Insider Sell Alert: Chief Accounting Officer Thomas Sullivan Sells 35,000 Shares of Repay ...

Repay Holdings Corp (NASDAQ:RPAY), a leading provider of vertically integrated payment solutions, has recently witnessed a significant insider sell by its Chief Accounting Officer, Thomas Sullivan. On November 22, 2023, Sullivan sold 35,000 shares of the company, a move that has caught the attention of investors and market analysts alike.

Who is Thomas Sullivan of Repay Holdings Corp?

Thomas Sullivan serves as the Chief Accounting Officer at Repay Holdings Corp. In his role, Sullivan is responsible for overseeing the company's accounting operations, financial reporting, and compliance with regulatory requirements. His position places him in a unique vantage point to understand the company's financial health and prospects, making his trading activities particularly noteworthy to the investment community.

Repay Holdings Corp's Business Description

Repay Holdings Corp operates in the financial technology sector, providing integrated payment processing solutions to verticals that are often underserved by traditional payment providers. The company's offerings include a suite of payment processing services that cater to the specific needs of its clients, enabling seamless transactions across various platforms. Repay Holdings Corp prides itself on its ability to offer tailored solutions that enhance the payment experience for both merchants and consumers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

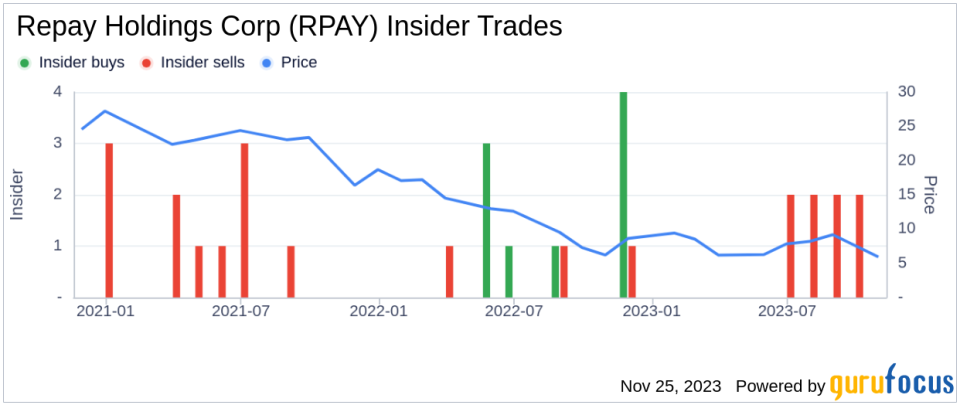

Insider trading activities, particularly sells, can provide valuable insights into a company's internal perspective on its stock's valuation. In the case of Repay Holdings Corp, the insider, Thomas Sullivan, has not made any stock purchases over the past year but has sold a total of 35,000 shares. This one-sided activity could signal a lack of confidence in the company's short-term growth prospects or simply a personal financial decision by the insider.

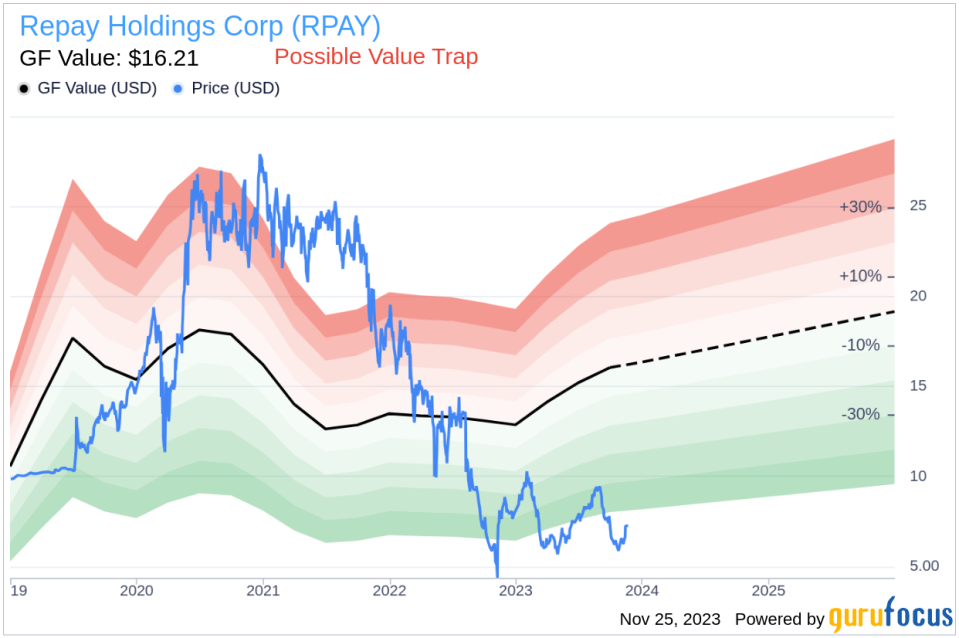

When examining the relationship between insider trading and stock price, it's crucial to consider the context of the transactions. The insider's recent sell occurred with the stock trading at $7.4 per share, which is significantly below the GuruFocus Value (GF Value) of $16.21. This discrepancy suggests that the stock may be undervalued, as indicated by the price-to-GF-Value ratio of 0.46, which labels the stock as a "Possible Value Trap, Think Twice."

The GF Value is a proprietary metric developed by GuruFocus to estimate a stock's intrinsic value. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current GF Value suggests that Repay Holdings Corp's stock might be trading at a discount, yet the insider's decision to sell could imply that there are other factors at play that might not be fully captured by the GF Value.

It's also important to note the broader insider trend at Repay Holdings Corp. Over the past year, there have been no insider buys but nine insider sells. This trend could be indicative of a general sentiment among insiders that the stock's current price does not reflect an attractive investment opportunity, despite the seemingly low price-to-GF-Value ratio.

The insider trend image above provides a visual representation of the selling pattern, which could be a red flag for potential investors. A consistent pattern of insider sells, without any offsetting buys, may suggest that those with the most intimate knowledge of the company's operations are choosing to reduce their holdings.

Market Cap and Valuation

With a market cap of $666.222 million, Repay Holdings Corp is a mid-sized player in the fintech space. The company's valuation, as reflected by its market cap, is a critical factor for investors to consider. While the market cap provides a snapshot of the company's size, the GF Value offers a deeper look into whether the stock is trading at a fair price relative to its intrinsic value.

Given the current market cap and the GF Value, investors might be tempted to view Repay Holdings Corp as an undervalued opportunity. However, the insider sell activity, particularly from a high-ranking accounting officer, should prompt a more cautious approach. Investors would be wise to delve deeper into the company's financials, industry trends, and potential headwinds before making a decision.

The GF Value image above illustrates the gap between the current stock price and the estimated intrinsic value. While this might typically be an encouraging sign for value investors, the insider sell activity complicates the narrative. It raises questions about whether the stock's undervaluation is a temporary market inefficiency or a reflection of underlying challenges within the company.

Conclusion

Thomas Sullivan's recent insider sell of 35,000 shares of Repay Holdings Corp is a significant event that warrants attention. While the GF Value suggests that the stock may be undervalued, the consistent pattern of insider sells over the past year, with no corresponding buys, paints a more complex picture. Investors should consider the insider trading trends, the company's market cap, and the GF Value in conjunction with a thorough analysis of Repay Holdings Corp's financial health and market position before making any investment decisions.

As with any investment, it's essential to conduct due diligence and consider the broader market context. Insider trading is just one piece of the puzzle, and while it can provide valuable clues, it should not be the sole basis for an investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.