Insider Sell Alert: Chief Sales Officer Michael Campbell Sells Shares of Equinix Inc (EQIX)

Recent filings with the Securities and Exchange Commission have revealed that Michael Campbell, the Chief Sales Officer of Equinix Inc (NASDAQ:EQIX), sold 600 shares of the company on November 20, 2023. This transaction has caught the attention of investors and analysts alike, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

Who is Michael Campbell of Equinix Inc?

Michael Campbell serves as the Chief Sales Officer at Equinix Inc, a position that places him at the forefront of the company's sales strategies and customer relations. His role involves overseeing the global sales team and ensuring that the company's services align with customer needs, driving revenue growth. Campbell's actions and decisions are critical to the success of Equinix, as they directly impact the company's market presence and profitability.

Equinix Inc's Business Description

Equinix Inc is a global leader in the data center and colocation industry, providing a platform where companies can come together to realize new opportunities and accelerate their business, IT, and cloud strategies. With a network of data centers across multiple continents, Equinix offers a wide range of services, including digital ecosystems for networks, cloud services, and enterprises. The company's infrastructure is critical for the seamless operation of internet services and cloud-based applications, making it an integral part of today's digital economy.

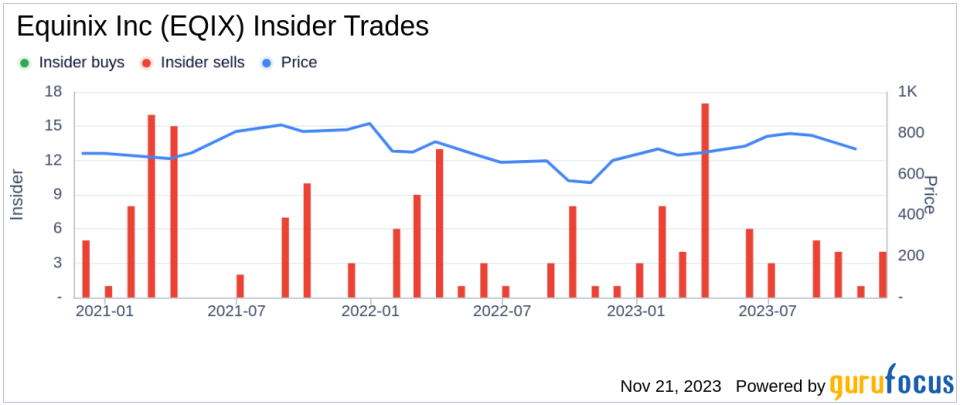

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often scrutinized by investors as they can indicate the confidence levels of a company's executives and board members in the firm's future. Over the past year, Michael Campbell has sold a total of 5,084 shares and has not made any purchases. This one-sided activity could suggest that the insider may perceive the stock's current valuation as being on the higher end, prompting a decision to realize gains.

However, it is essential to consider the broader context of insider transactions at Equinix Inc. The company has seen 55 insider sells and no insider buys over the past year. This trend could be interpreted in several ways. On one hand, it might indicate that insiders are taking advantage of the stock's price to cash out on their investments. On the other hand, these sales could be part of pre-determined trading plans or related to personal financial management, rather than a lack of confidence in the company's prospects.

On the day of Campbell's recent sale, shares of Equinix Inc were trading at $780.66, giving the company a substantial market cap of $74.01 billion. This price point is significant as it reflects investor sentiment and market conditions at the time of the transaction.

The price-earnings ratio of Equinix Inc stands at 84.77, which is considerably higher than the industry median of 17.32. This elevated ratio could suggest that the market has high expectations for the company's future earnings growth, or it may indicate that the stock is overvalued relative to its peers. Nonetheless, the ratio is lower than the company's historical median, which could imply that the stock is currently more reasonably priced compared to its own trading history.

When assessing the stock's valuation, the price-to-GF-Value ratio is a critical metric. With a share price of $780.66 and a GuruFocus Value of $820.35, Equinix Inc has a price-to-GF-Value ratio of 0.95, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling and buying patterns of insiders at Equinix Inc. The absence of insider buys coupled with a consistent pattern of sells could be a signal for investors to watch closely, although it should not be the sole factor in making investment decisions.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value, as estimated by GuruFocus. This analysis suggests that Equinix Inc's stock is not significantly over or undervalued, which may provide some reassurance to investors concerned about the implications of insider selling activity.

Conclusion

Michael Campbell's recent sale of Equinix Inc shares is a noteworthy event that warrants attention from the investment community. While insider sales can raise questions about a stock's future performance, it is crucial to consider the full spectrum of information available, including the company's valuation metrics and overall insider transaction trends. Equinix Inc's position as a key player in the digital infrastructure space, combined with its current fair valuation, suggests that the company remains a significant entity in the market, despite the recent insider sell activity.

Investors should continue to monitor insider transactions, along with other financial indicators and market news, to make informed decisions regarding their investment in Equinix Inc or any other stock of interest.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.