Insider Sell Alert: Chief Sales Officer Es Van Sells 5,537 Shares of The Vita Coco Co Inc (COCO)

In the world of stock market movements, insider transactions hold a special place for investors seeking clues about a company's health and future prospects. Recently, an insider sell event has caught the attention of market watchers. Es Van, the Chief Sales Officer of The Vita Coco Co Inc (NASDAQ:COCO), sold 5,537 shares of the company on November 29, 2023. This transaction has prompted a closer look into the insider's trading behavior and the potential implications for the stock.

Who is Es Van of The Vita Coco Co Inc?

Es Van serves as the Chief Sales Officer of The Vita Coco Co Inc, a position that places Van in a strategic role within the company. As a top executive, Van is responsible for overseeing the company's sales strategies and execution, which directly impacts the company's revenue and market presence. The insider's actions, especially in terms of stock transactions, are often scrutinized for insights into their confidence in the company's performance and outlook.

The Vita Coco Co Inc's Business Description

The Vita Coco Co Inc is renowned for its flagship product, Vita Coco, a popular brand of coconut water that has gained a significant following among health-conscious consumers. The company's portfolio extends beyond coconut water, encompassing a variety of healthy hydration and snacking options that cater to a growing market of individuals seeking natural and nutritious products. With a commitment to sustainability and social responsibility, The Vita Coco Co Inc has established itself as a leader in the beverage industry, particularly within the health and wellness segment.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can provide valuable insights into a company's internal perspective. Over the past year, Es Van has sold a total of 95,537 shares and has not made any purchases. This pattern of selling without corresponding buys could signal a variety of things, ranging from personal financial planning to a less optimistic view of the company's future stock performance.

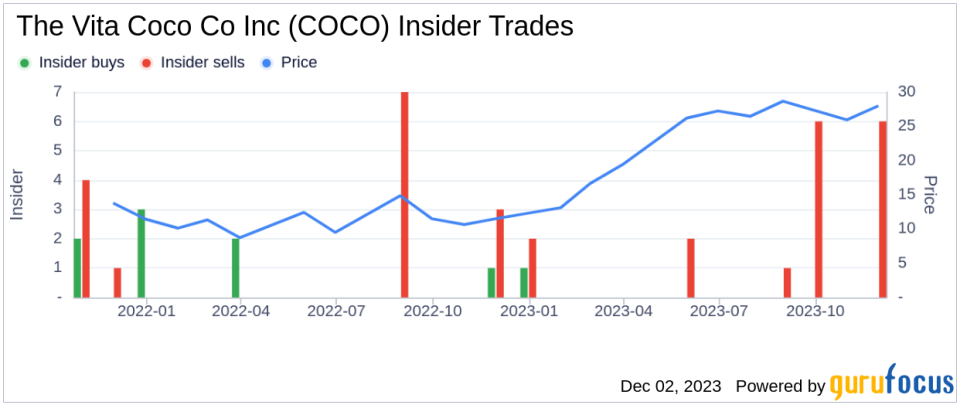

When examining the broader insider transaction history for The Vita Coco Co Inc, we observe that there has been only 1 insider buy in the past year, contrasted with 20 insider sells. This trend of more frequent selling over buying among insiders might raise questions about the long-term value of the stock from those who have the most intimate knowledge of the company.

On the day of Es Van's recent sale, shares of The Vita Coco Co Inc were trading at $28.84, valuing the company at a market cap of $1.576 billion. The price-earnings ratio stood at 43.42, which is higher than the industry median of 17.62 but lower than the company's historical median price-earnings ratio. This valuation suggests that while the stock may be trading at a premium compared to the industry, it is somewhat undervalued relative to its own historical pricing.

It is important to consider that insider sells can be motivated by various factors that may not necessarily reflect on the company's financial health. Insiders might sell shares for personal reasons such as diversifying their portfolio, tax planning, or major life expenses. Therefore, while insider sells can be a red flag, they should be evaluated within the broader context of the company's performance and market conditions.

The insider trend image above provides a visual representation of the buying and selling patterns of insiders at The Vita Coco Co Inc. The predominance of sell transactions over the past year is evident and could be a point of analysis for investors considering the stock's potential.

Conclusion

Es Van's recent sale of 5,537 shares of The Vita Coco Co Inc is a transaction that warrants attention. While the insider's sell-off does not inherently indicate a lack of confidence in the company's prospects, the overall trend of insider selling over buying could be a signal for investors to proceed with caution. It is essential for investors to conduct thorough due diligence, considering both insider activity and the company's fundamental performance, before making investment decisions.

As The Vita Coco Co Inc continues to navigate the competitive landscape of the health and wellness industry, insider transactions will remain a key area of interest for those looking to gauge the internal sentiment towards the company's future. Investors are encouraged to keep an eye on further insider activity and market developments to inform their investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.