Insider Sell Alert: Chief Business Officer Cassia Cearley Sells 8,759 Shares of Icosavax Inc (ICVX)

In a recent transaction on December 13, 2023, Cassia Cearley, the Chief Business Officer of Icosavax Inc (NASDAQ:ICVX), sold 8,759 shares of the company's stock. This move has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its executives.

Who is Cassia Cearley of Icosavax Inc?

Cassia Cearley has been serving as the Chief Business Officer of Icosavax Inc, a biopharmaceutical company focused on the discovery and development of vaccines against infectious diseases. In this role, Cearley is responsible for the company's business development, strategic partnerships, and commercial planning. The insider's actions, including stock transactions, are closely monitored as they can reflect the insider's belief in the company's future performance.

About Icosavax Inc

Icosavax Inc is a biotechnology firm that specializes in creating vaccines to combat infectious diseases. The company's proprietary technology platform is based on virus-like particle (VLP) engineering, which aims to improve the immune response to various pathogens. Icosavax's pipeline includes candidates for respiratory syncytial virus (RSV), human metapneumovirus (hMPV), and other viruses that pose significant health risks globally. The company's innovative approach to vaccine development has the potential to address some of the most pressing challenges in public health.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by Cassia Cearley of 8,759 shares is part of a broader pattern of insider transactions at Icosavax Inc. Over the past year, Cearley has sold a total of 27,307 shares and has not made any purchases. This one-sided activity could be interpreted in several ways. On one hand, insiders might sell shares for personal financial reasons that do not necessarily reflect their outlook on the company's future. On the other hand, a lack of insider purchases might suggest that insiders are not currently seeing the stock as undervalued or poised for significant growth.When analyzing insider transactions, it's important to consider the context of the company's stock price. On the day of Cearley's recent sale, Icosavax Inc's shares were trading at $16.01, giving the company a market cap of $787.622 million. While the stock price at the time of the transaction provides a snapshot of the company's valuation, it is also crucial to look at the stock's performance over time and any events that may have influenced the price.

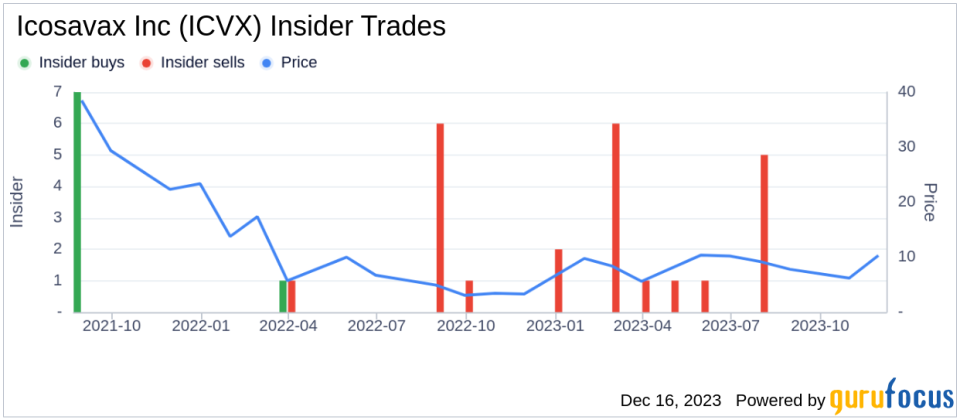

The insider trend image above shows the history of insider transactions over the past year. There have been no insider buys during this period, while there have been 16 insider sells. This trend could suggest that insiders, including Cearley, may have concerns about the stock's future appreciation or may simply be taking profits after a period of holding their shares.

Insider Trends and Market Reaction

The market often reacts to insider transactions, as they can be a signal of the insider's confidence in the company's future. A series of insider sales, especially without any offsetting buys, might lead investors to question the stock's potential for upside. However, it's also important to note that insiders may have various reasons for selling that are unrelated to their outlook on the company, such as diversifying their personal portfolio, tax planning, or other personal financial considerations.

Conclusion

The sale of 8,759 shares by Chief Business Officer Cassia Cearley is a notable event for investors of Icosavax Inc. While the reasons behind the sale are not publicly known, the pattern of insider transactions over the past year suggests a lack of insider buying activity. Investors should consider this information alongside other factors, such as the company's fundamentals, market conditions, and any recent news or developments that may impact the stock's performance.As with any insider transaction, it is essential for investors to conduct their own due diligence and not rely solely on insider behavior as an indicator of a stock's future movement. The sale by Cearley provides an opportunity for investors to reevaluate their position in Icosavax Inc and consider the broader context in which this transaction has occurred.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.