Insider Sell Alert: Chairman and CEO Michael Casey Sells 89,139 Shares of Carter's Inc (CRI)

In a notable insider transaction, Michael Casey, the Chairman and CEO of Carter's Inc (NYSE:CRI), sold 89,139 shares of the company on December 14, 2023. This move has caught the attention of investors and analysts, as insider sales can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Michael Casey of Carter's Inc?

Michael Casey has been a pivotal figure at Carter's Inc, serving as the Chairman and CEO. His leadership has been instrumental in guiding the company through various market conditions. With a deep understanding of the company's operations and strategic direction, Casey's actions in the stock market are closely monitored for indications of the company's health and future performance.

Carter's Inc's Business Description

Carter's Inc is a leading American marketer of children's apparel. The company owns some of the most recognized brands in the industry, including Carter's and OshKosh B'gosh. Their products are sold in department stores, national chains, and specialty retailers domestically and internationally. They also operate their own retail stores and online platforms, providing customers with a wide range of options for purchasing their clothing and accessories for children.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly those involving high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. In the case of Carter's Inc, the insider, Michael Casey, has been on a selling streak over the past year, with a total of 92,284 shares sold and no shares purchased. This pattern of behavior could signal a lack of confidence in the company's future growth or a belief that the stock is currently overvalued.

The insider trend image above shows a clear pattern of selling, with no insider buys over the past year. This trend can be concerning to investors, as it suggests that those with the most intimate knowledge of the company's workings are choosing to reduce their holdings.

Valuation and Market Response

On the day of the insider's recent sale, shares of Carter's Inc were trading at $75, giving the company a market cap of $2.719 billion. The price-earnings ratio of 13.47 is lower than both the industry median of 17.51 and the company's historical median, indicating that the stock may be undervalued compared to its peers and its own trading history.

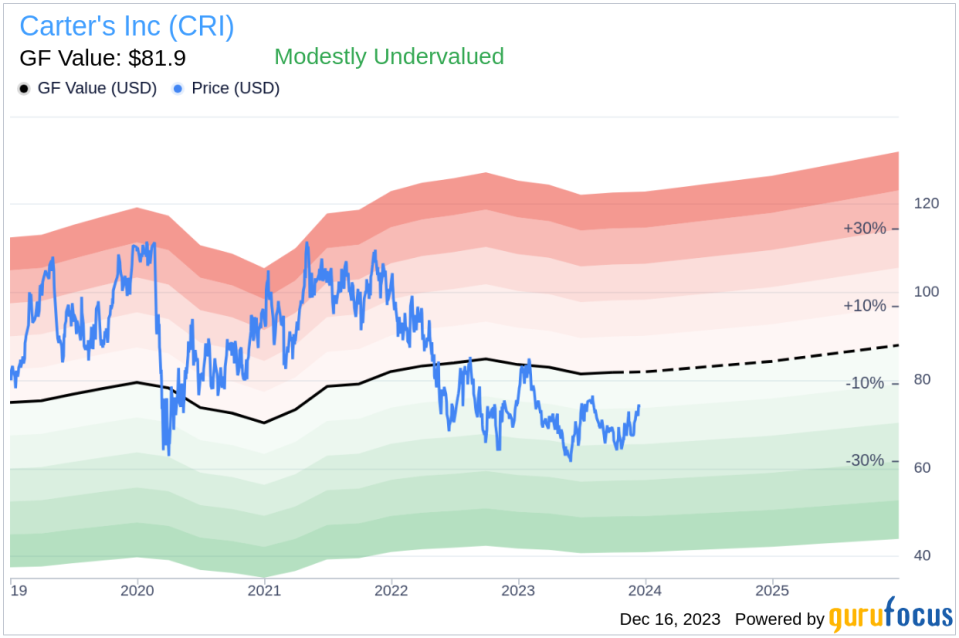

The GF Value image provides further context for the valuation of Carter's Inc. With a price of $75 and a GuruFocus Value of $81.90, the stock has a price-to-GF-Value ratio of 0.92, suggesting that it is modestly undervalued. The GF Value is a comprehensive measure that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.Despite the insider's recent sales, the modestly undervalued status of the stock could indicate an attractive entry point for investors. However, it is essential to consider the insider's actions as part of a broader investment analysis, as they may have personal reasons for selling that are not directly related to the company's performance or valuation.

Conclusion

The recent insider sale by Michael Casey of Carter's Inc is a significant event that warrants attention from the investment community. While the company appears to be undervalued based on various metrics, the consistent selling by the insider raises questions about the stock's future trajectory. Investors should weigh this insider activity alongside other financial analyses and market trends when making investment decisions regarding Carter's Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.