Insider Sell Alert: Chief Services Officer Mark Anderson Sells Shares of Model N Inc (MODN)

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, an insider sell event has caught the attention of the market. Mark Anderson, the Chief Services Officer of Model N Inc (NYSE:MODN), has sold a notable number of shares, prompting a closer examination of the implications of this transaction.Who is Mark Anderson?Mark Anderson serves as the Chief Services Officer at Model N Inc, a role that places him in a strategic position within the company. His responsibilities likely include overseeing the delivery of services and ensuring customer success, which gives him an intimate understanding of the company's operations and its market position. Anderson's actions, particularly in the realm of stock transactions, are closely monitored as they may reflect his confidence in the company's future prospects.About Model N IncModel N Inc is a public company that operates in the technology sector, providing cloud-based revenue management solutions to life sciences, technology, and manufacturing companies. The company's software helps clients streamline their revenue processes, manage contracts, pricing, incentives, and regulatory compliance. Model N's solutions are designed to support the complex billing and revenue recognition processes that are often a challenge in these industries.Analysis of Insider Buy/Sell and Relationship with Stock PriceMark Anderson's recent transaction involved the sale of 5,115 shares of Model N Inc on November 16, 2023. This sale is part of a larger pattern observed over the past year, where Anderson has sold a total of 37,033 shares and has not made any purchases. This one-sided activity could be interpreted in various ways by investors.The insider transaction history for Model N Inc shows a trend of more insider sells than buys over the past year, with 51 insider sells and no insider buys. This could signal that insiders, including Anderson, may believe that the stock is currently overvalued or that they are taking profits after a period of stock appreciation.

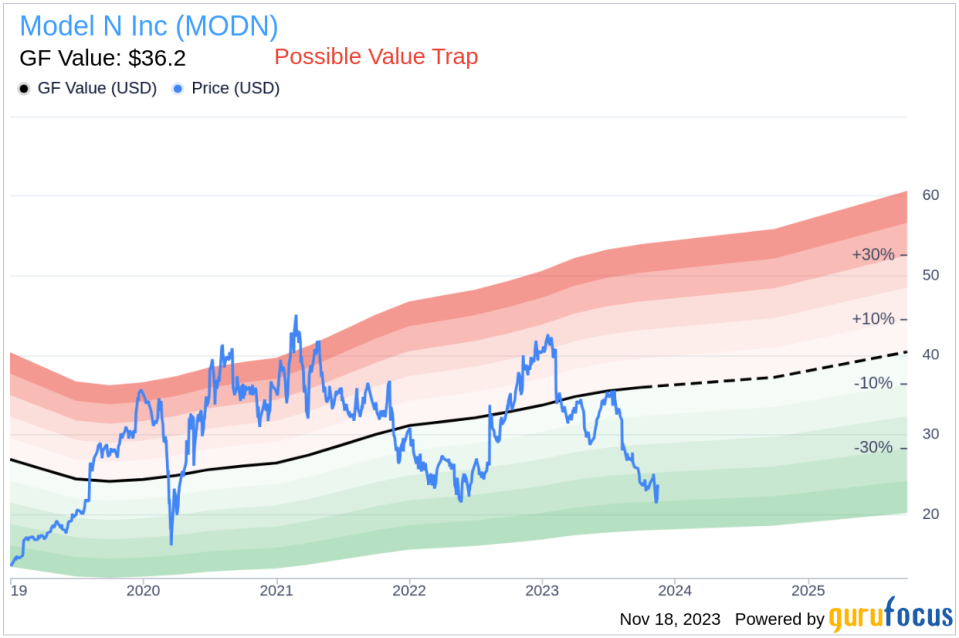

When analyzing the relationship between insider trading activity and stock price, it's important to consider the context. Insider sells do not always indicate a lack of confidence in the company. Executives may sell shares for personal financial planning reasons, diversification, or to exercise stock options. However, a consistent pattern of insider selling, especially when not accompanied by insider buying, can be a red flag for investors.Valuation and Market CapOn the day of Anderson's recent sale, shares of Model N Inc were trading at $22.95, giving the company a market cap of $904.056 million. This valuation is significant as it reflects the market's current assessment of the company's worth.The GF Value, an intrinsic value estimate developed by GuruFocus, suggests that Model N Inc has a price-to-GF-Value ratio of 0.63, with a GF Value of $36.20. This indicates that the stock might be a Possible Value Trap and investors should think twice before making a decision based on its GF Value.

The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio suggests that the stock is undervalued, which could mean that the market has not fully recognized the company's potential, or there may be underlying issues that have led to a lower valuation.ConclusionThe insider selling activity by Mark Anderson at Model N Inc raises questions about the stock's future performance and whether it represents a buying opportunity or a cautionary tale. While the GF Value indicates that the stock may be undervalued, the pattern of insider selling could suggest that those with the most knowledge of the company's inner workings are choosing to reduce their holdings.Investors should consider the insider trading trends, the company's valuation, and their own investment strategy when evaluating the significance of this insider sell event. As always, it is recommended to look at a comprehensive set of factors, including company fundamentals, industry trends, and broader market conditions, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.