Insider Sell Alert: Chief Accounting Officer Eckert William James IV Sells 7,000 Shares of ...

Equitable Holdings Inc (NYSE:EQH), a notable player in the financial services sector, has recently witnessed a significant insider transaction. Chief Accounting Officer Eckert William James IV sold 7,000 shares of the company on December 14, 2023. This move has caught the attention of investors and market analysts, prompting a closer examination of the implications of such insider activity.

Who is Eckert William James IV?

Eckert William James IV serves as the Chief Accounting Officer of Equitable Holdings Inc. In his role, he is responsible for overseeing the company's accounting operations, financial reporting, and compliance with regulatory financial requirements. His position grants him an intimate understanding of the company's financial health and strategic direction, making his trading activities particularly noteworthy to investors.

Equitable Holdings Inc's Business Description

Equitable Holdings Inc is a diversified financial services company that operates through various subsidiaries. The company provides a wide range of financial products and services, including life insurance, annuities, investment management, and retirement solutions. With a strong presence in the United States, Equitable Holdings Inc is committed to helping its clients secure their financial well-being and achieve their long-term financial goals.

Analysis of Insider Buy/Sell and Relationship with Stock Price

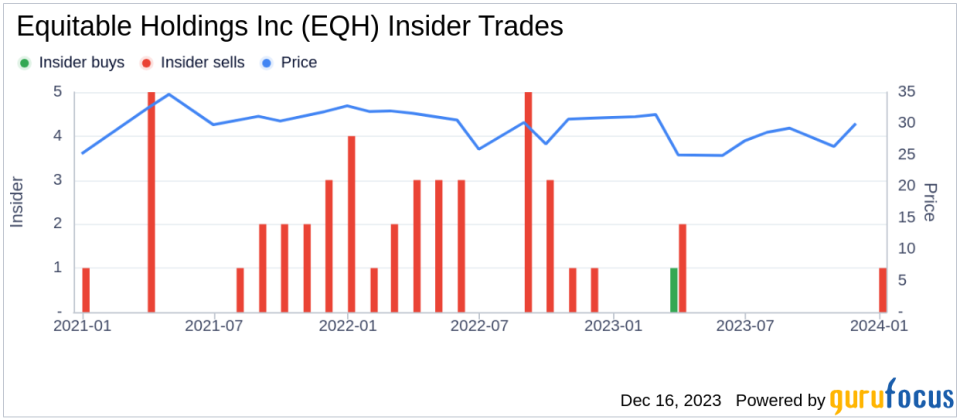

Insider trading activities, such as the recent sale by the insider, can provide valuable insights into a company's internal perspective on its stock's value. Over the past year, Eckert William James IV has sold a total of 15,100 shares and has not made any purchases. This one-sided activity may suggest that the insider perceives the current stock price as a favorable selling point or is reallocating personal assets for reasons unrelated to company performance.

When examining the broader insider transaction history for Equitable Holdings Inc, we observe that there has been a modest number of insider transactions over the past year, with 1 insider buy and 4 insider sells. This trend can be indicative of the insider sentiment towards the stock's valuation and future prospects.

On the day of the insider's recent sale, shares of Equitable Holdings Inc were trading at $34.59, giving the company a market cap of $11.522 billion. This price point is particularly interesting when considering the company's valuation metrics.

The price-earnings ratio of Equitable Holdings Inc stands at 6.05, which is lower than the industry median of 10.945 and also lower than the company's historical median price-earnings ratio. This could imply that the stock is undervalued compared to its peers and its own historical standards, potentially offering an attractive entry point for value investors.

However, with a price of $34.59 and a GuruFocus Value of $36.40, Equitable Holdings Inc has a price-to-GF-Value ratio of 0.95. This suggests that the stock is Fairly Valued based on its GF Value, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The GF Value is a proprietary metric that aims to determine a stock's intrinsic value by considering historical price multiples, adjustments for the company's past performance, and analyst projections for future earnings. In the case of Equitable Holdings Inc, the GF Value indicates that the stock is trading close to its fair value, which may explain the insider's decision to sell at this time.

Conclusion

The recent insider sell by Chief Accounting Officer Eckert William James IV of Equitable Holdings Inc has sparked interest among investors and analysts. While the insider's trading activities suggest a potential belief that the stock is currently priced favorably for selling, the company's valuation metrics and GF Value indicate that the stock is fairly valued. Investors should consider these factors, along with the overall insider trading trend and the company's financial performance, when making investment decisions regarding Equitable Holdings Inc.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It is essential for investors to conduct thorough due diligence, considering both the company's fundamentals and broader market conditions, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.