Insider Sell Alert: CFO Stuart Canfield Sells Shares of Electronic Arts Inc (EA)

Stuart Canfield, the Chief Financial Officer (CFO) of Electronic Arts Inc (NASDAQ:EA), has recently made a significant change to his holdings in the company. On November 29, 2023, Canfield sold 3,259 shares of Electronic Arts, a leading global interactive entertainment software company. This move by a key insider has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Stuart Canfield of Electronic Arts Inc?

Stuart Canfield has been serving as the CFO of Electronic Arts Inc, a position that places him at the heart of the company's financial strategies and decision-making processes. As CFO, Canfield is responsible for overseeing the financial operations, reporting, and compliance of the company. His role is crucial in shaping the financial health and guiding the strategic direction of Electronic Arts. His insider status provides him with a deep understanding of the company's operations, future prospects, and potential challenges.

Electronic Arts Inc's Business Description

Electronic Arts Inc is a global leader in digital interactive entertainment. The company develops and delivers games, content, and online services for Internet-connected consoles, mobile devices, and personal computers. EA's portfolio includes critically acclaimed brands such as The Sims, Madden NFL, EA SPORTS FIFA, Battlefield, Dragon Age, and Plants vs. Zombies. The company's unique ability to create a diverse range of entertainment experiences enables it to reach a broad demographic of players across various platforms.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-ranking executives like CFOs, are closely monitored by investors as they can provide valuable insights into the company's internal perspective on its stock's value. Over the past year, Stuart Canfield has sold a total of 3,259 shares and has not made any purchases. This one-sided activity could suggest that the insider sees the current stock price as an opportune time to realize gains or reallocate personal investment portfolios.

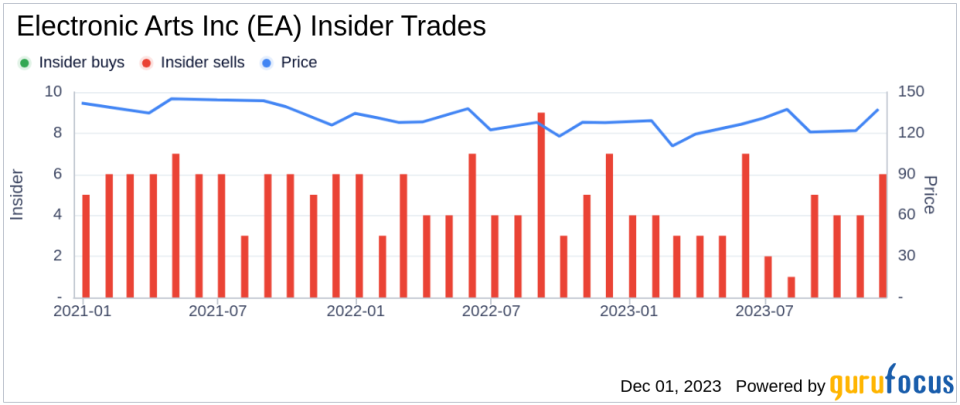

When analyzing insider trends, it's notable that there have been no insider buys and 43 insider sells over the past year for Electronic Arts Inc. This pattern of insider selling could indicate that those with the most intimate knowledge of the company's workings believe that the stock may be fully valued or that they are taking profits after a period of stock price appreciation.

On the day of Canfield's recent sell, shares of Electronic Arts Inc were trading at $136.88, giving the company a market cap of $37.044 billion. The price-earnings ratio of 37.95 is higher than the industry median of 21.08 and also above the company's historical median, suggesting a premium valuation compared to its peers and its own trading history.

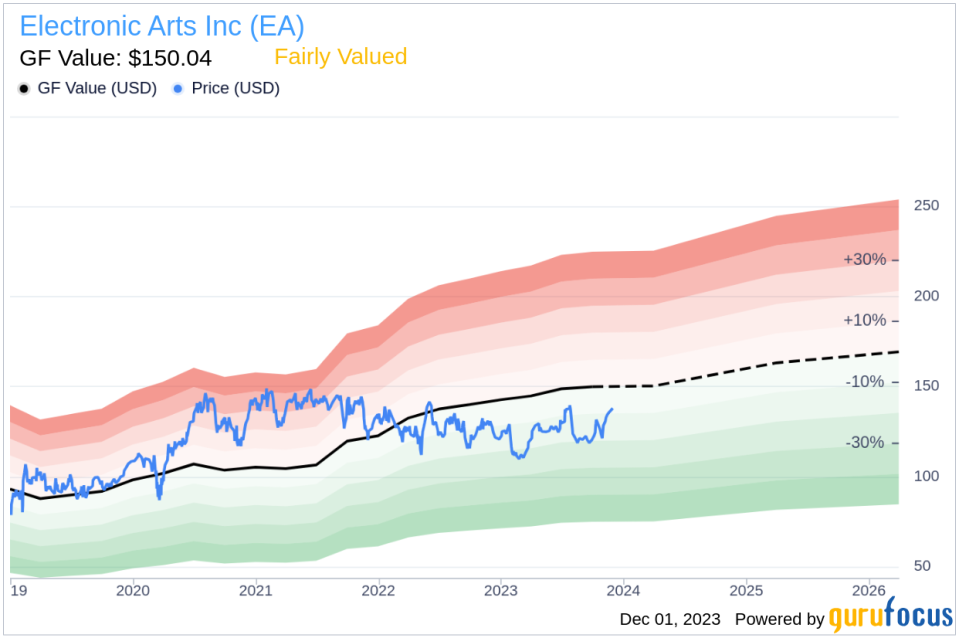

However, with a price of $136.88 and a GuruFocus Value of $150.04, Electronic Arts Inc has a price-to-GF-Value ratio of 0.91, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling pattern by insiders at Electronic Arts Inc. This consistent selling trend could be interpreted in various ways, but it often raises questions among investors about the potential reasons behind such activity.

The GF Value image offers a perspective on the stock's valuation relative to its intrinsic value. A price-to-GF-Value ratio below 1 suggests that the stock may be undervalued, while a ratio above 1 would indicate overvaluation. In the case of Electronic Arts Inc, the ratio suggests that the stock is fairly valued, which could mean that the insider's decision to sell does not necessarily reflect a belief that the stock is overpriced.

Conclusion

The recent insider sell by CFO Stuart Canfield of Electronic Arts Inc is a significant event that warrants attention from the investment community. While the insider's sell activity alone does not provide a complete picture, it is an important piece of information that, when combined with other data points such as the company's valuation metrics and market performance, can help investors make more informed decisions. As always, investors should consider a wide range of factors, including insider trends, valuation, and the company's overall financial health, before making investment choices.

It is also important to note that insider selling can be motivated by various personal factors that may not necessarily relate to the company's performance or outlook. Therefore, while insider transactions are a valuable piece of the puzzle, they should not be the sole basis for investment decisions.

Investors and analysts will continue to monitor insider activity and other market signals to gauge the potential future direction of Electronic Arts Inc's stock price. As the gaming industry evolves and Electronic Arts Inc strives to maintain its position as a leading entertainment company, the actions of its insiders will remain a topic of keen interest.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.