the modest undervaluation indicated by the GF Value suggest that the stock may still be an attractive investment opportunity.

Investors should consider the insider's actions as one of many factors in their investment decision-making process. It is also crucial to conduct thorough research and consider the company's financial health, market position, and growth prospects before making any investment decisions. As always, a diversified investment strategy is recommended to mitigate risks associated with individual stock movements.

Heidrick & Struggles International Inc continues to be a significant player in the leadership advisory and executive search industry, and its stock remains a subject of interest for those looking to invest in the human capital management space.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.