Insider Sell Alert: Chief Scientific Officer Jude Onyia Sells Shares of Neurocrine Biosciences Inc

Neurocrine Biosciences Inc (NASDAQ:NBIX), a prominent player in the biopharmaceutical industry, has recently witnessed a significant insider sell event. Chief Scientific Officer Jude Onyia sold 2,331 shares of the company on November 29, 2023. This transaction has caught the attention of investors and market analysts, as insider trading activities can provide valuable insights into a company's financial health and future prospects.

Who is Jude Onyia of Neurocrine Biosciences Inc?

Jude Onyia serves as the Chief Scientific Officer at Neurocrine Biosciences Inc. With a strong background in scientific research and development, Onyia plays a crucial role in guiding the company's innovation strategies and overseeing its research initiatives. The insider's expertise in the field is instrumental in driving Neurocrine Biosciences' efforts to develop treatments for neurological and endocrine-related diseases.

Neurocrine Biosciences Inc's Business Description

Neurocrine Biosciences Inc is a biopharmaceutical company focused on discovering, developing, and commercializing innovative treatments for neurological, endocrine, and psychiatric disorders. The company's portfolio includes marketed products and therapies in various stages of clinical development, targeting conditions such as Parkinson's disease, tardive dyskinesia, and endometriosis. Neurocrine Biosciences is committed to improving the lives of patients through science-driven approaches and cutting-edge medical solutions.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, particularly sells, can be interpreted in various ways by investors. While some may view insider sells as a lack of confidence in the company's future, others consider these transactions as routine financial planning or diversification by the insiders. In the case of Jude Onyia, the insider has sold 10,163 shares over the past year without any recorded purchases. This pattern of selling could suggest that the insider is adjusting personal investment holdings or capitalizing on the stock's current market value.

On the day of the latest sell, shares of Neurocrine Biosciences Inc were trading at $113.57, giving the company a market cap of $11.51 billion. The price-earnings ratio stood at 62.97, which is above the industry median of 23.42 but below the company's historical median price-earnings ratio. This indicates that while the stock is trading at a premium compared to the industry, it is relatively lower than its own historical valuation.

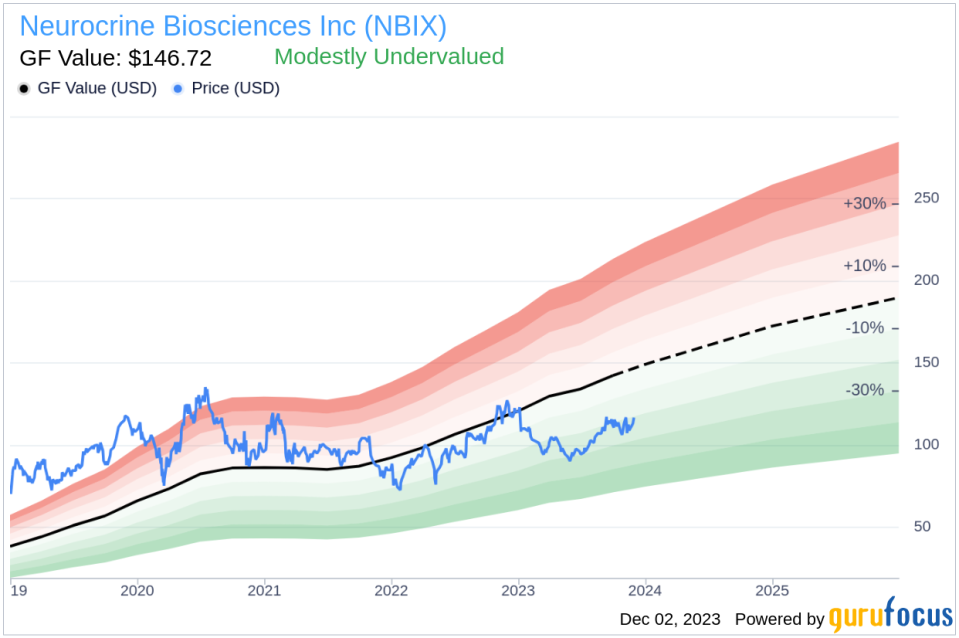

Moreover, with a price-to-GF-Value ratio of 0.77, Neurocrine Biosciences Inc is considered modestly undervalued based on its GF Value of $146.72. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation suggests that the stock may have upside potential, despite the recent insider sell.

The insider trend image above illustrates the pattern of insider transactions over the past year. Notably, there have been no insider buys and 46 insider sells during this period. This trend could indicate that insiders, including Jude Onyia, may perceive the stock's current price as an opportune time to realize gains.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current modest undervaluation could attract value investors looking for potential growth opportunities.

Conclusion

The recent insider sell by Chief Scientific Officer Jude Onyia has brought Neurocrine Biosciences Inc into the spotlight. While the insider's sell-off may raise questions, the company's solid business fundamentals and modest undervaluation based on the GF Value suggest that the stock could still be an attractive investment. Investors should consider the broader context of insider trading patterns, the company's valuation, and its growth prospects when making investment decisions. As always, it is essential to conduct thorough research and consider multiple factors before investing in any stock.

For more detailed analysis and up-to-date information on insider trading activities and stock valuations, investors are encouraged to visit gurufocus.com.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.