Insider Sell Alert: CFO Tania Secor Offloads 20,274 Shares of Integral Ad Science Holding Corp (IAS)

In a notable insider transaction, Tania Secor, the Chief Financial Officer of Integral Ad Science Holding Corp (NASDAQ:IAS), sold 20,274 shares of the company on December 6, 2023. This move has caught the attention of investors and market analysts, as insider selling can often provide valuable insights into a company's financial health and future prospects.

Who is Tania Secor?

Tania Secor is a seasoned financial executive with a track record of driving growth and operational efficiency. As the CFO of Integral Ad Science Holding Corp, Secor oversees the company's financial operations, including accounting, financial planning and analysis, investor relations, and M&A activities. Her role is crucial in shaping the company's financial strategy and ensuring its fiscal responsibility and sustainability.

About Integral Ad Science Holding Corp

Integral Ad Science Holding Corp is a global leader in digital ad verification, offering technologies that drive high-quality advertising media. IAS's solutions focus on ensuring that ads are viewable by real people, in safe and suitable environments, thereby enhancing the value of online advertising. The company's proprietary technology leverages artificial intelligence to provide actionable insights that empower advertisers and publishers to protect their investments and maximize their returns.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving high-ranking executives like CFOs, can be a strong indicator of a company's internal perspective on its stock's value. In the case of Tania Secor's recent sale, the transaction could be interpreted in several ways. While some may view insider selling as a lack of confidence in the company's future growth, it is also possible that the insider is diversifying their personal portfolio or addressing personal financial needs.

It is important to consider the context of the sale. According to the data, over the past year, Tania Secor has sold a total of 20,274 shares and has not made any purchases. This one-sided activity could suggest that the insider is taking profits or reducing exposure to the company's stock. However, without additional information on the insider's motives, it is difficult to draw definitive conclusions.

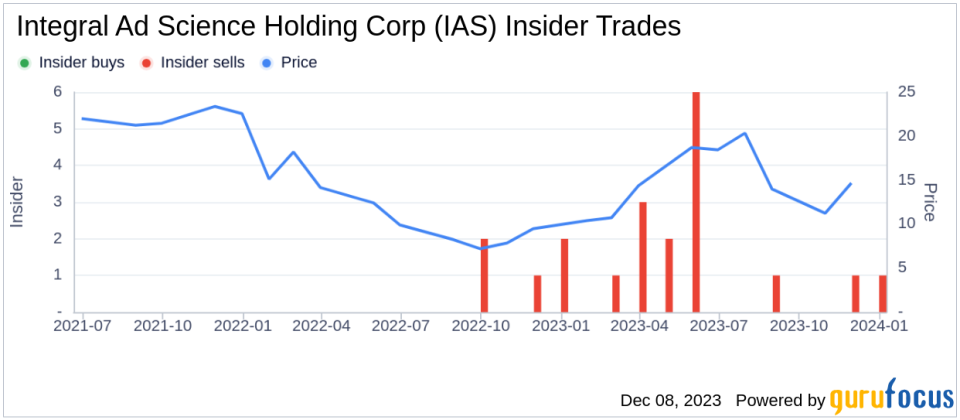

The insider transaction history for Integral Ad Science Holding Corp shows a trend of more insider selling than buying over the past year, with 17 insider sells and no insider buys. This pattern may raise questions among investors about the insiders' collective outlook on the stock's future performance.

On the day of Secor's sale, shares of Integral Ad Science Holding Corp were trading at $14.09, giving the company a market cap of $2.214 billion. The price-earnings ratio of 280.60 is significantly higher than both the industry median of 17.5 and the company's historical median price-earnings ratio. This high valuation could be a factor in the insider's decision to sell, as it may suggest that the stock is overvalued relative to its earnings potential.

When analyzing insider transactions, it is also useful to look at the stock's performance before and after the sale. If the stock price tends to decline following insider sales, it could indicate that the market perceives the insider's actions as a bearish signal. Conversely, if the stock price remains stable or increases, it may suggest that the sale has not negatively impacted investor sentiment.

The insider trend image above provides a visual representation of the buying and selling activities of insiders over time. A consistent pattern of insider selling, as seen in the case of Integral Ad Science Holding Corp, can be a point of analysis for investors considering the stock's potential.

Conclusion

Insider transactions, such as the recent sale by CFO Tania Secor, offer valuable data points for investors. While insider selling alone should not be the sole basis for investment decisions, it is an important factor to consider in the broader context of a company's financial health, valuation, and market performance. Investors are encouraged to conduct thorough research and consider multiple indicators before making any investment decisions regarding Integral Ad Science Holding Corp or any other stock.

As always, it is recommended to keep an eye on insider trends and market news to stay informed about potential shifts in company dynamics and stock valuation. The sale by Tania Secor may be a piece of the puzzle, but it is the investor's responsibility to assemble the full picture.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.