Insider Sell Alert: Chief Analytics Officer Arthur Smith Sells Shares of Credit Acceptance Corp ...

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Arthur Smith, the Chief Analytics Officer of Credit Acceptance Corp (NASDAQ:CACC), made a notable move by selling 5,788 shares of the company on November 14, 2023. This transaction has caught the attention of market analysts and investors alike, as insider sales can provide insights into a company's financial health and future prospects.

Who is Arthur Smith of Credit Acceptance Corp?

Arthur Smith has been serving as the Chief Analytics Officer at Credit Acceptance Corp, a key figure in the company's strategic decision-making process. Smith's role involves leveraging data analytics to drive business insights and enhance the company's competitive edge in the auto finance industry. His actions, particularly in buying or selling company stock, are closely monitored as they may reflect his confidence in the company's future performance.

Credit Acceptance Corp's Business Description

Credit Acceptance Corp is a financial services company that operates in the auto finance sector. The company specializes in providing financing solutions to automobile dealers, enabling them to sell vehicles to consumers regardless of their credit history. Credit Acceptance Corp's unique business model involves partnering with a nationwide network of dealers, offering them the ability to deliver credit approvals to consumers within 30 seconds. The company's programs are designed to help dealers sell more vehicles while providing consumers with an opportunity to improve their credit scores through timely repayments.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activity, such as the recent sale by Arthur Smith, can be a double-edged sword when it comes to interpreting its impact on the stock price. On one hand, insiders may sell shares for various personal reasons that do not necessarily reflect their outlook on the company's future. On the other hand, a pattern of insider selling could signal that those with the most intimate knowledge of the company's workings anticipate a downturn or are taking profits after a period of performance.

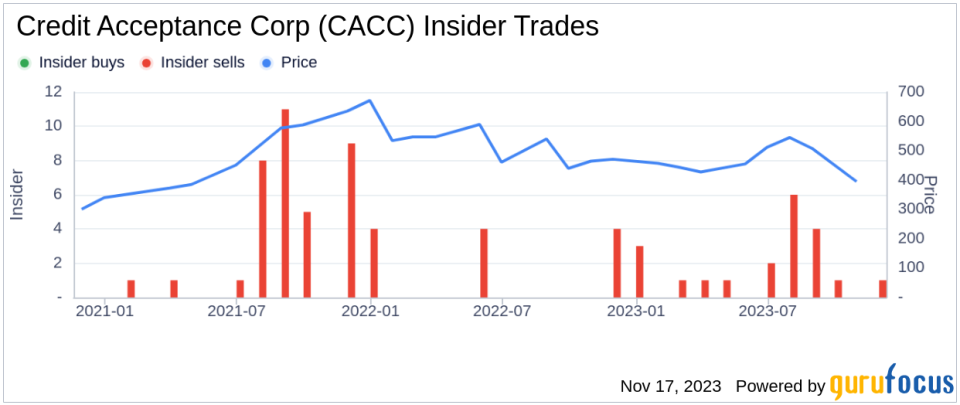

Arthur Smith's sale of 5,788 shares is part of a broader trend observed over the past year at Credit Acceptance Corp. There have been 20 insider sells and no insider buys during this period, which could suggest that insiders are generally more inclined to sell their shares than to acquire more. This pattern of selling may raise questions among investors about the long-term value of the stock.

On the day of the insider's recent sale, shares of Credit Acceptance Corp were trading at $422.22, giving the company a market cap of $5.394 billion. This price point is particularly interesting when considering the company's valuation metrics.

The price-earnings ratio of 17.66 is higher than the industry median of 12.61, indicating that the stock may be priced at a premium compared to its peers. However, this higher ratio could also reflect investor confidence in the company's earnings potential relative to the industry.

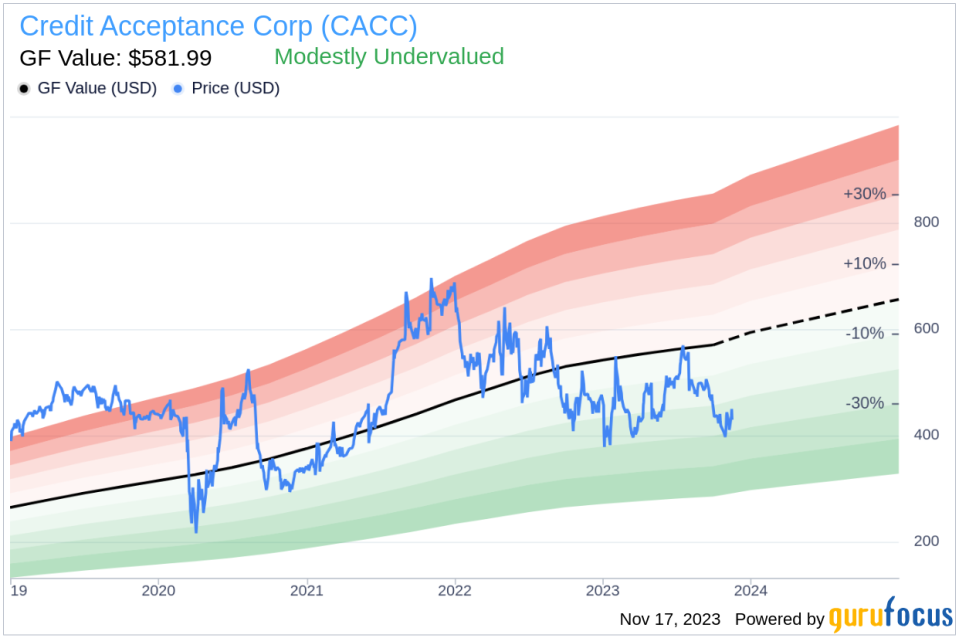

Moreover, with a price of $422.22 and a GuruFocus Value of $581.99, Credit Acceptance Corp has a price-to-GF-Value ratio of 0.73, suggesting that the stock is modestly undervalued based on its GF Value. This valuation presents a more complex picture, as it contrasts with the insider selling trend.

The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past performance, and future business performance estimates from analysts. The current GF Value indicates that Credit Acceptance Corp's stock might have room to grow, despite the recent insider selling activity.

When analyzing the insider trend image above, it's clear that the selling pattern is consistent, which could be a point of concern for potential investors. However, it's important to consider the broader context, including the company's financial health and market position.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current undervaluation could be an attractive entry point for investors who believe in the company's fundamentals and long-term growth prospects, despite the insider's decision to reduce their holdings.

Conclusion

Arthur Smith's recent sale of shares in Credit Acceptance Corp has sparked interest among investors and analysts. While the insider's actions may raise questions, it's crucial to consider the company's valuation, business model, and market position. The stock's modest undervaluation according to the GF Value suggests that there may still be potential for growth, despite the insider selling trend. Investors should weigh these factors carefully and conduct thorough due diligence before making any investment decisions.

As with any insider activity, it's essential to view these transactions as part of a broader investment strategy and not as standalone indicators. The financial market is influenced by a multitude of factors, and insider trades are just one piece of the puzzle that investors must piece together to form a comprehensive view of a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.