Insider Sell Alert: Chief Strategy Officer Benson Michael Lee Jr. ...

In a recent transaction on December 6, 2023, Benson Michael Lee Jr., the Chief Strategy Officer of Instructure Holdings Inc (NYSE:INST), sold 20,000 shares of the company's stock. This move has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Benson Michael Lee Jr.?

Benson Michael Lee Jr. serves as the Chief Strategy Officer of Instructure Holdings Inc, a position that places him at the heart of the company's strategic planning and execution. His role involves identifying growth opportunities, overseeing mergers and acquisitions, and ensuring that the company's long-term plans align with market trends and shareholder interests. Lee Jr.'s decisions and insights are crucial for the company's success, making his trading activities particularly noteworthy for investors.

About Instructure Holdings Inc

Instructure Holdings Inc, traded under the ticker symbol INST on the New York Stock Exchange, is a leading software-as-a-service (SaaS) company that specializes in educational technology. The company's flagship product, Canvas, is a widely adopted learning management system (LMS) that facilitates teaching and learning for educational institutions and organizations across the globe. Instructure's suite of products aims to empower educators, engage students, and elevate learning outcomes through innovative technology and services.

Analysis of Insider Buy/Sell and Relationship with Stock Price

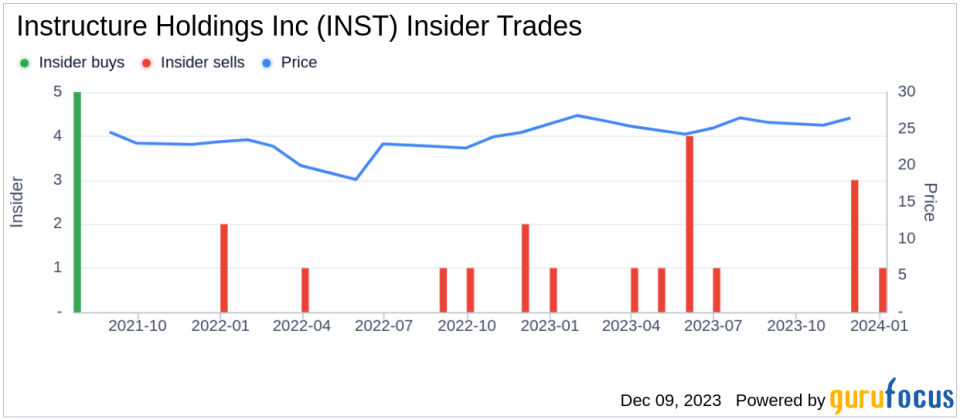

Insider transactions, particularly those involving sales or purchases of a company's stock by its executives, can be a strong indicator of the company's health and future performance. In the case of Instructure Holdings Inc, the insider transaction history shows a pattern of more sells than buys over the past year. Specifically, there have been 11 insider sells and 0 insider buys. This could suggest that insiders, including Lee Jr., may perceive the stock to be fully valued or are taking profits after a period of appreciation.

On the day of the insider's recent sale, shares of Instructure Holdings Inc were trading at $26.11, giving the company a market cap of $3.928 billion. The sale of 20,000 shares by Lee Jr. represents a significant transaction that could signal his belief that the stock may not see substantial upside in the near term. However, it is also common for insiders to sell shares for personal financial planning reasons, unrelated to their outlook on the company's future performance.

It is important to consider the context of the sale. If the insider has been selling shares consistently over time, it may be part of a planned selling program. On the other hand, a sudden large sale could be more indicative of a lack of confidence in the company's future prospects. In Lee Jr.'s case, the sale of 20,000 shares follows a year in which he sold a total of 30,000 shares and made no purchases, suggesting a pattern of divestment.

Investors often look at insider trading patterns for clues about a stock's future direction. While a number of sells over buys could be seen as a negative signal, it is also essential to analyze the company's performance, industry trends, and broader market conditions before drawing conclusions.

The insider trend image above provides a visual representation of the buying and selling activities of insiders at Instructure Holdings Inc. This graphical data can help investors identify trends and make more informed decisions.

Conclusion

While the sale of shares by Benson Michael Lee Jr. may raise questions among investors, it is crucial to consider the broader picture and not make investment decisions based solely on insider activity. Instructure Holdings Inc's position in the educational technology sector and its product offerings continue to be relevant and in demand. However, investors should keep an eye on insider trends, company performance, and industry developments to gauge the potential impact on the stock price and make well-informed investment choices.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential. It is advisable for investors to conduct their own due diligence, considering both the insider's actions and the company's fundamentals, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.