Insider Sell Alert: Chief Accounting Officer Kami Turner Sells Shares of Donnelley Financial ...

In the realm of financial markets, insider transactions hold a significant place as they can provide insights into a company's internal perspective on its stock's value. Recently, an insider sell event has caught the attention of investors and analysts alike. Kami Turner, the Chief Accounting Officer of Donnelley Financial Solutions Inc (NYSE:DFIN), sold 8,202 shares of the company on November 29, 2023. This transaction has sparked interest in the financial community, prompting a closer look at the implications of such a move.

Who is Kami Turner of Donnelley Financial Solutions Inc?

Kami Turner serves as the Chief Accounting Officer at Donnelley Financial Solutions Inc, a role that places her at the heart of the company's financial reporting and compliance. Her position involves overseeing the accounting operations, ensuring the accuracy of financial statements, and maintaining the integrity of financial practices within the organization. Turner's actions, especially in terms of stock transactions, are closely monitored as they may reflect her confidence in the company's financial health and future prospects.

Donnelley Financial Solutions Inc's Business Description

Donnelley Financial Solutions Inc is a company that specializes in providing financial communications, data services, and regulatory compliance solutions. It caters to global capital markets and compliance professionals, offering a suite of technology-enabled services that facilitate effective and secure communication among market participants. The company's offerings include software and services that support the creation, management, and distribution of financial and regulatory documents and data. With a focus on innovation and client service, Donnelley Financial Solutions Inc plays a critical role in the smooth functioning of financial markets.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

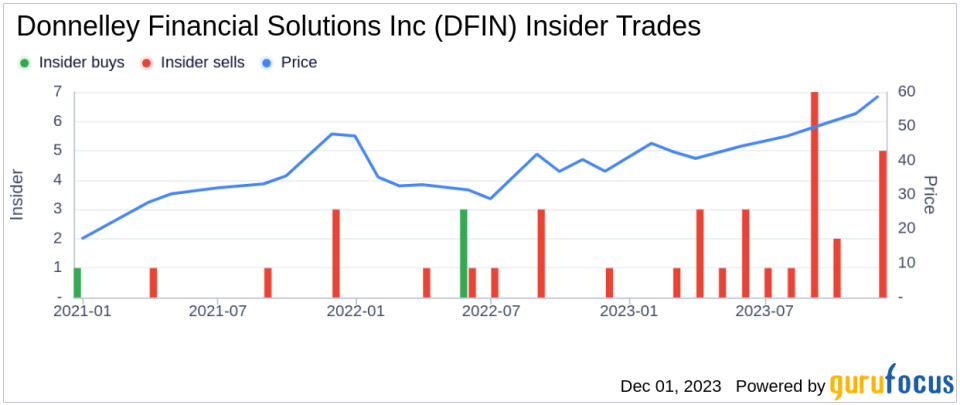

Insider transactions, particularly sales, can be interpreted in various ways. While some may view insider selling as a lack of confidence in the company's future, it is essential to consider the context and frequency of such transactions. In the case of Kami Turner, the insider has sold 8,202 shares over the past year and has not made any purchases. This pattern of behavior could suggest that the insider is taking profits or diversifying their investment portfolio, rather than signaling a fundamental issue with the company.

It is also noteworthy that there have been 24 insider sells and no insider buys over the past year for Donnelley Financial Solutions Inc. This trend may raise questions among investors about the insiders' collective outlook on the stock's valuation.

On the day of Turner's recent sale, shares of Donnelley Financial Solutions Inc were trading at $58.26, giving the company a market cap of $1.717 billion. This valuation places the stock at a price-earnings ratio of 21.53, which is higher than both the industry median of 18.13 and the company's historical median price-earnings ratio. Such a premium could be a factor in the insider's decision to sell shares.

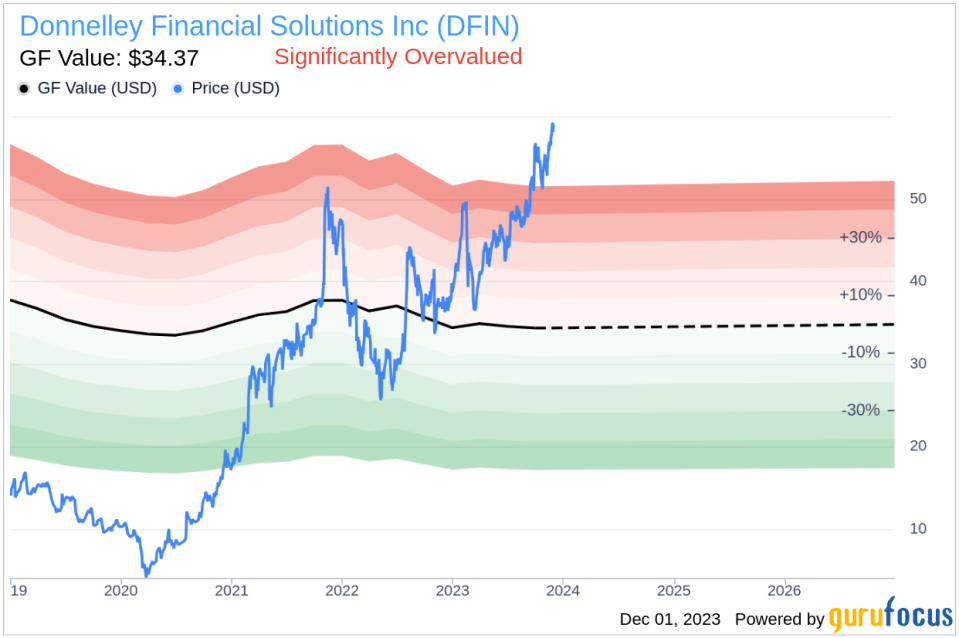

Moreover, the stock's price-to-GF-Value ratio stands at 1.7, indicating that Donnelley Financial Solutions Inc is significantly overvalued based on its GF Value of $34.37. This discrepancy between the market price and the intrinsic value estimate may further justify the insider's choice to sell at this point in time.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. When the stock's price significantly exceeds the GF Value, as it does in this case, it suggests that the stock may be overpriced relative to its fundamental worth.

The insider trend image above provides a visual representation of the selling and buying activities of insiders at Donnelley Financial Solutions Inc. The absence of insider buys coupled with a consistent pattern of sells could be indicative of a consensus among insiders that the stock's current price may not be sustainable in the long term.

The GF Value image further illustrates the disparity between the stock's current market price and its estimated intrinsic value. Investors often use such valuation metrics to gauge whether a stock is trading at a fair price or if market sentiment has potentially driven the price away from its fundamental value.

Conclusion

The recent insider sell by Chief Accounting Officer Kami Turner at Donnelley Financial Solutions Inc has provided the market with valuable information. While insider sells are not always indicative of a company's future performance, they do offer a glimpse into the perspectives of those with intimate knowledge of the company's operations and financials. In the case of Donnelley Financial Solutions Inc, the high price-earnings ratio and the significant overvaluation based on the GF Value suggest that insiders may view the stock as being priced above its intrinsic value. As always, investors should consider insider trends as one of many factors in their investment decision-making process.

For those closely monitoring Donnelley Financial Solutions Inc, it will be important to watch for any changes in insider transaction patterns, as well as any developments in the company's business performance that could influence its valuation and stock price.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.