Insider Sell Alert: Chief Banking Officer Greg Lapointe Sells Shares of SouthState Corp

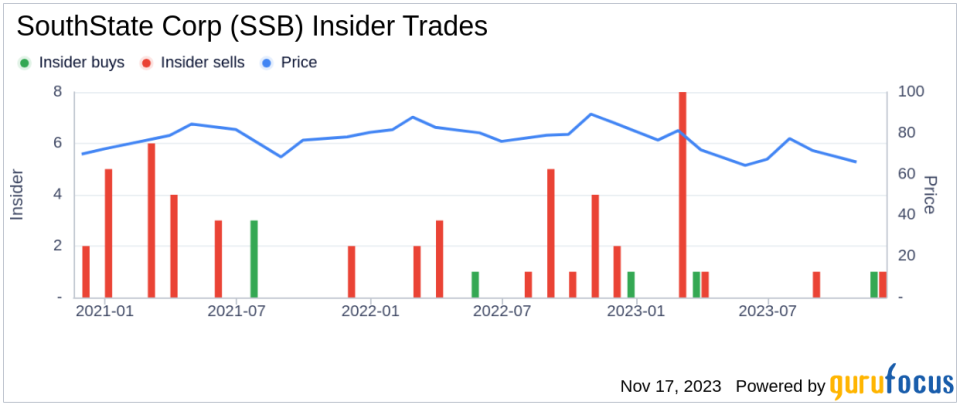

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, SouthState Corp (NASDAQ:SSB) has witnessed a notable insider transaction that has caught the attention of market participants. Greg Lapointe, the Chief Banking Officer of SouthState Corp, sold 2,600 shares of the company on November 15, 2023. This sale has prompted a closer examination of the insider's trading behavior and its potential implications for the stock's future performance.Who is Greg Lapointe of SouthState Corp?Greg Lapointe has been serving as the Chief Banking Officer at SouthState Corp, a prominent financial institution. His role at the company involves overseeing the banking operations and contributing to the strategic direction of the organization. With a deep understanding of the banking industry and a significant position within the company, Lapointe's trading activities are closely monitored for insights into the internal perspectives on the company's health and future prospects.About SouthState CorpSouthState Corp is a financial services company that operates primarily in the southeastern United States. The company provides a wide range of banking services, including retail and commercial banking, mortgage, and wealth management solutions. With a commitment to delivering exceptional service and fostering long-term customer relationships, SouthState Corp has established itself as a trusted financial partner in the communities it serves.Analysis of Insider Buy/Sell and Relationship with Stock PriceOver the past year, Greg Lapointe has sold a total of 7,230 shares and has not made any purchases of SouthState Corp stock. This pattern of selling without corresponding buys could be interpreted in various ways. While some may view it as a lack of confidence in the company's future growth, it is also possible that the insider is diversifying their investment portfolio or addressing personal financial needs.The insider transaction history for SouthState Corp shows a trend of more insider sells than buys over the past year, with 11 sells and only 3 buys. This trend could suggest that insiders, on balance, are taking the opportunity to realize gains or adjust their holdings rather than accumulating more shares.

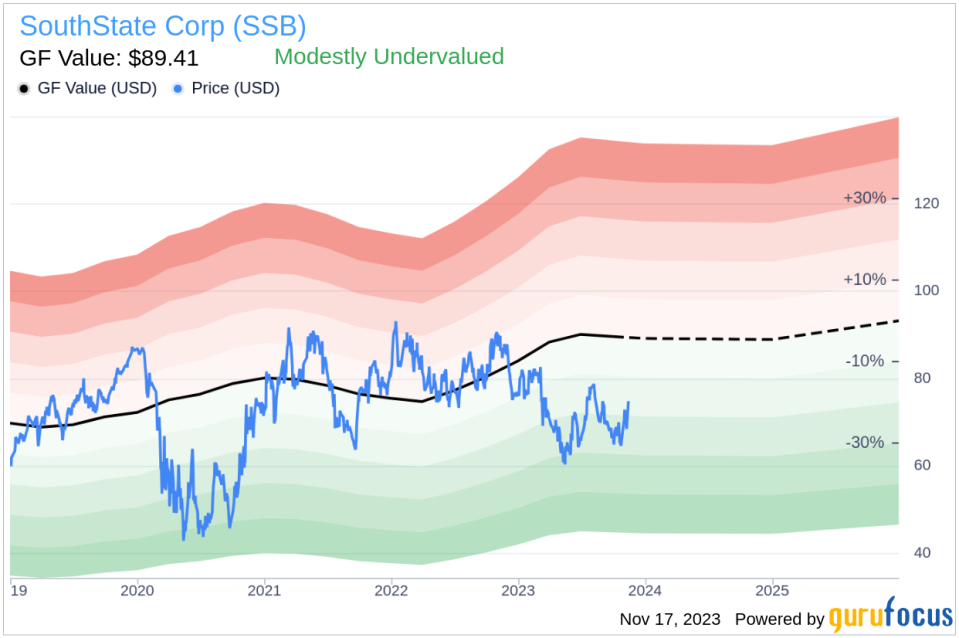

When analyzing the relationship between insider trading activity and stock price, it is important to consider the context of each transaction. The recent sale by Greg Lapointe occurred with SouthState Corp shares trading at $75.82, giving the company a market cap of $5.702 billion. This price point is particularly interesting when juxtaposed with the company's valuation metrics.Valuation and Market ResponseThe price-earnings ratio of SouthState Corp stands at 10.78, which is higher than the industry median of 8.49 but lower than the company's historical median price-earnings ratio. This suggests that the stock is trading at a reasonable valuation compared to its peers and its own historical standards.Moreover, with a current price of $75.82 and a GuruFocus Value of $89.41, SouthState Corp has a price-to-GF-Value ratio of 0.85, indicating that the stock is modestly undervalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The modest undervaluation of SouthState Corp, as suggested by the GF Value, could imply that the stock has room for appreciation. However, the insider selling activity, particularly by a high-ranking officer such as Greg Lapointe, may lead some investors to question whether the insider sees limited upside potential or other risks on the horizon.ConclusionThe sale of SouthState Corp shares by Chief Banking Officer Greg Lapointe is a development that warrants attention from investors and market analysts. While the company's valuation metrics and GF Value suggest an attractive entry point for investors, the insider's decision to sell shares could be interpreted in various ways. As with all insider trading activity, it is essential to consider the broader market context, the company's financial health, and other potential factors influencing the insider's decision. Investors should continue to monitor insider trends and perform due diligence to inform their investment decisions regarding SouthState Corp.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.