Insider Sell Alert: CFO Sonia Jain Sells 39,191 Shares of Cars.com Inc

In a notable insider transaction, CFO Sonia Jain of Cars.com Inc (NYSE:CARS) sold 39,191 shares of the company's stock on November 28, 2023. This move has caught the attention of investors and analysts who closely monitor insider behaviors as indicators of a company's financial health and future performance. Understanding who Sonia Jain is and the context of this transaction is crucial for stakeholders and potential investors.

Who is Sonia Jain?

Sonia Jain serves as the Chief Financial Officer of Cars.com Inc, a leading digital marketplace and solutions provider for the automotive industry. Jain's role at Cars.com Inc involves overseeing the financial operations, strategy, and reporting of the company. Her decisions and insights are instrumental in shaping the company's financial planning and in maintaining investor confidence. Jain's tenure and actions as CFO are closely watched, as they can provide valuable insights into the company's internal assessments of its financial standing and market position.

About Cars.com Inc

Cars.com Inc operates as a prominent player in the digital automotive marketplace. The company's platform connects car shoppers with sellers, providing a comprehensive set of solutions that aid in the decision-making process for buying, selling, or owning a car. Cars.com Inc offers a vast inventory of new and used vehicles, a suite of research tools, and detailed vehicle listings, making it a go-to resource for consumers in the automotive market. The company's innovative approach to car sales has positioned it as a key facilitator in the automotive e-commerce space.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving high-ranking executives like CFOs, can provide valuable clues about a company's internal perspective on its stock's value. Sonia Jain's decision to sell 39,191 shares could be interpreted in various ways. It might indicate that the insider believes the stock is currently overvalued or that they are diversifying their personal portfolio for reasons unrelated to the company's performance.

Over the past year, Sonia Jain has sold a total of 39,191 shares and has not made any purchases. This one-sided activity could suggest a lack of confidence in the company's short-term growth prospects or simply a personal financial decision. The broader insider trend at Cars.com Inc shows a total of 15 insider sells and no insider buys over the same timeframe, which could be seen as a bearish signal by market observers.

However, it is essential to consider these transactions in the context of the company's stock performance and valuation metrics. On the day of Jain's recent sale, Cars.com Inc shares were trading at $18.98, giving the company a market cap of $1.241 billion. The price-earnings ratio stood at 10.65, lower than both the industry median of 17 and the company's historical median price-earnings ratio. This could suggest that the stock is undervalued based on earnings potential.

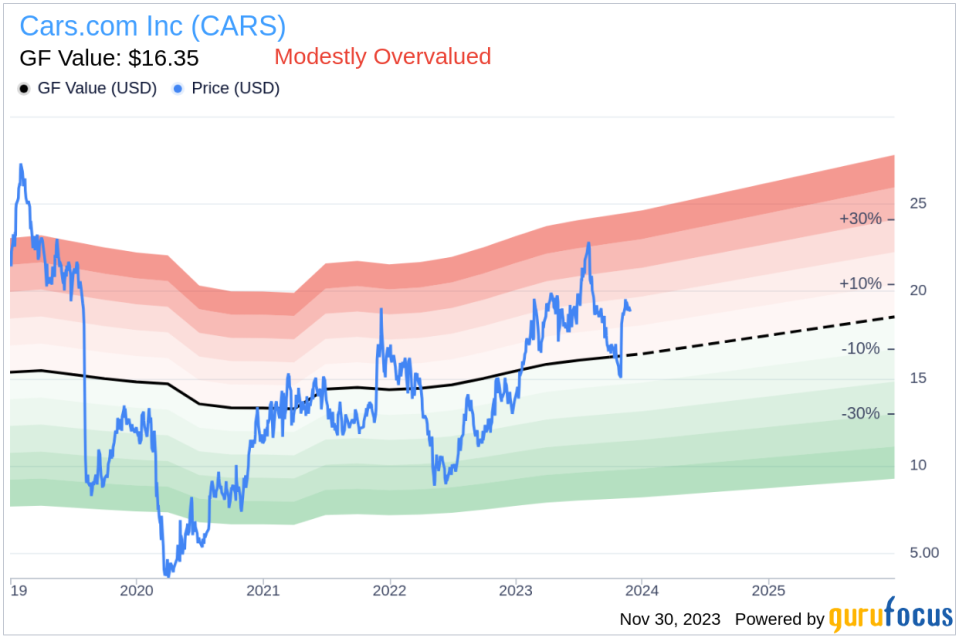

When assessing the stock's valuation, the price-to-GF-Value ratio is a critical metric. With a share price of $18.98 and a GuruFocus Value of $16.35, Cars.com Inc has a price-to-GF-Value ratio of 1.16, indicating that the stock is modestly overvalued based on its GF Value. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling pattern among insiders at Cars.com Inc, which could be a factor for investors to consider when evaluating the stock.

The GF Value image offers insight into the stock's valuation relative to its intrinsic value estimate, which is a composite of historical trading multiples, company returns and growth, and analyst performance estimates.

Conclusion

While insider selling can be a red flag for potential investors, it is important to analyze the context of such transactions. Sonia Jain's sale of 39,191 shares could be influenced by various factors, including personal financial planning. However, the lack of insider buying over the past year at Cars.com Inc, coupled with multiple insider sells, may raise questions about the insiders' confidence in the company's near-term growth potential.

Investors should weigh the insider selling trend against the company's favorable price-earnings ratio and the modest overvaluation indicated by the price-to-GF-Value ratio. As always, it is advisable for investors to conduct their due diligence and consider a multitude of factors, including insider transactions, financial metrics, and broader market conditions, before making investment decisions.

For those interested in Cars.com Inc's stock, keeping an eye on insider transaction patterns and staying informed about the company's financial performance and market valuation will be key to making informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.