Insider Sell Alert: CIO Alagu Sundarrajan Sells 6,000 Shares of Ryerson Holding Corp (RYI)

In a notable insider transaction, Alagu Sundarrajan, the Chief Information Officer of Ryerson Holding Corp, sold 6,000 shares of the company on December 1, 2023. This move has caught the attention of investors and market analysts, as insider trades can provide valuable insights into a company's prospects and the confidence level of its executives.

Who is Alagu Sundarrajan of Ryerson Holding Corp?

Alagu Sundarrajan serves as the Chief Information Officer (CIO) at Ryerson Holding Corp, a leading processor and distributor of metals. In his role, Sundarrajan is responsible for overseeing the company's information technology strategies and ensuring that its IT infrastructure aligns with the organization's overall objectives. His position places him in a strategic role where he can assess the company's operational efficiency and future growth potential.

Ryerson Holding Corp's Business Description

Ryerson Holding Corp, traded under the ticker symbol RYI on the New York Stock Exchange, specializes in the processing and distribution of industrial metals. The company offers a wide array of products, including stainless steel, aluminum, carbon steel, and alloy steels, catering to various industries such as commercial ground transportation, metal fabrication and machine shops, industrial machinery and equipment, and consumer durables. Ryerson's services extend beyond metal distribution to include just-in-time delivery, supply chain management, and fabrication.

Analysis of Insider Buy/Sell and Relationship with Stock Price

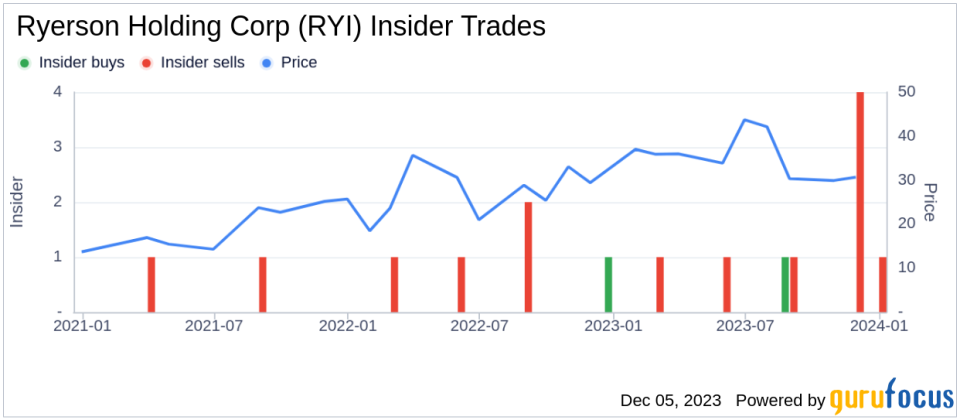

Insider transactions are often scrutinized by investors as they can signal the confidence level of a company's executives and insiders in the firm's future performance. Over the past year, Alagu Sundarrajan has sold a total of 6,000 shares and has not made any purchases. This could be interpreted in various ways; however, without additional context, it is challenging to draw a definitive conclusion about the insider's sentiment towards the company's future.

Comparing this activity to the broader insider transaction history for Ryerson Holding Corp, we see a pattern of more insider selling than buying over the past year, with 1 insider buy and 8 insider sells. This trend might raise questions about the insiders' collective outlook, although it is essential to consider that insiders might sell shares for reasons unrelated to their expectations for the company, such as diversifying their personal portfolios or meeting personal financial needs.

On the day of Sundarrajan's recent sale, shares of Ryerson Holding Corp were trading at $31.65, giving the company a market cap of $1.088 billion. This price point is significant as it relates to the company's valuation metrics and market sentiment.

The price-earnings ratio of Ryerson Holding Corp stands at 11.88, which is lower than the industry median of 22.68. This suggests that the stock is trading at a discount compared to its industry peers, potentially indicating undervaluation or a more cautious market outlook on the company's earnings potential.

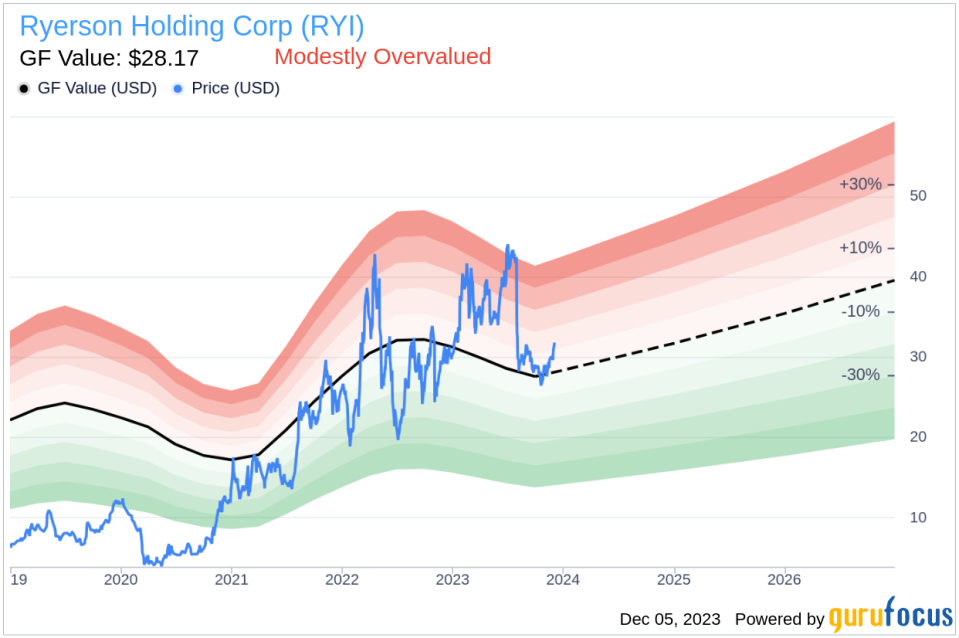

However, when considering the GuruFocus Value, which is set at $28.17, Ryerson Holding Corp's price-to-GF-Value ratio is 1.12, indicating that the stock is modestly overvalued. This assessment is based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the buying and selling activities of insiders over time. This can be a useful tool for investors to gauge the internal perspective on the company's valuation and future prospects.

The GF Value image offers an additional layer of analysis, comparing the current stock price to the intrinsic value estimate developed by GuruFocus. This comparison can help investors determine if the stock is trading at a fair value, undervalued, or overvalued based on the calculated GF Value.

Conclusion

Alagu Sundarrajan's recent sale of 6,000 shares of Ryerson Holding Corp is a transaction that warrants attention from the investment community. While the insider's actions alone should not be the sole basis for any investment decision, they can provide valuable context when combined with a comprehensive analysis of the company's financial health, industry position, and market valuation. As Ryerson Holding Corp's stock currently appears modestly overvalued based on the GF Value, investors should conduct further research and consider a multitude of factors before making portfolio adjustments.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.